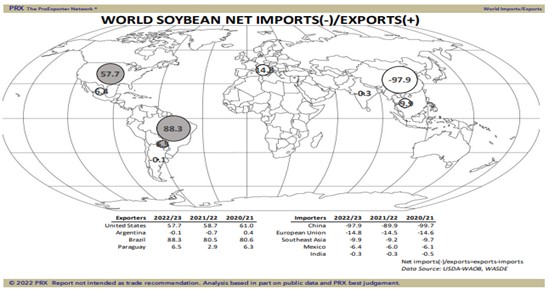

SOYBEANS

Soybeans futures ended sharply lower. Early selling was linked to concern that this week’s US CPI data will show even higher inflation. This could force US Central Bank to increase interest rates until US is in a recession. There was also concern that it has been 6 weeks since USDA announced new US soybean sales to China. Some report slow daily China feeders soymeal buying and crush margins remain negative. Finally, noon GFS US weather turned wetter over the central Midwest over the next 7 days. Some feel the maps were overdone. USDA dropped US 2021/22 soybean crush 10 mil bu. This increased carryout to 215. USDA also dropped US 2021/22 Soyoil production 100 mil lbs and dom use 100. USDA dropped US 2022 Soybean crop 135 mil bu, dropped 2022/23 crush 10 and exports 65. End result was a drop in carryout to 230. USDA dropped World 2022/23 soybean crop 4 mmt and exports 2 mmt. USDA est China imports near 98 mmt (-1) vs 90 ly. They est 2023 Brazil crop at 149 mmt vs 126 this year and Argentina 51 vs 44 this year.

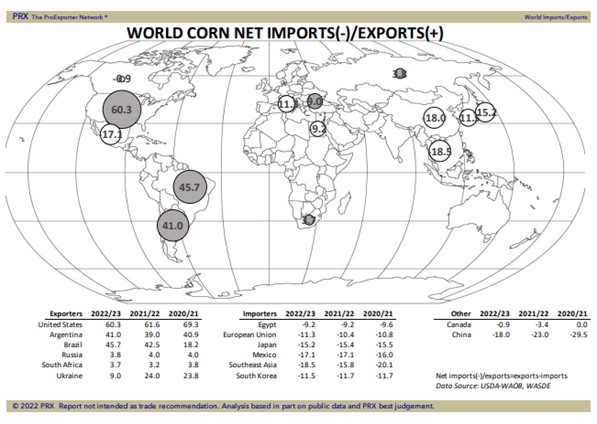

CORN

Corn futures were down sharply with CU back below 6.00. Early selling was linked to concern that this week’s US CPI data will show even higher inflation. This could force US Central Bank to increase interest rates until US is in a recession. There was also talk that tomorrow there will be a meeting in Turkey with UN, Ukraine and Russia. This to try to come up with a plan to open Ukraine grain exports. Participants are a military delegation and not diplomats. Russia is not expected to allow exports unless west sanctions are dropped and Ukraine is not expected to de-mine ports unless Russia stop attacks. There was talk of vessels heading to Ukraine port to load grain. These vessels load only 5-6,000 mt and ports can only unload 60 mt of grain per day by truck. Rail service has stopped after key bridge was bombed. Finally, noon GFS US weather turned wetter over the central Midwest over the next 7 days. Some feel the maps were overdone. USDA dropped US 2021/22 feed use 25 mil bu. This increased carryout to 1,510. USDA increased US 2022 corn crop 45 mil bu. Higher imports and higher crop resulted in an increase in carryout to 1,470. USDA increased World 2022/23 end stocks 2 mmt. USDA est Brazil 2023 corn crop at 126 mmt vs 116 this year and Argentina 55 vs 53. They est EU corn crop at 68 mmt with some closer to 62. They est World 2022/23 corn exports at 182 mmt vs 199 last year with Ukraine 9 vs 24.

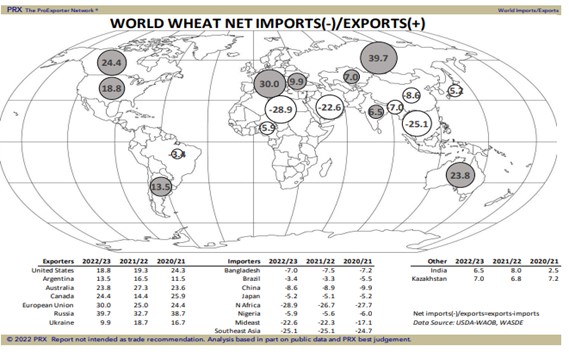

WHEAT

Wheat futures ended lower. Lack of bullish USDA numbers limited new buying. Early selling was linked to concern that this week’s US CPI data will show even higher inflation. This could force US Central Bank to increase interest rates until US is in a recession. There was also talk that tomorrow there will be a meeting in Turkey with UN, Ukraine and Russia. This to try to come up with a plan to open Ukraine grain exports. Participants are a military delegation and not diplomats. Russia is not expected to allow exports unless west sanctions are dropped and Ukraine is not expected to demine ports unless Russia stop attacks. There was talk of vessels heading to Ukraine port to load grain. These vessels load only 5-6,000 mt and ports can only unload 60 mt of grain per day by truck. Rail service has stopped after key bridge was bombed. USDA dropped US 2021/22 wheat seed use 4 mil bu and exports 1 mil bu to get to a carryout of 660. USDA increased US 2022 wheat crop 44 mil bu dropped imports 10 and raised 2022/23 export 25 to get to a carryout of 639. USDA increased World 2022/23 end stocks 1 mmt. USDA est Russia 2022 wheat crop at 81.5 mmt vs 75.1 last year and EU 134.1 vs 138.4 LY. They est EU Wheat exports at 35.5 mmt vs 29.5 ly and Russia 40 mmt vs 33 ly. They est World 2022/23 total wheat exports at 205.5 mmt vs 200.0 last year. Some feel EU and Russia exports may be too high.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.