MORNING COMMENTS

Ag Fundamentals:

China bought another small flash of US soybeans this morning. 132K MT of soybeans sold to China and 132K MT of US soybeans sold to unknown destinations this morning. Small bites from China until they know who they are playing chess against. Their recent stimulus is still a talking point but nothing has changed recently. The EIA ethanol production and corn usage numbers come out later today. Last week we saw in increase in ethanol production and unchanged stocks. Meaning domestic demand is solid. This is part of the reason why corn spreads have been firming. The huge global supply picture sits on corn and bean values light huge paperweight. The US election is putting many on the sidelines and I don’t see anything that could shake the market before Tuesday next week.

Weather:

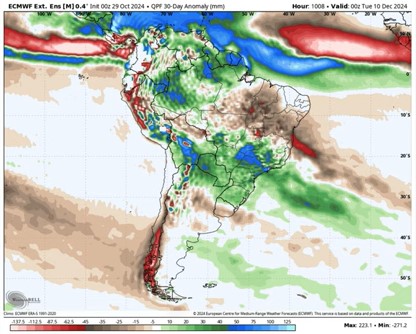

Rains coming across Kansas, Nebraska and Iowa later this evening. By 5 am tomorrow the storm will have moved over Iowa and most of Illinois. Systems are not expected to continue into the southeast. South American 30-day rain anomaly map can be seen below.

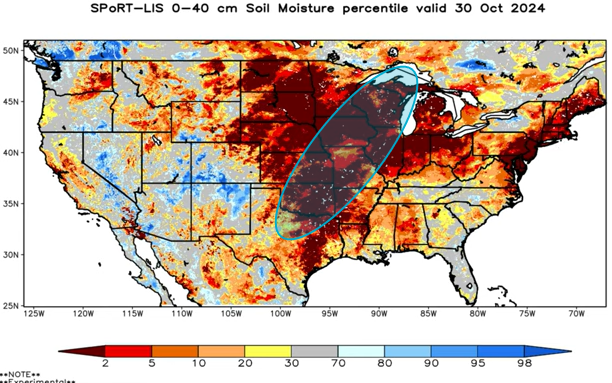

The US Soil Moisture Map will hopefully see relief within the circled area below from the rains expected in the next 5 days. |

The Mississippi River Gauge at Memphis is still below -9 feet and will reach -11 feet by Monday next week according to the chart that was generated with the 5 day forecast in mind yesterday morning. I think the rains coming across the Midwest in the next 5 days will help, but the lower Mississippi river is best fed by rains that fall in the Ohio River Valley.

South America’s 30-Day Precipitation Anomaly Map is still drawing focus around the north eastern dryness. Argentina’s dry pocket is shrinking with the added expectations of rain in the 8-14 day forecast.

Export & World News

South Korea bought 201K MT of animal feed corn yesterday, sourced from the US, South America, or South Africa. Jordan bought 65K MT of hard milling wheat in an international tender yesterday.

Malaysian palm oil futures were up overnight 58 ringgit, at 4695.

Daily Trading Limits: Corn $0.30 (expanded $0.45); Soybeans $0.85 (expanded $1.30); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

>>Interested in more commentary by Joe Mauck? Go HERE

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.