SOYBEANS

Soybeans ended higher. Soybean futures may be adding an US weather premium. US

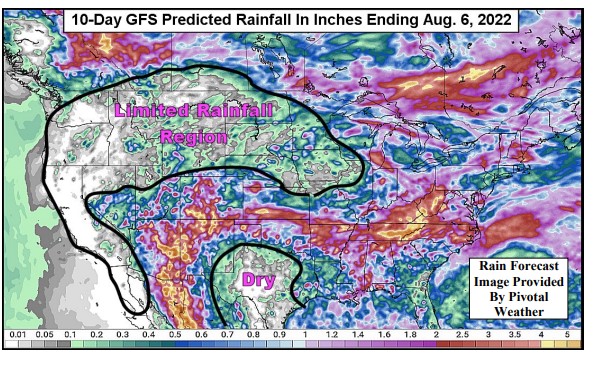

Midwest 30 day weather forecast is warm and dry. This week, USDA dropped US soybean rating to 59 pct G/E vs 61 last week and 58 ly. One crop watcher dropped US yield .5 to 51.0. S MN, E SD, E NE and W and NC IA are drying down significantly today. These areas have short to very short topsoil moisture and marginally adequate to very short subsoil moisture. The need for rain is steadily increasing and it is expected to reach a serious peak next week when the next heatwave begins to press in on the region. Trade expects no August soybean and soymeal deliveries. SQ is near 15.78. SMQ is near 488.9. SU traded over 200 day moving average near 14.11. Weekly US soybean export sales are est near -200/300 mt old crop and 100-500 mt new.

CORN

Corn futures ended higher on light volume. USDA also lowered US corn crop rating to 61 pct G/E vs 64 last week and 64 ly. Crop is about 1 week later than normal. One crop watcher dropped US yield 2 bpa to 175.0. MATIF corn futures still trending higher with U-Z spread making new highs. EU weather is warm and dry. Some estimate EU corn crop closer to 54 mmt than USDA 68. Weekly US ethanol production was down 1 pct from last week but up 1 pct from last year. Stocks were also down 1 pct from last week but up 2 pct from last year. CU is tested 20 day moving average near 6.05. Weekly US corn export sales are est near 200-625 mt. S MN, E SD, E NE and W and NC IA are drying down significantly today. These areas have short to very short topsoil moisture and marginally adequate to very short subsoil moisture. The need for rain is steadily increasing and it is expected to reach a serious peak next week when the next heatwave begins to press in on the region. The heatwave is expected to begin during mid-week next week in the Plains and western Midwest with some heat already building up over the drier areas Sunday and Monday. Crop stress is then expected to evolve and it will last through August 6 without much more than a brief bout or two of showers. The precipitation might slow the drying trend and offer some brief bouts of relief, but most likely the resulting rainfall will be much too light to stop crop stress or the declining trend in crop production potential.

WHEAT

Wheat futures ended lower. WU is near 7.89. Session high was 8.18. KWU is near 8.61. MWU is near 9.09. There remains uncertainty over just how much grain Ukraine will export over the next few months. World needs Ukraine grain to help with shortages especially Africa and Middle East. First day of Annual US spring wheat crop tour estimated a yield of 48.9 vs 29.5 in 2021. Weekly US wheat export sales are est near 250-625 mt. The JCC in Istanbul reportedly became operational, and EU traders were looking for evidence that grain was starting to move. Some feel that the USDA’s 10 mmt could be accurate for final exports. Some feel though USDA Russian wheat exports guess could be a function not of crop size, but of quality and logistics with most closer to 30 mmt than USDA 40 mmt. India reports all-time record high domestic prices despite the export ban. USDA 6.5 mmt export number could be unfeasible. The world wheat market remains fundamentally bullish.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.