SOYBEANS

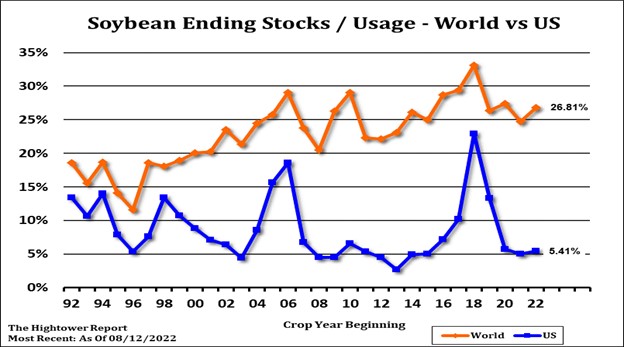

Soybeans futures ended higher. There was some talk that China may have taken advantage of lower US futures and lower Argentina export prices to book 5-7 US soybean cargoes, 8 Brazil and up to 10 Argentina. China needs to buy 400 mt or 8 cargoes per day to reach USDA import goal of 98.0 mmt. USDA China Ag attaché lowered estimate of China pork imports due to lower domestic prices. Could be some positioning in front of next weeks USDA report. Trade estimates US 2022 soybean crop near 4,496 mil bu vs USDA 4,531. This suggest a yield of 51.5 vs USDA 51.9. Trade est US 2021/22 soybean carryout near 233 mil bu vs USDA 225. Trade also est US 2022/23 soybean carryout near 248 vs USDA 245. Some feel normal 2023 South America crop and slow China demand could eventually increase US 2022/23 carryout closer to 400. We finally get export sales next Thursday.

CORN

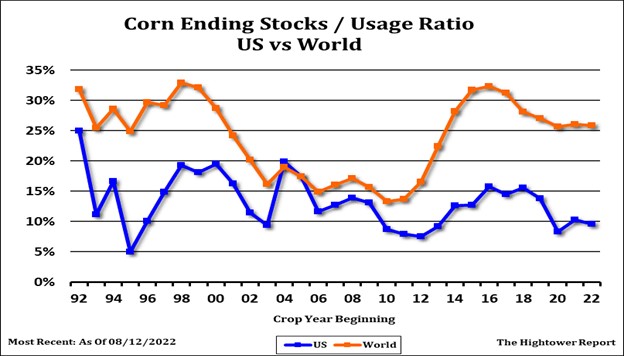

Next USDA US crop report and US and World supply and demand is Sep 12. US west Midwest is dry but noon GFS added rains to IA and E NE. There were already rains forecasted for WI and N IL. US SE is wet. Argentina is dry. S Brazil rains are normal. Our weather guy released a special report that La Nina could last into January. This could suggest another dry year in South America, US SW and US south Plains. Ukraine Oct-Nov premiums fell further in what presumably was perceived increased urgency to get corn out before any change to export corridor. It will take time for traders to evaluate impact Russia reevaluation of the Ukraine corridor export deal. White House released a statement that it feels Ukraine export corridor will remain open. Trade feels Russia will not renew the deal when it expires in November. Trade is looking for a lower US corn crop on Sep 12 but could also eventually see an equal drop in US corn exports. Trade estimates US 2022 corn crop near 14,088 mil bu vs USDA 14,359. This suggest a yield of 172.5 vs USDA 175.4. Trade est US 2021/22 corn carryout near 1,547 mil bu vs USDA 1,530. Strong US cash could suggest carryout could be lower. Trade also est US 2022/23 corn carryout near 1,217 vs USDA 1,300. Some fear final exports could drop 300 mil bu and out carryout closer to 1,600. US domestic cash corn basis remains firm on slow farmer selling. Weekly ethanol production was up 2 pct from last week and 7 pct from last year. Stocks were down 2 pct from last week but are up 13 pct from ly. US gas demand was down 9 pct yoy.

WHEAT

Wheat futures ended lower. Lower wheat futures tend to be on demand worries. Higher days tend to be due to supply worries. Russia President speech that suggest reevaluating the Ukraine export corridor deal send wheat futures higher even though most of shipments to date has been corn and to Africa countries. Only 16 pct has gone to EU. Russia has asked NATO countries to drop all economic sanctions so they can export grain and fertilizer. This at a time when 7 largest countries are expected to cap Russia energy prices. White House released a statement that they expected the Ukraine export corridor to remain open. Some in trade feels Russia will not extend the deal when it expires in November. Crude is the best indicator of global commodity demand and continues to trend lower. Some debate if Crude is heading toward $60 or back up to $100. Higher US interest rates and higher Dollar should continue to weigh on Crude prices. Our weather guy released a special report that La Nina could last into January. This could suggest another dry year in US SW and US south plains.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.