MORNING COMMENTS

Geopolitics:

Russia issued a warning to the US on Thursday, stating that the newly built US missile defense base in Poland is now on a list of potential targets. It’s on the opposite side of Poland from Ukraine and not really that close to the fight so this seems like a lot of talk. Conflicts around the Black Sea will be monitored by traders over the weekend. We are still waiting to see what Iran does to retaliate against Israel for their strikes in late October.

Macroeconomics:

It will be interesting the see what the COT reports say later today. Estimating managed money has extended their corn length to more than 110K contracts. December contracts first notice day and options expiration is today. I expect most positions to be out by end of day Monday. Row crops start the day higher on the board. Brazilian weather is stable and not offering a post US harvest bean rally. Tariffs or not, the globe is sitting on a large supply. Argentina’s soybean planting has jumped 15% from last week to this week, now above 36% planted. Argentina’s corn planting was not prioritized, advancing less than 1% week-over-week now at around 40%. Australia is looking at an extra 1 million metric tons of wheat over what was previously estimated in September. This year’s Aussie wheat harvest will be 23% higher than last year’s and could make up for less trade in the Black Sea.

Ag Fundamentals:

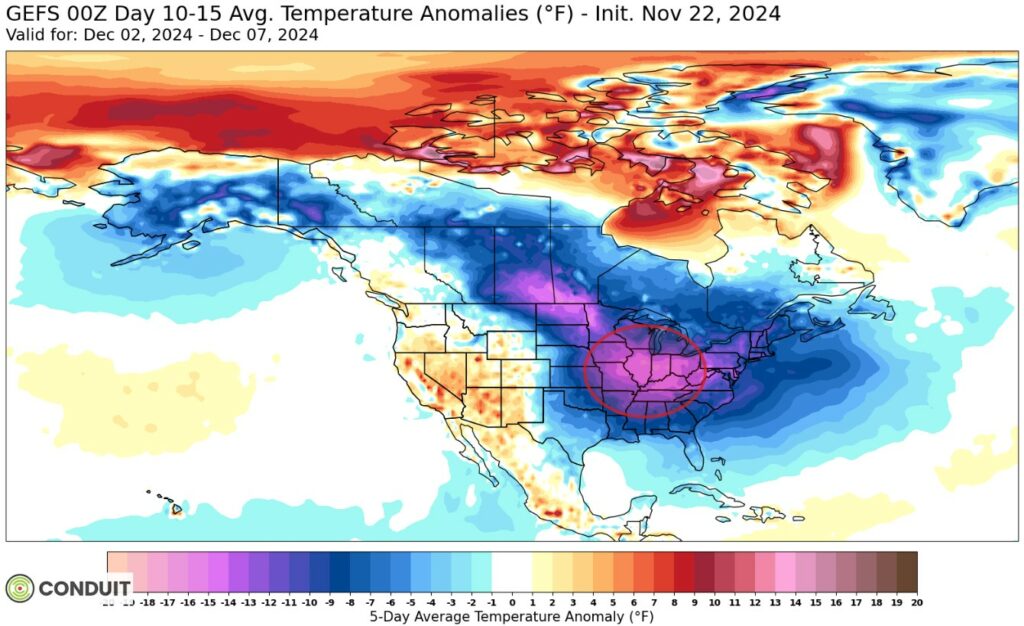

Enjoy this weekend’s “warm” 30-40 degree weather because following Monday, the country will see much colder temps settle in from the north. Most of the central US will be dry until the last half of next week.

Temperature Anomalies showing colder than normal temps will drop into the heart of the country on December 2nd-7th.

Export & World News

Malaysian palm oil futures were down overnight 130 ringgit, now at 4642.

Daily Trading Limits: Corn $0.30 (expanded $0.45); Soybeans $0.85 (expanded $1.30); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

>>Interested in more commentary by Joe Mauck? Go HERE

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.