OPENING COMMENTS

|

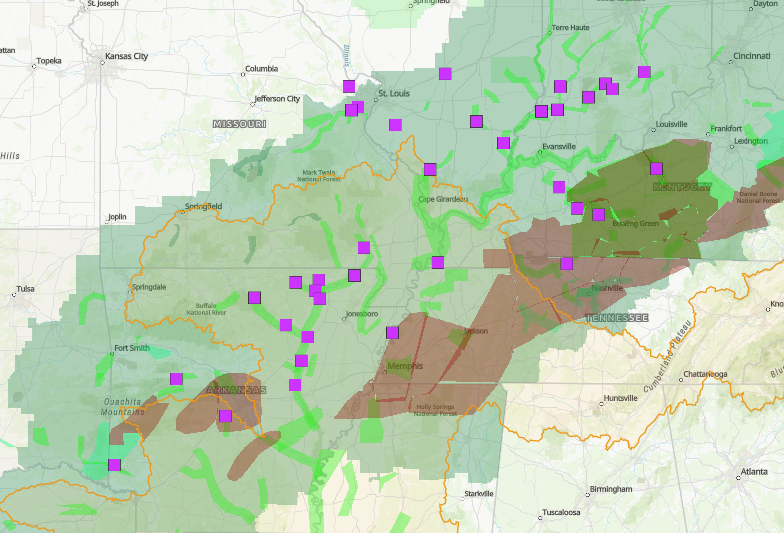

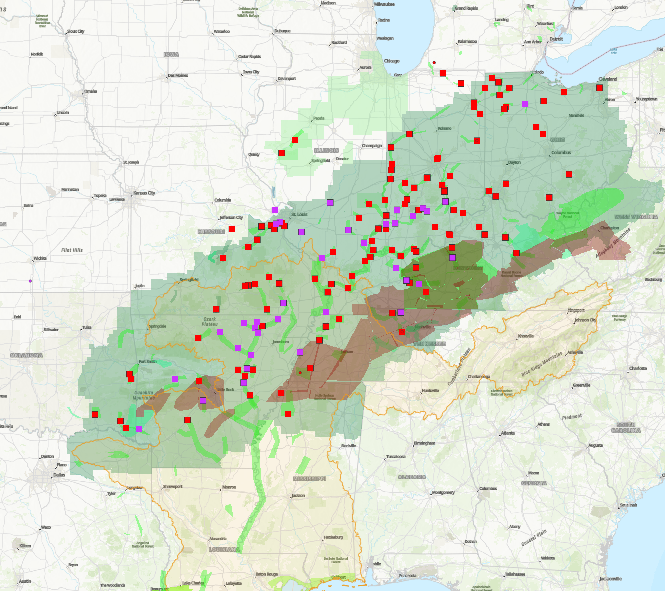

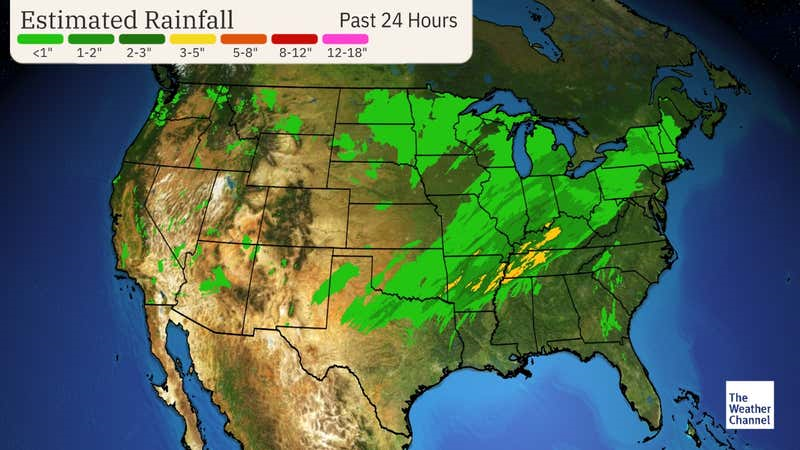

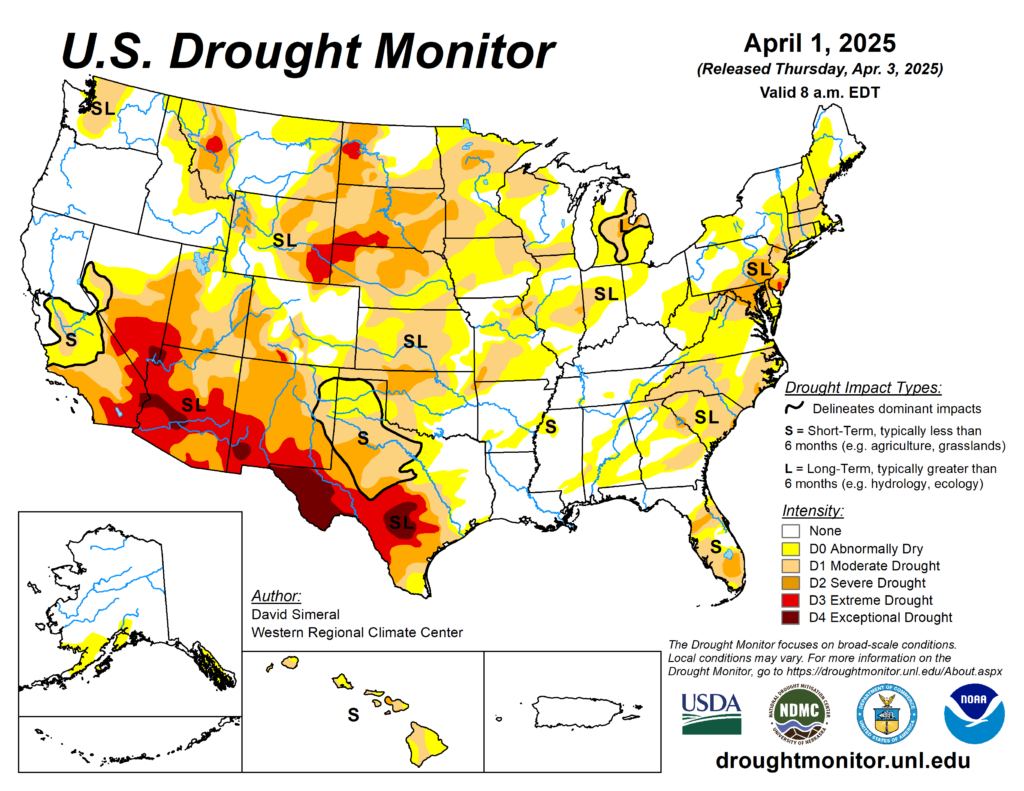

Areas that are Expecting Moderate and Major Floods can be seen in the image below. The red squares represent moderate floods in the forecast and the purple square represent the areas expecting major flood levels. Rains like these at this time are not ideal for the southern farmer to begin planting corn.

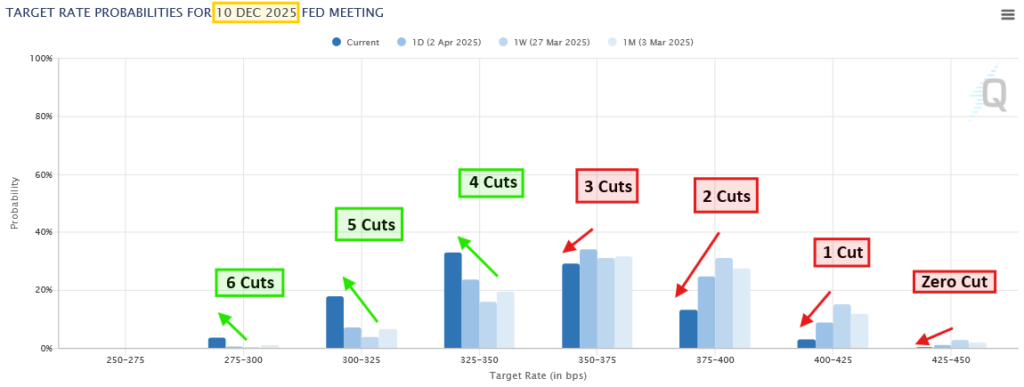

LThe December 10th 2025 Fed Probability Bar Chart in the last two days has increased the chance of the number of federal interest rate cuts from 2-4 cuts to 3-5 cuts between now and the end of this year. Jerome Powell expected to speak on economic outlook today around noon.

Export & World News

South Korea is believed to have purchased about 65K MT of animal feed corn yesterday in a private deal according to European sources.

Daily Trading Limits: Corn $0.30 (expanded $0.45); Soybeans $0.85 (expanded $1.30); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

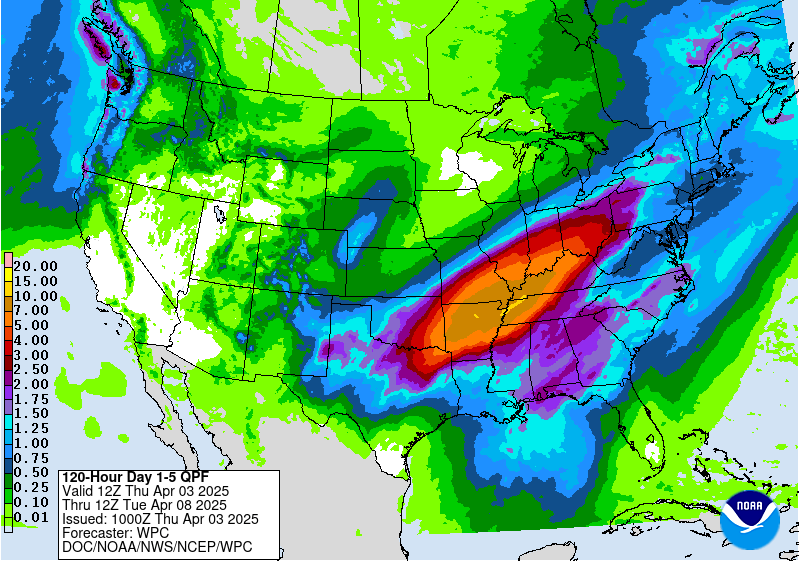

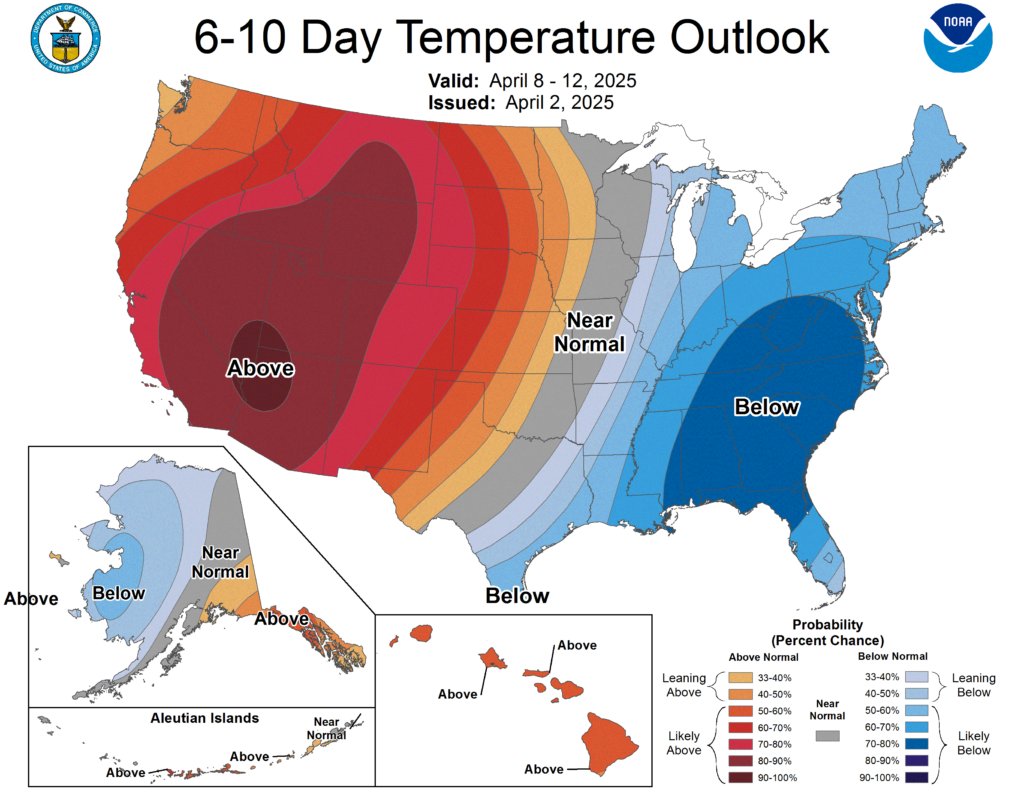

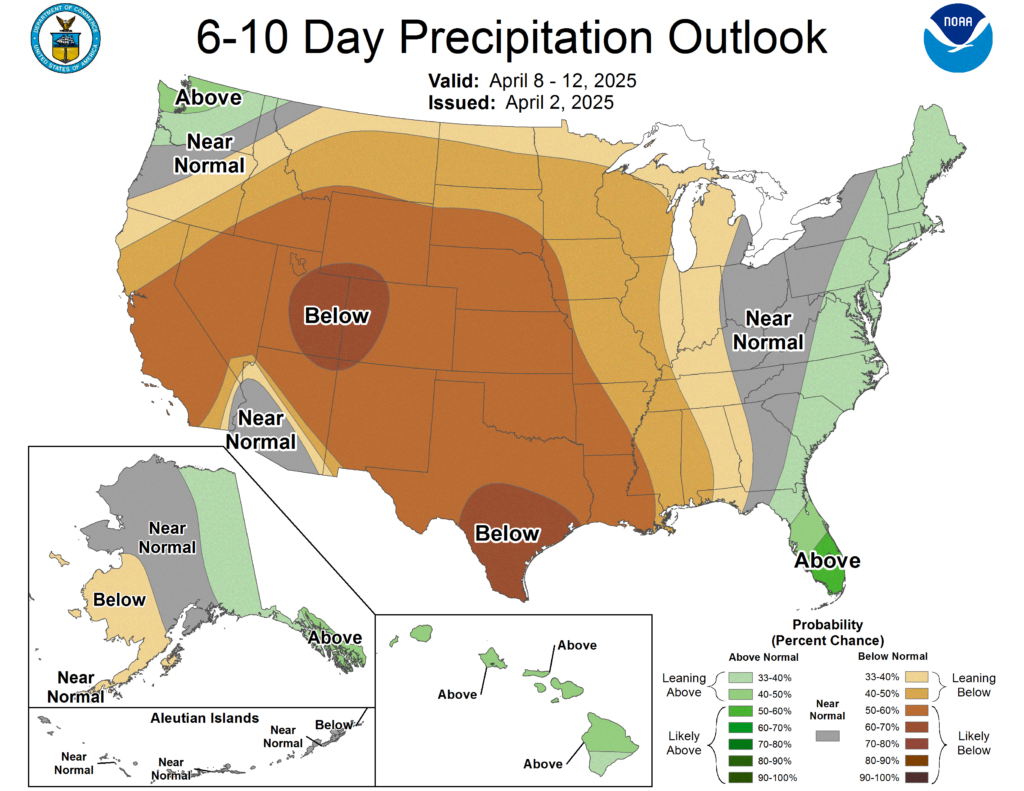

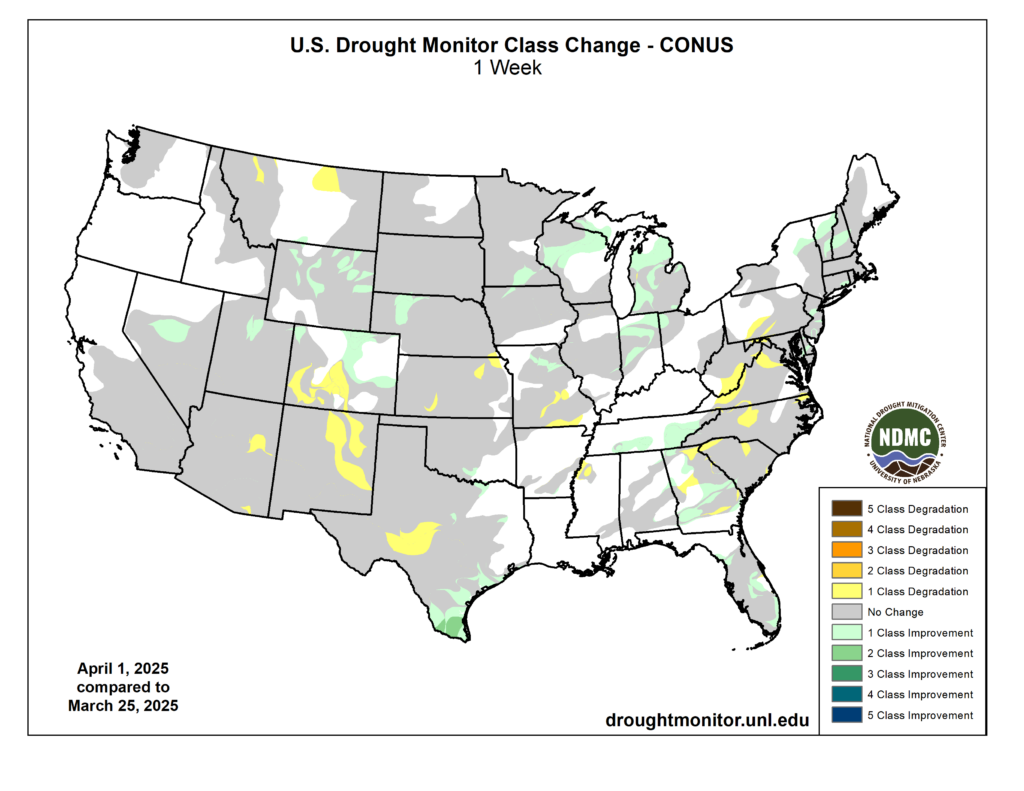

Weather Outlook

>>Interested in more commentary by Joe Mauck? Go HERE

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.