by Stephen Platt and Mike McElroy

Price Overview

The petroleum complex traded in a divergent fashion with crude sharply higher reaching a high of 101.88 before attracting profit taking into the weekend and settling just under the 99.00 level basis Sept. On the other hand, products were mixed with gasoline a few cents higher while diesel was off 6.40 cents and both cracks were sharply lower.

The strength in crude continues to be linked to supply concerns with next week’s OPEC meeting on production levels in focus. Reports that OPEC+ will consider keeping oil output targets relatively steady appeared to bolster strong buying interest. The meeting begins on August 3 and the question on whether Saudi Arabia is willing to raise production in response to pleas by the Biden Administration continue to arise. The need for the largest producers to boost production has been apparent given the low commercial inventories in the OECD along with the inability of many OPEC producers to reach production targets due to the lack of investment and difficulty getting key materials due to supply chain disruptions. In addition, fears over Russian availability due to sanctions also remains in the background particularly in Europe. The supply concerns have begun to be manifested in the strong demand for US net exports of Crude and Products, which reached record high levels in the most recent EIA report at a time when inventories are extremely low in both the US and Europe. Undoubtedly the situation would be far graver if Strategic Reserves had not been released. With uncertainty associated with the prospective end to the releases in October, concerns over supply tightness might get magnified.

While demand concerns linked to recessionary fears due to higher interest rates and slower growth in China remain in the background, a reduction in gas flows to to one quarter their normal level in Europe should continue to attract substitution of petroleum derivatives in Europe keeping demand for US product exports strong from that area. It is interesting to note that the US in the most recent EIA report was the largest petroleum exporter of crude and products globally.

The crude market is likely to move in a choppy fashion higher. The prospective return of some production in Libya might help ease the premium of Brent to WTI. However reports of political instability in Iraq might be a potential source of concern given the storming by protesters of their Parliament this past week, who were denouncing the Iranian ties of the leading candidate, might become problematic for heightened Mid-East instability. We continue to see the potential for crude to test the 109-110 level basis Sept in the intermediate term particularly into the Hurricane season.

Natural Gas

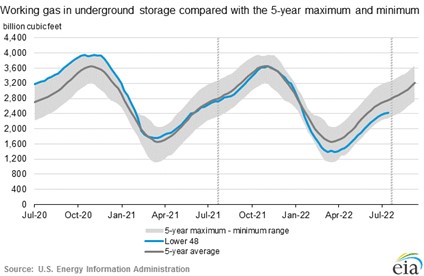

Prices took a breather today with values trading in what now might be considered a tight range of only 38 cents compared to an average trade range of 65 cents. Stocks remain low with the EIA report yesterday showing a smaller than expected injection rate of only 15 bcf. Inventories at 2,416 bcf are 293 bcf less than last year and 345 bcf below the five year average. The prospect for hotter weather to return as we move through August should continue to underpin values near the 7.80 level basis Sept as low stocks ahead of winter, the beginning of Hurricane season and restart of Freeport LNG plant in late Oct leads to heightened concern over prevailing storage levels as we approach winter and a potential retest of contract highs near the 9.50 level basis Sept.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.