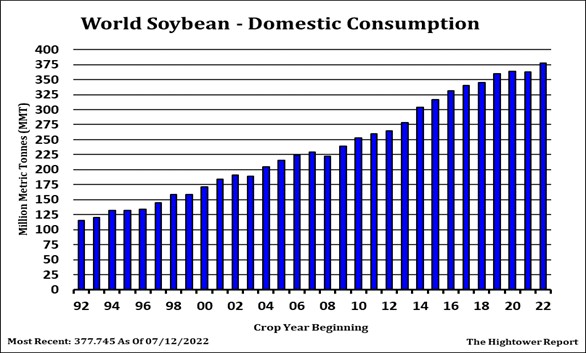

SOYBEANS

Nearby soybean ended lower. SU traded up to 15.57 on new sales to China and firm US domestic crush margins, need for crushers to buy soybean and higher domestic US soymeal basis. Fact noon GFS added large rains next week across the dry areas of SD, IA, NE, KS and MO weighed on soybean futures. Our weather guy does not see as much rain that are on the map. Weekly US soybean export sales are est -100/200 old crop and 300-700 new. Trade is looking for USDA to estimate US soybean yield near 51.1 vs USDA 51.5. They are also looking at US 2021/22 carryout near 226 vs USDA July 215 and 2022/23 230 vs USDA 230. One group est US 2021/22 carryout at 234 and 2022/23 at 257. This due to lower exports.

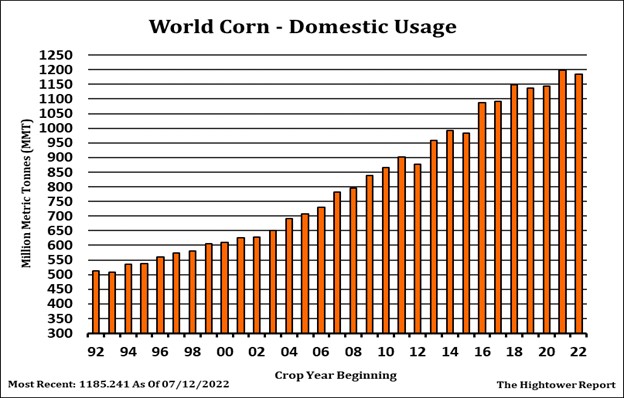

CORN

Corn futures ended higher but off session high. CU traded up to near 6.32 on continued talk of lower EU corn crop and possibility of a lower US final corn yield. Fact noon GFS added large rains next week across the dry areas of SD, IA, NE, KS and MO. Weighed on corn futures. Weekly US ethanol production down from last week but up from last year. Stocks were down from last week but up from last year. Weekly US gas data showed higher stocks and lower demand. CPI data today showed lower inflation than expected. This due to lower gas prices. Food prices were still higher. Weekly US corn export sales are est 0-300 old crop and 100-600 new. Trade is looking for USDA to estimate US corn yield near 175.9 vs USDA 177.0. Some could see US corn yield down 4 bpa but debate is from where? Recent 181 trend or USDA 177. Trade is also looking at US 2021/22 carryout near 1,512 vs USDA July 1,510 and 2022/23 1,402 vs USDA 1,470. Some of the drop in 2023 could be higher exports. Still, Brazil prices are below US and Ukraine corn exports are on the rise. One group est US 2021/22 carryout at 1,615 and 2022/23 at 1,512. This lower 2021 demand and lower 2023 export demand.

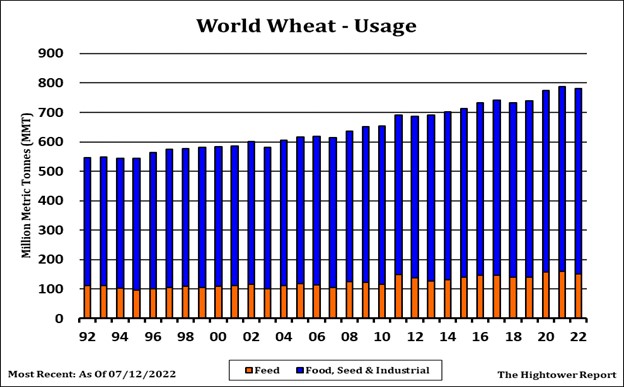

WHEAT

Wheat futures rallied after US CPI was not as inflationary as feared. Most of the decline was in energy prices. Food prices are still high. US Dollar fell sharply after the report. Most commodities including Wheat rallied on the lower Dollar. WU is near 7.99 with todays low near 7.80. KWU is near 8.74 with a low near 8.51. MWU is near 9.06 with a low near 8.91. Weekly US wheat export sales are est at 200-600 mt. Wheat market trying to balance lower crops in Argentina and lower exports in EU and Russia versus increase exports from Ukraine and Australia. So far, Ukraine exports are corn. Fire in Pendleton, OR flour mill could disrupt flour flow in PNW. Some est Q3 flour coverage near 90-95 pct, Q4 50-60 pct and Q1,23 5-10 pct.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.