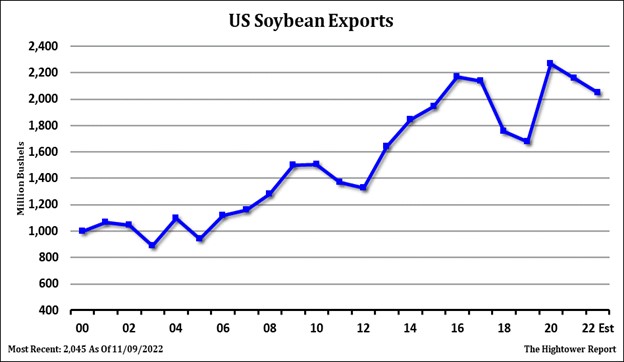

SOYBEANS

Headlines today continued to talk about EPA mandate reducing demand for soyoil for biofuel. Soybeans were supported by feelings Thursdays losses were overdone. Argentina is dry and will be hot next week but long range maps suggest better chances for rains. China is said to have bought 10 cargoes of soybeans; 4 US Dec and 6 Brazil Feb-Mar. China is also going to sell 500 mt of soybeans from reserve on Dec 9. Informa est Brazil crop at 152.5 mmt vs 127.0 ly. They est Argentina at 50.0 vs 43.9 ly. Talk that La Nina may be weakening into Feb, 2023 could help late planted Argentina soybeans.

CORN

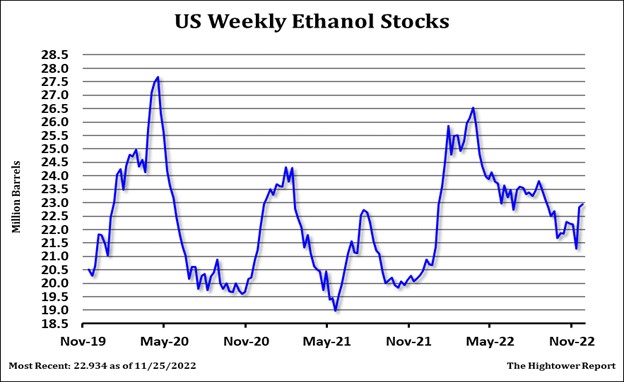

Corn futures ended lower. Fact CZ-CH spread is widening is bearish and suggest commercials may not be in need of additional 2022 corn. Dec deliveries continue to circulate with Cargill yet to stop their receipts. Brazil shipped a record 6.1 mmt corn in Nov and could export a record 5.5 in Dec. Ukraine continue to ship corn despite logistic challenges. Informa est Brazil crop at 127.0 mmt vs 116.5 last year. They est Argentina at 53.0 versus 52.0 ly. They dropped Ukraine crop 2.5 mmt to 29.0 and vs 42.0 ly. Talk that La Nina may be weakening into Feb, 2023 could help late planted Argentina corn. This could also help US 2023 crops. Some looking to increase US 2023 corn yield higher than trend of 181.0. CH below 6.40 could test 6.20 then 6.00. Corn futures may be trying to find new export and domestic crush demand. Gas demand is still on decline and US President might drop mandates as there are more electric cars. The United Nations food agency’s world price index fell marginally in November, marking an eighth straight monthly fall since a record high in March after Russia’s invasion of Ukraine. The Food and Agriculture Organization index averaged 135.7 points last month, down from 135.9 for October. Soaring grain and livestock prices are expected to push U.S. farm incomes to a historic high this year. Net farm income is forecast to increase to $160.5 billion in 2022 from $141.0 billion a year earlier.

WHEAT

Chicago March wheat futures tested the mid August lows on concern about demand for US wheat export. There is talk that money flow could move toward equities and away from Commodities. Weak weekly US export sales and fact Algeria bought wheat $40 below US HRW offered resistance. Talk that La Nina may weaken into 2023 could increase chances for spring US south plains rains. WH is making new lows since January. Matif wheat futures are the lowest since August. USDA increased China wheat crop 1.0 mmt to 140.0, India 3.5 mmt to 109.0. They est EU crop at 137.9, Russia 99.0 and Ukraine 20.5 vs 41.0 ly. Matif wheat futures are the lowest since August. USDA increased China wheat crop 1.0 mmt to 140.0, India 3.5 mmt to 109.0. They est EU crop at 137.9, Russia 99.0 and Ukraine 20.5 vs 41.0 ly. The United Nation food agency’s world price index fell marginally in November, marking an eighth straight monthly fall since a record high in March after Russia invasion of Ukraine. The Food and Agriculture Organization index averaged 135.7 points last month, down from 135.9 for October.

See more market commentary here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.