OPENING COMMENTS

Macroeconomics:

Following Friday’s labor market reports, the US dollar has surged against nearly ever G20 peer currency. if the job reports continue to impress through the next few months, the Fed may decide no cuts are necessary for the rest of the year. the next time the fed is most likely to cut is June, but that opinion could easily change if the labor market remains in good shape. The dollar is looking to consolidate in the 109-111.0 levels on the index. If we surge past 110.79 resistance, 113.91 (October 2022 highs) is back on the table.

Ag Fundamentals:

China bought a 198K MT tender from the US this morning following Friday’s bullish report and prior to Trump’s inauguration. China’s soybean imports were at a record 105 million MT in 2024. Chinese reserves “filled” according to Asian sources which means demand could slow following any new tariffs added by the new US administration. The late summer dryness in the US cause moisture levels at the scales to drop. Many calculations and yield surveys done last year did not account for the loss in moisture due to the late season dryness. dropping corn 3.8 bpa and beans 1 bpa is enough to spark optimism in prices, but many fear a healthy rain in Argentina before the end of the week will land on this parade.

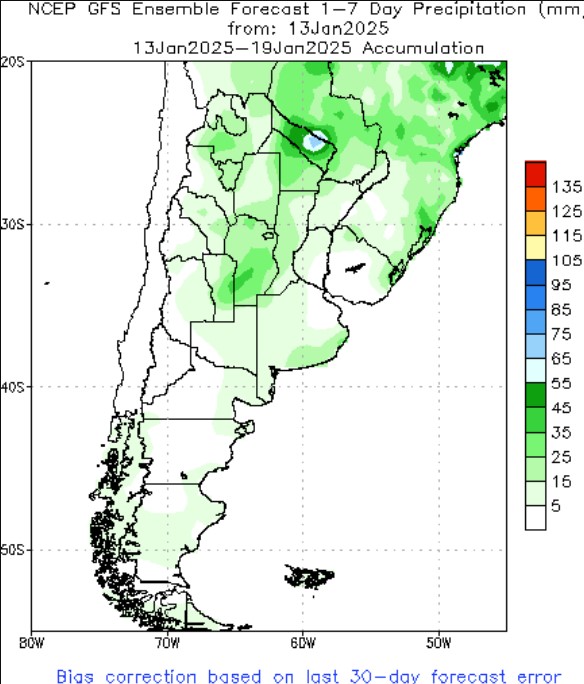

One Week Total Rainfall in Argentina. Expecting to see 2 to 2.5 inches in some areas.

Export & World News

The US sold 198K MT of soybeans to china this morning. South Korea is believed to have bought up to 199K MT of animal feed corn last week.

Malaysian palm oil futures were up 113 ringgit overnight, at 4504.

Daily Trading Limits: Corn $0.30 (expanded $0.45); Soybeans $0.85 (expanded $1.30); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

>>Interested in more commentary by Joe Mauck? Go HERE

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.