Soybeans, soymeal, soyoil, corn and Chicago wheat traded lower. US Dollar was lower. US stocks were higher. Crude was higher. Gold was higher.

SOYBEANS

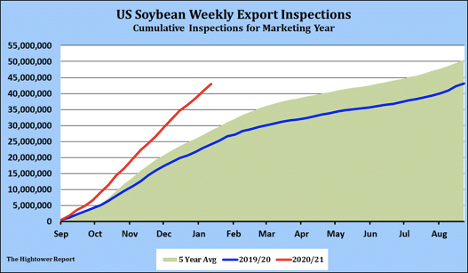

Soybeans traded sharply lower. Rains over portions of Brazil(85 pct coverage) and Argentina (55 pct coverage) offered resistance. Talk of new cases of the virus spreading in China also raised concern over their soybean import demand. New US soybean export sales to China were for new crop which raised concern that they were done buying US old crop soybeans. Most still feel Brazil soybean crops could be 3-5 mmt below USDA 133 and Argentina could be 2-4 mmt below USDA 48. There is talk that a disease may be causing soybean in Matto Grosso to rot in pods. Weekly US soybean exports were near 2.0 mmt (75 mil bu). This was above expectations. Season to date exports are near 42.9 mmt (1,578 mil bu) versus 24.1 (888 mil bu) last year. USDA goal is 60.7 mmt ( 2,230 mil bu) versus 45.7 (1,682 mil bu) last year. Key SH support is near 13.29.

CORN

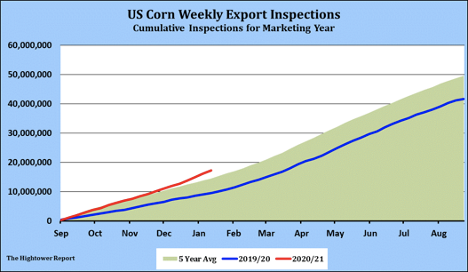

Corn futures traded lower. Rains over portions of Brazil (85 pct coverage) and Argentina (55 pct coverage) offered resistance. Talk of new cases of the virus spreading in China also raised concern over their feedgrain import demand. New US corn export sales to Japan failed to offer support. Most still feel Brazil corn crops could be 3-5 mmt below USDA 109 and Argentina could be 2-4 mmt below USDA 47.5. Managed funds were net sellers of 10,000 corn. We estimate Managed Money net long 404,000 Corn. The long was more than expected and could suggest futures may be overbought. Weekly US corn exports were near 876 mt. Season to date exports are near 17.2 mmt versus 9.4 last year. USDA goal is 64.7 mmt versus 45.1 last year. CH initial support is the gap near 5.17. Mexico announced that will limit imports of GMO corn. Most feel this may not happen given their strong demand for feed corn. Argentina is talking about an export tax for corn. Russia is also talking about an export tax for corn and barley. Ukraine will soon meet to talk about restricting corn exports. Ukraine grain traders appose restricted corn exports.

WHEAT

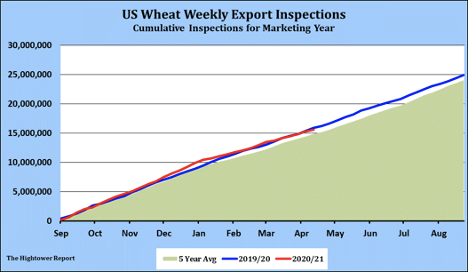

Wheat futures closed mixed. WH dropped 3 cents and closed near 6.72. KWH closed near 6.44. MWH closed near 6.43. Talk of lower Russia wheat exports to near 32-34 mmt versus USDA 39 is supportive. China wheat futures were higher. China sold 3.9 mmt of wheat from reserve at prices $27 per tonne higher than last week. Talk of tighter EU wheat supplies pushed Matif wheat futures to new highs. Weekly US wheat exports were near 276 mt (10 mil bu). Season to date exports are near 15.5 mmt (572 mil bu) versus 15.9 (587 mil bu) last year. USDA goal is 26.8 mmt ( 985 mil bu) versus 26.2 (965 mil bu) last year. WH initial support is near 6.60. Talk of new virus cases in China and continued increase cases globally raised concern that economic turnaround could be delayed which could delay increase in food demand.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.