|

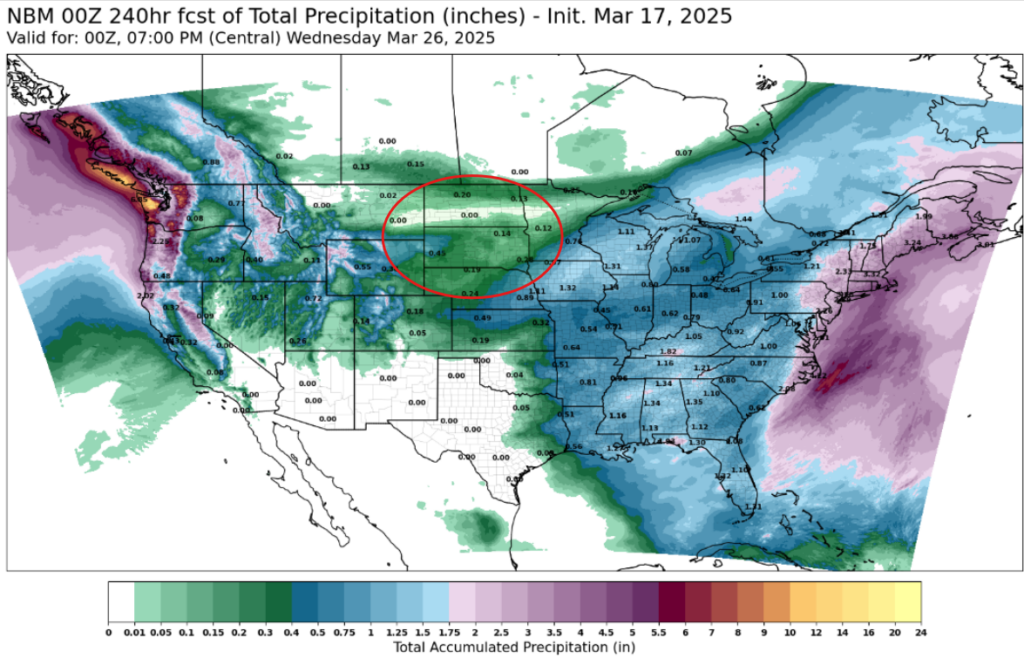

Next 10 Days of Precipitation. The area circled in red is already in a moderate-severe drought and the next 10 days of precip are not helping.

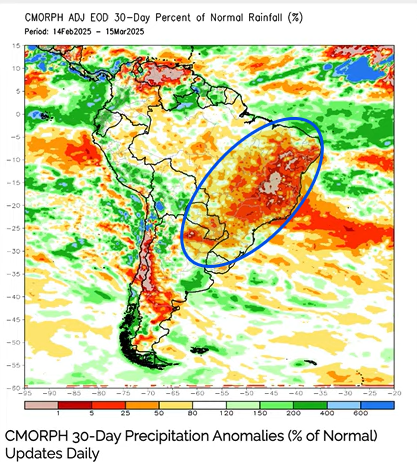

Percent of Normal Precipitation for South America shows the eastern growing regions have experienced drier than normal weather and NDVI levels in these areas are below the 20-year average range. Brazil’s soybean crop is 70% harvested, but the 2nd corn crop may be in jeopardy due to this dry pattern.

CALENDAR SPREADS

Spread | Last | Chg | Full | % of FC |

CK25/CN25 | -9 | 0 | -21 | 43% |

CN25/CU25 | 22 1/4 | – 3/4 |

|

|

SK25/SN25 | -13 3/4 | +1/4 | -27 | 51% |

SN25/SQ25 | 2 3/4 | – 1/2 |

|

|

SN25/SX25 | 10 3/4 | -1 1/4 |

|

|

MWK25/MWN25 | -15 1/4 | – 1/2 | -20 1/2 | 74% |

WK25/WN25 | -16 1/2 | – 1/2 | -16 | 103% |

KWK25/KWN25 | -12 1/4 | +1/2 | -16 1/2 | 74% |

COST OF CARRY

Crush and ethanol margins have tightened and nearby export demand is at risk due to changes to trade policy.

Daily Trading Limits: Corn $0.30 (expanded $0.45); Soybeans $0.85 (expanded $1.30); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

Futures Settlements & Technicals

Symbol | Close | Chg | High | Low | Support | Resist | 20-Day | 50-Day |

CK25 | 461 | +2 1/2 | 465 1/2 | 457 1/4 | 457 | 467 | 478 | 486 1/4 |

CN25 | 470 | +2 1/2 | 473 3/4 | 467 | 467 | 477 | 484 1/4 | 490 1/4 |

SK25 | 1015 1/2 | – 1/2 | 1021 3/4 | 1010 1/4 | 1011 | 1027 | 1028 1/4 | 1043 |

SN25 | 1029 1/4 | – 3/4 | 1036 | 1024 1/2 | 1024 | 1040 | 1042 3/4 | 1056 1/4 |

SQ25 | 1026 1/2 | – 1/4 | 1033 | 1022 1/2 | 1024 | 1040 | 1040 1/2 | 1052 1/2 |

MWK25 | 615 | +13 1/4 | 619 1/2 | 602 | 611 | 625 | 612 1/4 | 613 |

MWN25 | 630 1/4 | +13 3/4 | 634 1/4 | 618 1/2 | 625 | 640 | 626 | 624 3/4 |

WK25 | 568 1/2 | +11 1/2 | 575 1/4 | 559 | 562 | 582 | 570 1/2 | 569 3/4 |

WN25 | 585 | +12 | 591 1/2 | 575 1/2 | 580 | 596 | 584 3/4 | 581 3/4 |

KWK25 | 605 1/2 | +19 1/2 | 609 | 591 | 599 | 615 | 588 3/4 | 585 1/4 |

KWN25 | 617 3/4 | +19 | 621 1/4 | 602 1/4 | 613 | 626 | 601 3/4 | 596 |

SMK25 | 304.3 | -1.60 | 307.7 | 303.4 | 302.00 | 309.50 | 302.10 | 307.50 |

BOK25 | 42.10 | +0.51 | 42.26 | 41.56 | 41.85 | 42.85 | 44.20 | 44.85 |

>>Interested in more commentary by Joe Mauck? Go HERE

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.