CLOSING COMMENTS

Macroeconomics:

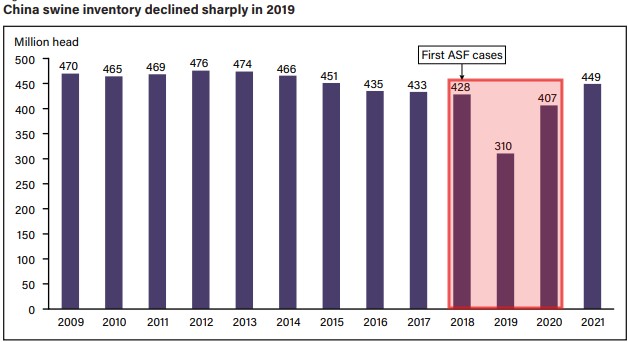

As more within the Agriculture space share opinions about the effects of another Trump administration, it is important to remember the large spike in African Swine Flu cases right in the middle of it in 2018/2019. The number of hog heads in China dropped nearly 30% following the applied tariffs. Over 110 million hogs fewer in 2019 than China’s 2018 inventory. The Trade war started on June 7th 2018 with a 25% tariff from both US and China. The trade war did not conclude, but a phase-one document was signed by both the US and China in January of 2020. Before 2019, there were more small hog farms in China that were not meeting proper sanitation requirements to avoid this disease. Many of those farms have since fallen off, consolidated or improved sanitary conditions. It may be different this time around if China can keep a healthy and hungry hog heard.

Ag Fundamentals:

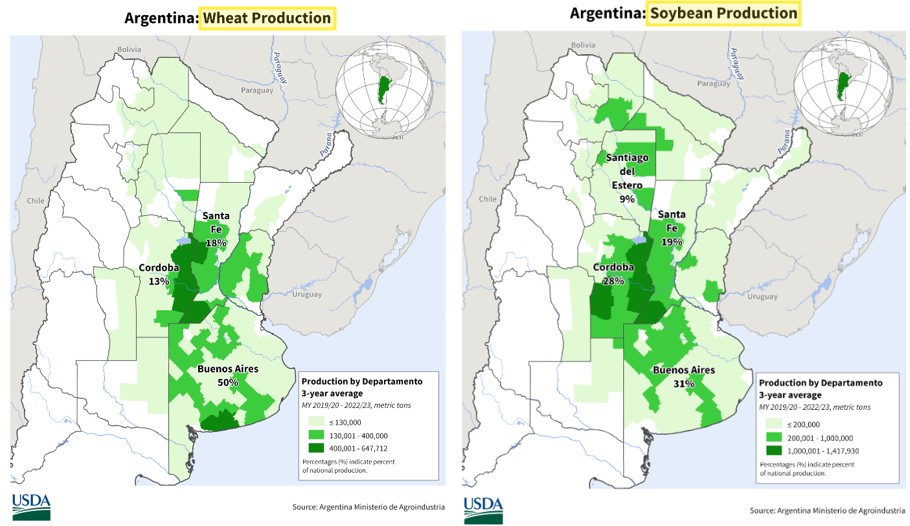

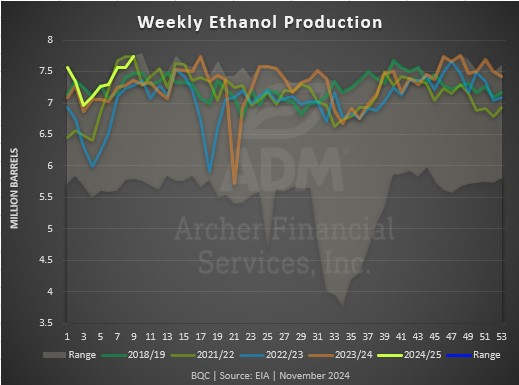

Conab released their estimates for Brazilian corn and bean production. They estimate Brazil’s bean production at 166.14 vs. the USDA’s 169 MMT, and they estimate Brazil’s corn at just under 120 million metric tons, below the USDA’s 127.0 MMT estimate last week. Argentina is expected to produce 51-53 MMT of soybeans depending on how their planting/growing season develops. the recent dryness in parts of Argentina has allowed for soybean planting and wheat harvest to operate smoothly so far. Ethanol Production hits a new weekly all time high at 1.113 million barrels per day despite lower margins. Corn usage can be found near the top of the range at 15.98 million bushels per day. over 1 million bushels per day more than what is needed to reach the USDA’s ethanol estimate. I expect them to adjust the corn demand numbers on next month’s WASDE report.

Weather:

Normal rainfall and adequate soil moisture is needed now through December in Argentina for them to complete their soybean planting. There are some pockets of dryness in the central and most production packed areas of Argentina, but they will receive over an inch of rain over the next 10-14 days.

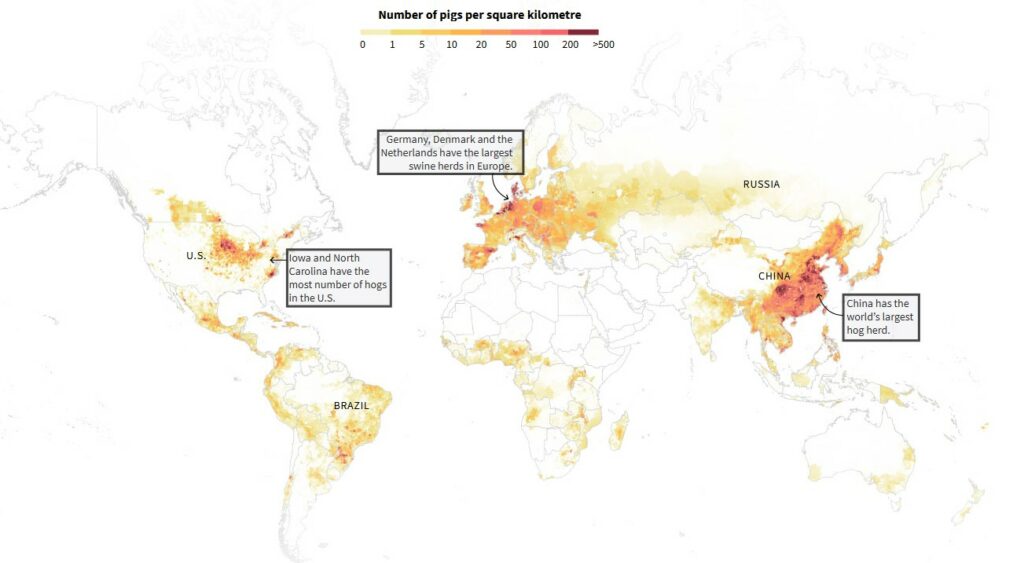

The Number of Hogs per Square Kilometer is displaying in the map below. China has the Worlds largest hog herd. Germany has the largest herd in the EU and Iowa with the most in the US.

China’s Swine Inventory dipped drastically during Trump’s Trade War (highlighted in red). The Trade war started in June of 2018 and the phase-one trade deal was singed in January of 2020.

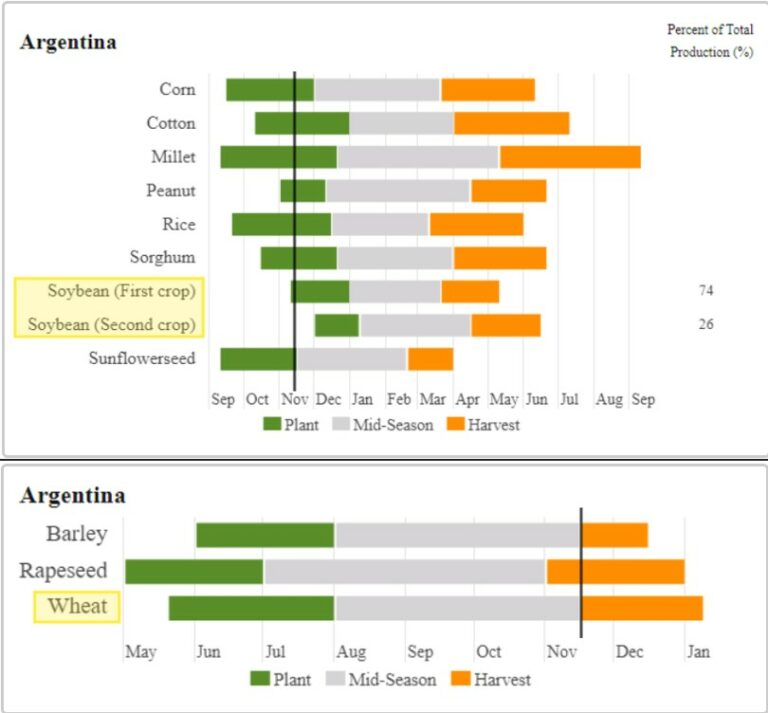

Argentina’s Crop Schedule can be seen below. They are at the tail end of corn planting and at the beginning of planting their first bean crop. Whet harvest has also started and will both bean planting and wheat harvest will continue through mid January.

Left: Argentina’s Wheat Growing Areas

Right: Argentina’s soybean Growing Areas

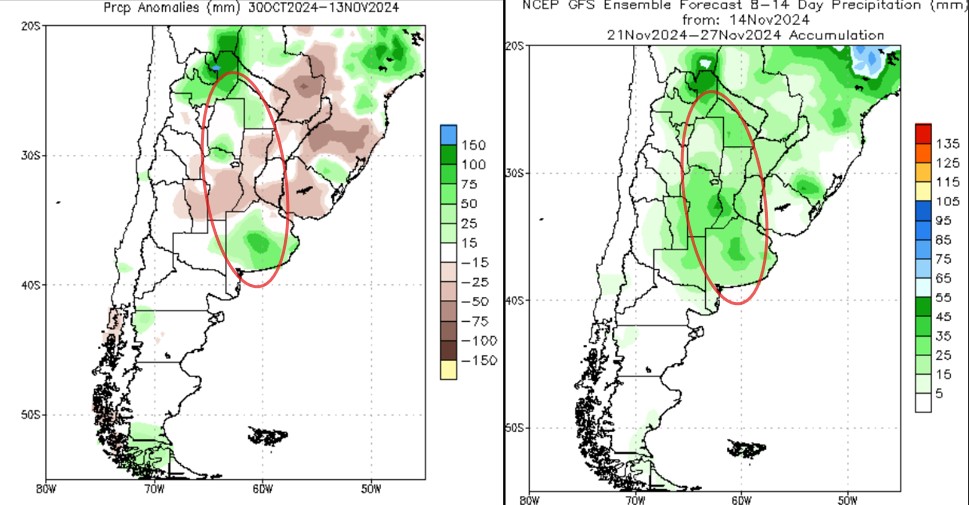

Left: Last 2 Weeks of Precip Anomalies Shows the center of the Argentina growing area has had less than normal rainfall in the last 2 weeks.

Right: The 8-14 Day total Rainfall Map is still below normal, but it will provide some moisture to growing areas.

EIA Weekly Ethanol Production

|

|

Calendar Spreads

Spread | Last | Chg | Full | % of FC |

CZ24/CH25 | -11 3/4 | – 3/4 | -30 3/4 | 38% |

SF25/SH25 | -11 3/4 | -1 | -26 | 45% |

SH25/SK25 | -14 | -1 | -27 | 52% |

SF24/SN25 | -38 | -2 1/4 | -79 1/2 | 48% |

MWZ24/MWH25 | -19 1/4 | +3 | -30 | 64% |

WZ24/WH25 | -18 | -2 1/2 | -23 1/2 | 77% |

KWZ24/KWH25 | -13 3/4 | +1/4 | -23 1/2 | 59% |

Cost of Carry

Daily Trading Limits: Corn $0.30 (expanded $0.45); Soybeans $0.85 (expanded $1.30); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

>>Interested in more commentary by Joe Mauck? Go HERE

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.