Geopolitics: Brazil’s President Luiz and China’s Leader Xi met in Beijing today to sign 20 trade deals between the two powerhouses. They both pledged to defend free trade. The deals included agricultural products as the two countries plan to conduct more business in the future. Prior to Luiz’s visit to China, many trade restrictions were lifted regarding Brazilian soybean shipments. Nearly $5 billion dollars of Chinese investments in Brazil were captured in this visit. The two leaders will meet again in July at the BRICS summit. The Pakistan and India conflict seems to have settled down as Trump, Vance and Rubio all have worked with Indian officials to develop a “cessation of hostilities”. Secretary of State Rubio is also set to discuss peace talks between Russia and Ukraine in Turkey on Thursday this week.

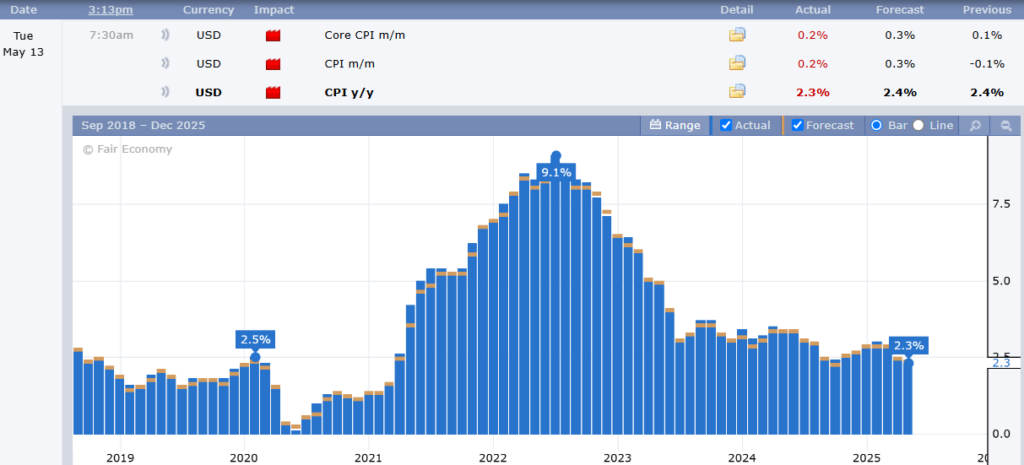

Macroeconomics: President Trump was welcomed to the Saudi investment forum in Riyadh today for an announcement of a $600 billion investment in the US. Trump announced he will lift sanctions against Syria to allow them “a chance at greatness”. CPI data this morning suggests consumer inflation is decreasing, CPI now at 2.3%. We are below the 2.5% inflation rate recorded in February of 2020 (prior to COVID). Crude oil jumped +1.30 higher today, July futures closing above $63/barrel.

Ag Fundamentals: A Republican led bill has been proposed in the House of Representatives to extend the biodiesel tax credit for two years at the blender level. “The Biodiesel Tax Credit Extension Act of 2025” would allow taxpayers to choose between the Biodiesel Tax Credit and the ’45Z’ Clean Fuel Production Credit. July soyoil futures closed at it’s highest level since November 2023. The USDA lowered the expected bean oil usage for biofuel -150 million pounds to 13.1 billion lbs. Spot board crush margins were up +5.5¢ to $1.39 per bushel as soybean oil peroxide value moved above 46%, the highest percentage since November. The Northern Plains and Midwestern growing regions will receive 1.5 to 3 inches of rain over the next 5-10 days. This is much needed in some areas in the north that have been dry, and will kick-start the early growth stages of many acres already sowed.

Consumer Price Index reported a drop in consumer inflation this morning. The market was expecting a 2.4% increase year-over-year and we reported a 2.3% increase. Inflation is still here, but has cooled off from the post-COVID highs.

CALENDAR SPREAD

Spread | Last | Chg | Full | % of FC |

CN25/CU25 | 14 3/4 | – 1/2 |

|

|

CU25/CZ25 | -13 1/4 | – 1/2 | -31 | 43% |

SN25/SQ25 | 2 1/4 | – 3/4 |

|

|

SQ25/SX25 | 10 3/4 | 0 |

|

|

SN25/SX25 | 13 | – 3/4 |

|

|

MWN25/MWU25 | -13 | +1/2 | -20 1/2 | 63% |

WN25/WU25 | -14 1/2 | 0 | -15 3/4 | 92% |

KWN25/KWU25 | -14 1/2 | +1/4 | -15 3/4 | 92% |

COST OF CARRY

Daily Trading Limits: Corn $0.30 (expanded $0.45); Soybeans $0.85 (expanded $1.30); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

Futures Settlements & Technicals

|

>>Interested in more commentary by Joe Mauck? Go HERE

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.