OPENING COMMENTS

AG FUNDAMENTALS:

Export Sales reported another strong week for corn with about 53.5M bushels with the main destinations being Japan(493K MT), Mexico(426K MT), Spain, and South Korea. There was a bonus 1.8M bushels of corn sold for the 25/26 crop year as well. Mexico has been the largest buyer of US corn by far with over 600 million bushels on the books and still 300M bushels yet to deliver. With February 1st being the previously proposed date of beginning a trade war with Mexico, it’s hard to believe managed money is overly concerned about this situation with them being almost +350K contracts long at this point. The record long for MM was +409K contracts in 2011. Their whole mantra is: “The trend is your friend”, but it seems as though they are getting very extended on their current position. I do expect an announcement of some sort on Saturday regarding both Mexico and Canada, but I do not think there will be a blanket 25% tariff on our neighbors. Currently it seems President Trump’s goals are less about trade leverage and more about boarder security. Current ending stocks to use ratio for corn is estimated at 10.2%. Wheat export sales were on the high side of estimates, and up over 90% from the last 4-week average. Major wheat destinations were the Philippines(86K MT), Unknown (85K MT) and South Korea (70K MT). The wheat market has found a leg to stand on and is attempting to close the gap between wheat and corn. Global wheat stocks to use ratio is at 32.4%, the slimmest that has been since 2015. Soybean meal export sales were reported above the estimate range at 410K MT. Soybeans export sales however disappointed, coming in below the estimate range. The US is expecting to lose soybean acres to corn this spring.

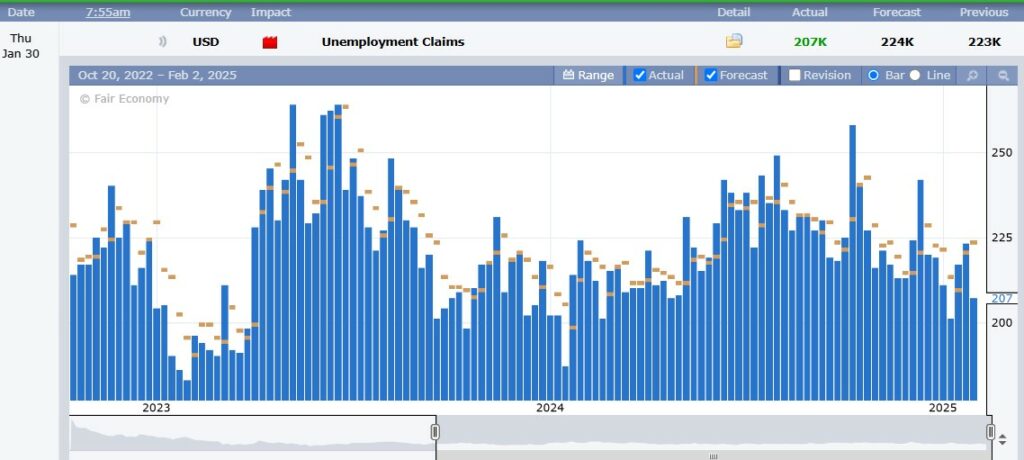

Unemployment Claims came in lower than expected. Estimates were anticipating 224K claims and 207K were reported this morning. This is a solid argument for the Fed to hold off on cutting rates as the labor market remains strong.

WEEKLY EXPORT SALES

|

EXPORT & WORLD NEWS

Japan’s feed wheat and barley tender failed to trade late yesterday. Jordan has issued an international tender to buy up to 120K MT of milling wheat from optional origins.

Malaysian palm oil market is closed for the Chinese new year holiday

Daily Trading Limits: Corn $0.30 (expanded $0.45); Soybeans $0.85 (expanded $1.30); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

>>Interested in more commentary by Joe Mauck? Go HERE

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.