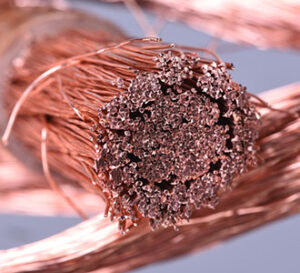

COPPER

March copper futures declined to their lowest point in more than three weeks. This decline was sparked by concerns over global trade disruptions following the announcement of new U.S. tariffs, which triggered a broad selloff in risk assets.

In China, which is the world’s biggest copper consumer, a private survey showed manufacturing activity grew less than expected in January, with foreign orders shrinking in light of ongoing global trade uncertainties. Although Chinese markets are closed for the Lunar New Year, trading will resume on Tuesday.

GOLD

March gold futures advanced to record highs despite sharp gains in the U.S. dollar. Most of today’s strength in precious metals can be linked to flight to quality buying after the U.S. introduced 10% tariffs on China and 25% tariffs on Canada and Mexico, raising concerns about slower global economic growth.

The precious metal remains supported by expectations of continued central bank buying.

SILVER

March silver futures were lower in the overnight trade in response to the sharply higher U.S. dollar. However, there has been a recovery as the flight to quality influence has taken over.

The Silver Institute recently forecasted a fifth consecutive year of a significant market deficit for silver in 2025. This projection is driven by strong industrial demand and retail investment, which are expected to outpace weaker consumption in jewelry and silverware. While global silver supply is anticipated to increase this year with higher output from China, Canada, and Chile, the ongoing deficit is still expected to persist.

Interested in more futures markets? Explore our Market Dashboards here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.