OPENING COMMENTS

Geopolitics:

President Trump and President Putin are expected to hold a phone call tomorrow (Tuesday) regarding the negotiations of a ceasefire and possibly the end to the Ukraine/Russia war. Wheat prices continue to react to news of a peace deal. Tomorrow’s discussion will be focused around assets like land and power plants that may be divided depending on the result of the negotiation.

Macroeconomics:

On Wednesday this week, the Federal Reserve will announce their decision on interest rate levels. The market is expecting the Fed to leave rates unchanged which would be the least turbulent decision today. Following a solid round of job reports and better than expect inflation reports, the market is favoring a fed rate cut by the June meeting. This morning’s retail sales report came in lower than expected. Estimates were expecting spending to be up 0.6% but reported this morning at 0.2%.

Ag Fundamentals:

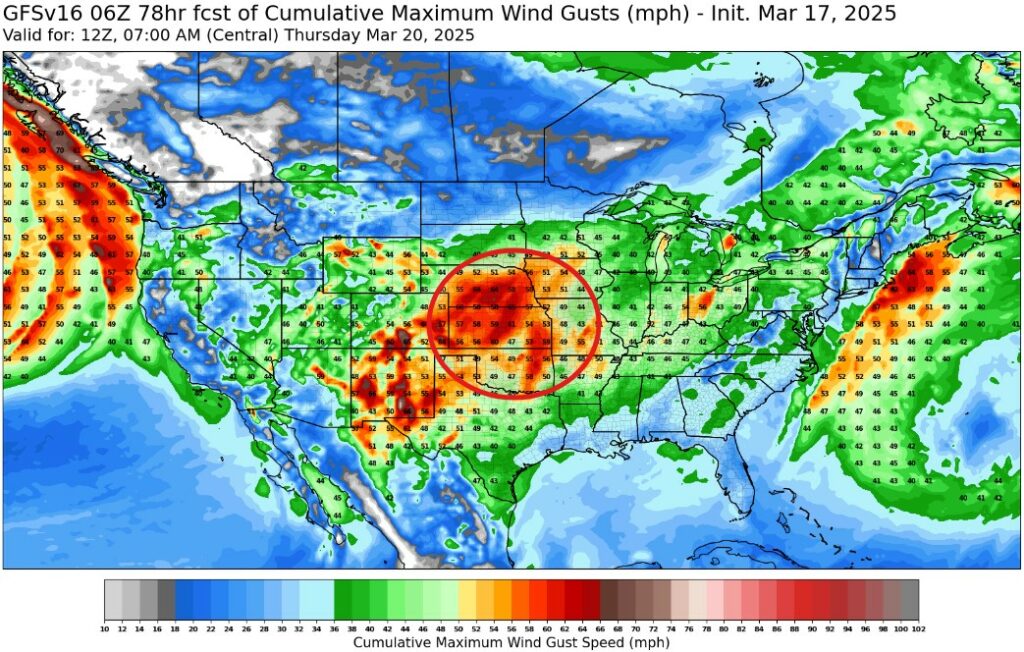

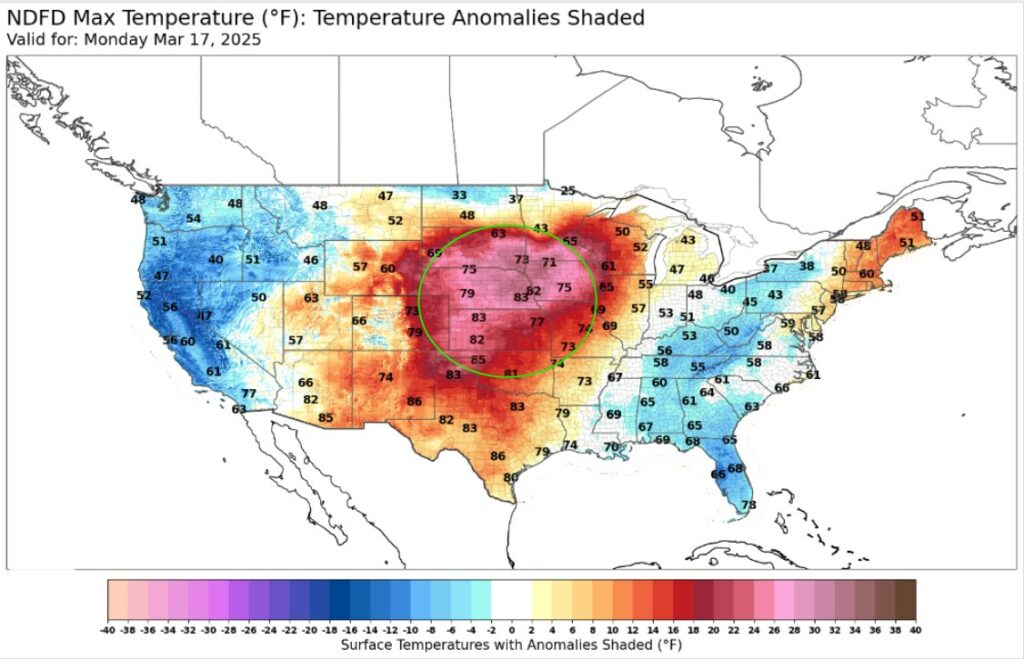

The CFTC Commitment of Traders Report on Friday showed managed money sold 73K contracts of corn week-over-week, the 3rd consecutive week of selling corn. Now over -200K contracts less than their position highs in early January. They short covered soybeans and soybean meal, while flipping their position from long 9K to short 13K contracts of soybean oil. The funds now hold their largest short position in Chicago wheat despite the 5K contracts that covered shorts last week. High winds in the central plains and Midwest are threatening the wheat crop quality. Winds are expected to reach up to 60-65 mph. Temps in that same area will be higher than normal reaching into the up 70s while the winds are blowing. Part of the reason wheat is higher this morning. According to Agrural, Brazil’s soybean crop is 70% harvested vs. 63% year. They also reported the second Brazilian corn crop is 97% planted.

The FedWatch Tool has set the probability of NO CUT to federal interest rates this week at 99%.

Another Gust of High Winds expected to hit wheat country on Wednesday/Thursday this week. Wind gusts are expected to reach up to 65 mph at the highest.

Max Temps in Wheat Country will be in the upper 70s/low 80s which in combination with wind can add damage to the wheat crop.

EXPORT & WORLD NEWS

Friday morning the USDA flashed a 218K MT corn sale from the US to unknown destinations, and the US also sold 20K MT of soybean oil to unknown destinations as well.

Malaysian palm oil futures were down overnight 107 ringgit, now at 4469

Daily Trading Limits: Corn $0.30 (expanded $0.45); Soybeans $0.85 (expanded $1.30); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

>>Interested in more commentary by Joe Mauck? Go HERE

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.