by Stephen Platt and Mike McElroy

Price Overview

The petroleum complex surged to upside as a bullish DOE report added fuel to supply concerns and low inventory levels. While demand concerns linked to recessionary fears due to higher interest rates and slower growth in China remain in the background, a reduction in gas flows to one quarter their normal level in Europe along with the appearance that demand for US exports of both crude and products has ramped up has encouraged good buying interest.

The DOE report showed US crude inventories dropping by 4.5 mb. The decline was in large part a result of a surge in US export to all time highs due to the big discount of US crude when compared to international benchmarks such as Brent. The report also reported a large increase of 200 tb/d in domestic production levels of 200 tb/d to 12.1 mb/d. In products, stocks also fell with gasoline stocks falling by 3.3 mb and distillate inventories falling by .8 mb. Refinery utilization continued to fall with it declining 1.5 percent to 92.2 percent. Refinery capacity continues to be a major concern and today’s decline certainly was not welcome given expectations for an increase. Most impressive was that net exports of crude and products reached 2.6 mb/d compared to .7 last week. and a net import level of 1.1 mb/d last year. Total disappearance fell to 20 mb/d from 21 mb/d last week as other oils and propane showed sharp declines.

The market is likely to move in a choppy fashion higher. The prospective return of some production in Libya might help ease the premium of Brent to WTI. However reports of political instability in Iraq might be a potential source of concern, More important is the cut in Nat Gas supplies from Russia to Europe which will encourage the use of petroleum derivatives and attract additional product imports from the US keeping supplies tight.

Overall we still see good support on setbacks despite the bleak economic outlook and prospects high prices will stunt demand growth. Low inventory levels along with the uncertain global petroleum supply should continue to attract good buying interest and still suggests the potential for crude to test the 109-110 level in the intermediate term particularly into the Hurricane season.

Natural Gas

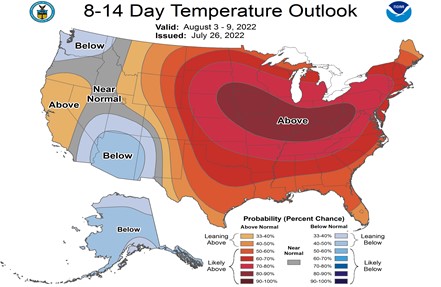

Prices retraced sharply falling as much as 26 from yesterday’s weak close and the expiration of the August contract today. Ideas the market was overbought along with moves by the EC to reduce Nat Gas use as much as 15 percent likely helped spur the better selling interest. In addition forecasts for less US demand next week than previously expected along with record gas output levels helped encourage profit taking and evening up ahead of tomorrow’s EIA report. Expectations point to an injection of 30 bcf keeping storage as much as 12 percent below the five year average for this time of year. Weather into August following record power demand this past month will likely be a key consideration as we move into August along with development of any Hurricane threats.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.