OPENING COMMENTS

AG FUNDAMENTALS:

Mexico Buys 235K MT of corn from the US this morning. The USDA reported a flash sale this morning of 130K MT of corn sold for the current 24/25 marketing year and 105K MT of US corn sold to Mexico in the 25/26 marketing year. That should catch them back up from the lack luster purchases last week. Japan showed up for US export sales last week. Japan was the top buyer of corn, soybeans, and wheat. Aside from a solid export report, corn and beans are riding on hopes of a deal for both ethanol and biofuel policies out of Washington. The CFTC will release the commitment of traders report later this afternoon.

Buyers For Week Ending 4/17

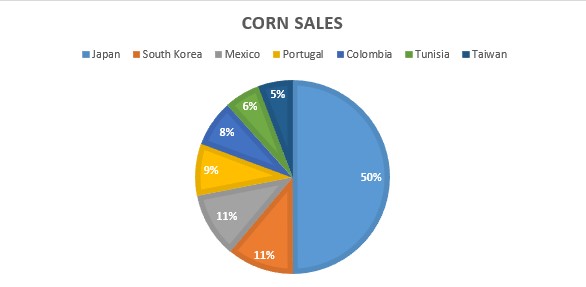

Corn Export Sales: Mexico fell to the third slot behind Japan and the Netherlands for last week’s export sales.

Country | Corn Sales (1K MT) |

Japan | 629.2 |

South Korea | 140.6 |

Mexico | 136.4 |

Portugal | 110 |

Colombia | 96.9 |

Tunisia | 75.5 |

Taiwan | 71.2 |

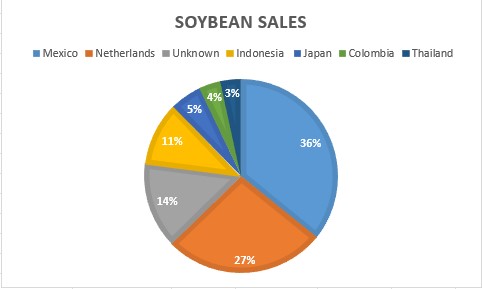

Soybean Export Sales: Mexico was the lead buyer for US soybeans last week, followed by the Netherlands. China focusing their purchasing power toward South America.

Country | Soybean Sales |

Mexico | 87.8 |

Netherlands | 65.8 |

Unknown | 35 |

Indonesia | 26.2 |

Japan | 13 |

Colombia | 8.9 |

Thailand | 8.2 |

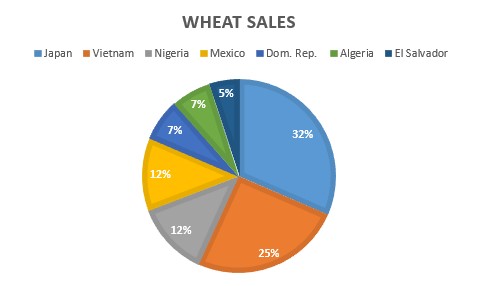

Wheat Export Sales: Japan lead the purchases in wheat last week as well, followed closely by Vietnam.

Country | Wheat Sales (1K MT) |

Japan | 93.9 |

Vietnam | 75.3 |

Nigeria | 37 |

Mexico | 36.2 |

Dom. Rep. | 21.1 |

Algeria | 19.8 |

El Salvador | 14.6 |

Export & World News

Iran bought 50K tons of animal feed barley this week. Iran is also interested in purchasing up to 120K MT of animal feed corn, 120K MT of feed barley, and 120K MT of soymeal.

Malaysian palm oil futures were up 10 ringgit overnight, now at 4046.

Daily Trading Limits: Corn $0.30 (expanded $0.45); Soybeans $0.85 (expanded $1.30); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

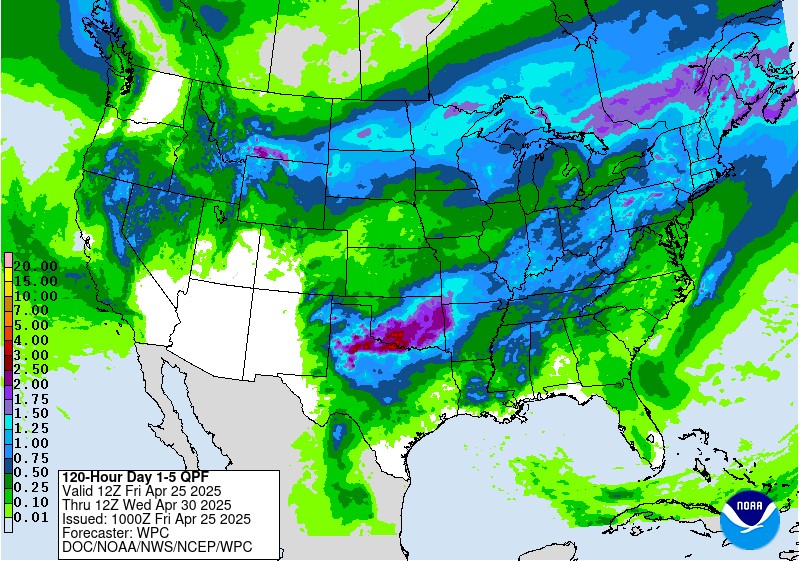

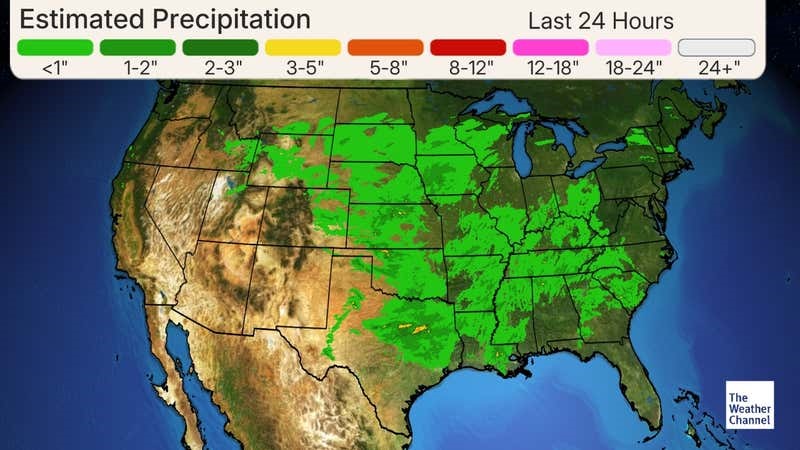

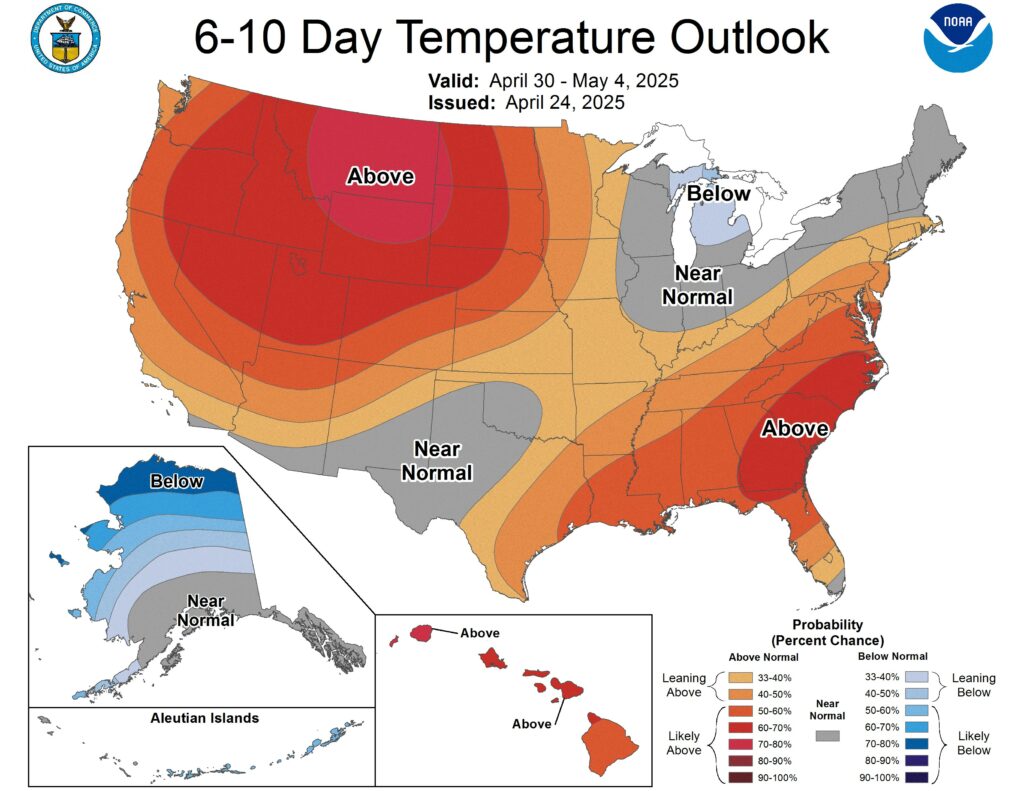

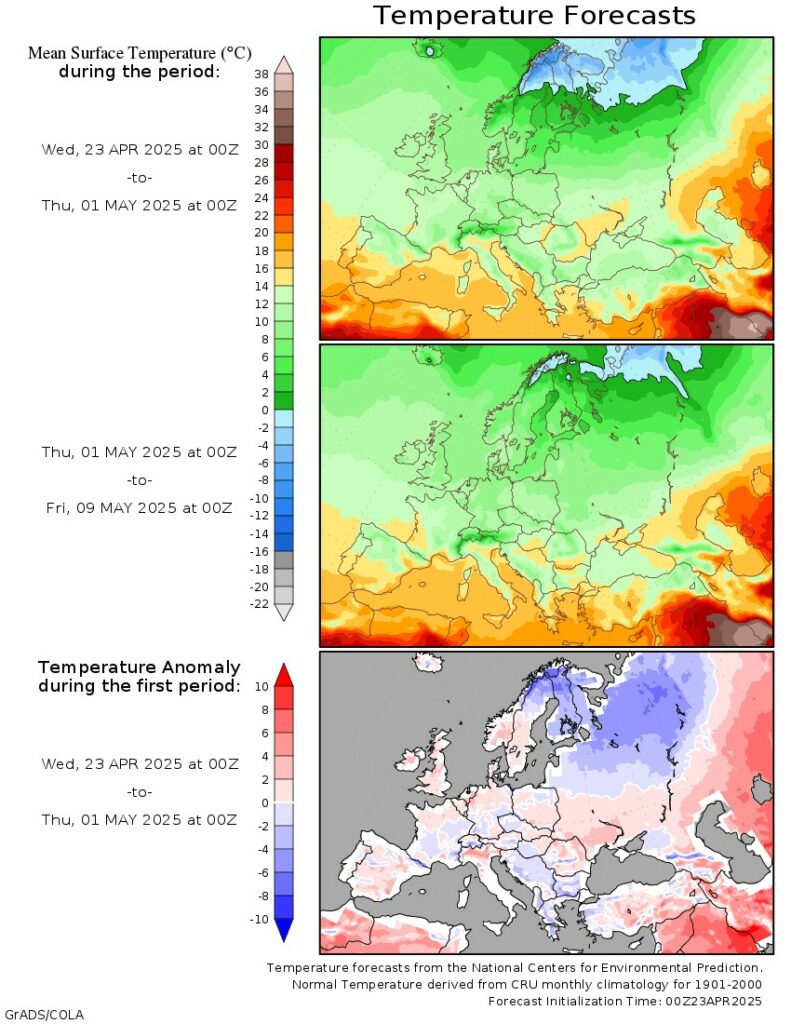

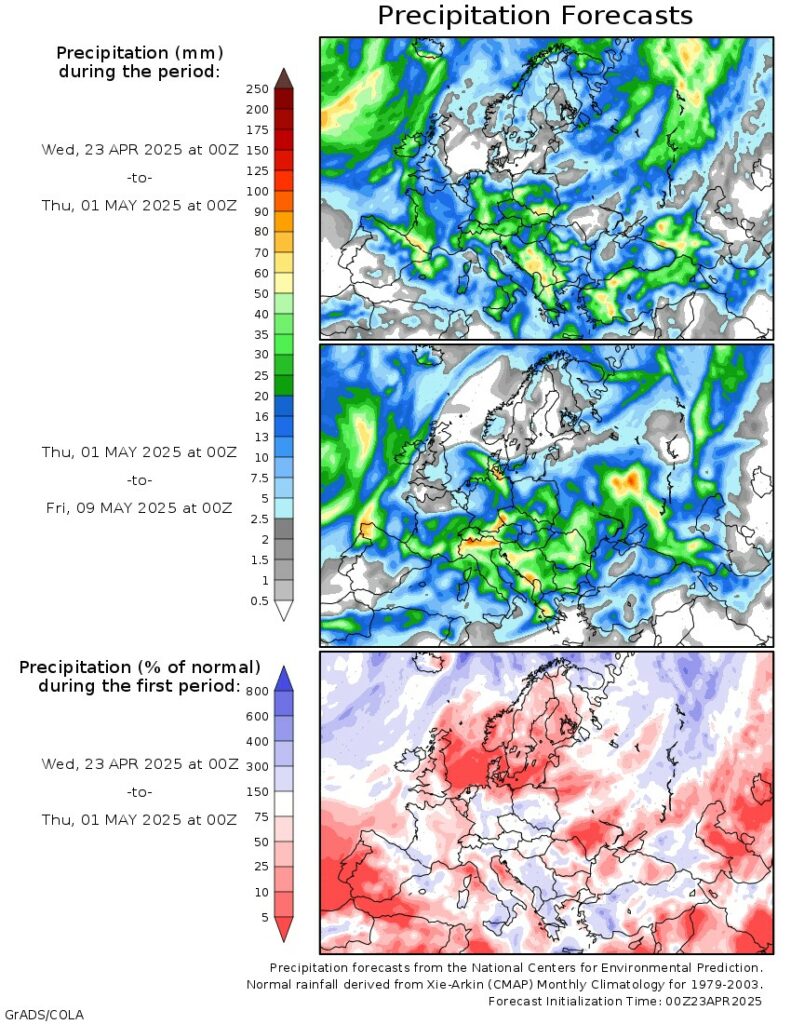

Weather Outlook

>>Interested in more commentary by Joe Mauck? Go HERE

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.