|

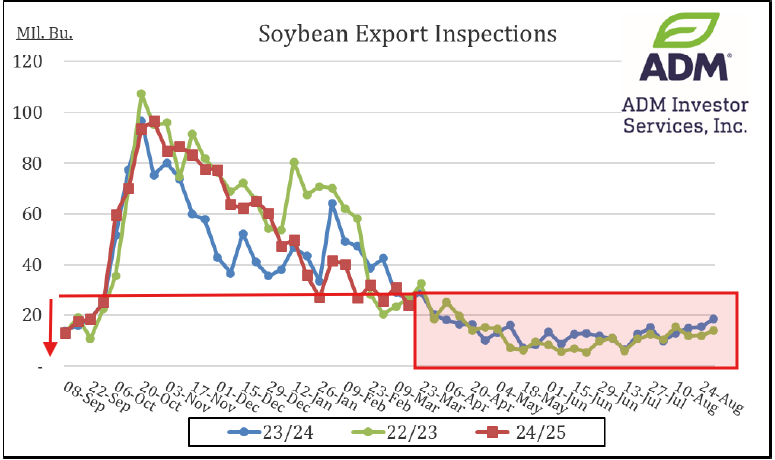

US Soybean Export Inspections: With Brazil over 75% harvested at this point, the window has closed to see any sort of Chinese buying spree.

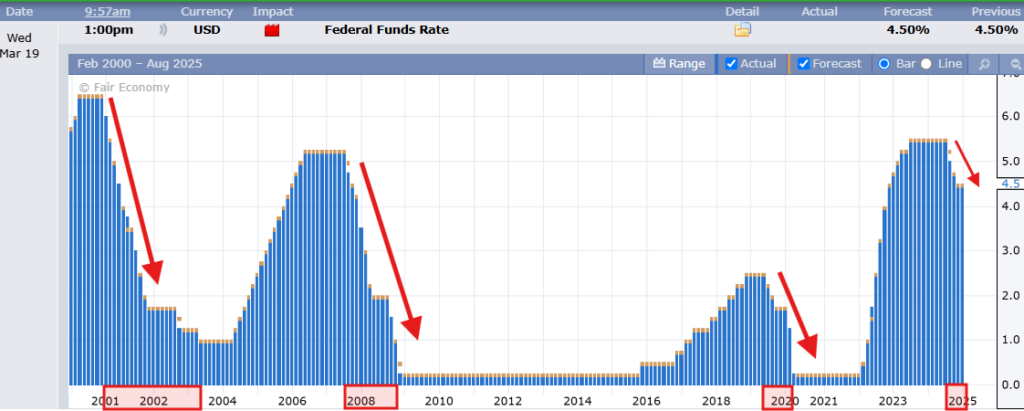

The Federal Funds Rate has gone through 3 other cutting seasons in the last 25 years excluding the one we are in right now.

CALENDAR SPREADS

Spread | Last | Chg | Full | % of FC |

CK25/CN25 | -9 1/4 | – 1/4 | -21 | 44% |

CN25/CU25 | 20 3/4 | -1 1/2 | ||

SK25/SN25 | -13 3/4 | 0 | -27 | 51% |

SN25/SQ25 | 3 | +1/4 | ||

SN25/SX25 | 11 | +1/4 | ||

MWK25/MWN25 | -16 1/4 | -1 | -20 1/2 | 79% |

WK25/WN25 | -17 | – 1/2 | -16 | 106% |

KWK25/KWN25 | -12 3/4 | – 1/2 | -16 1/2 | 77% |

COST OF CARRY

Daily Trading Limits: Corn $0.30 (expanded $0.45); Soybeans $0.85 (expanded $1.30); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

Futures Settlements & Technicals

|

>>Interested in more commentary by Joe Mauck? Go HERE

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.