CLOSING COMMENTS

Geopolitics:

President-elect Trump made some statements today at a press conference in Mar-a-Lago. He started out with an announcement of a 20 billion dollar investment in data centers here in the US. That was largely overshadowed on X and other social media by his comments made about Greenland, Canada, the Gulf of Mexico (“America”) and the Panama Canal. All of this talk is reminding me of basketball players rubbing elbows around the paint as they wait for the free-throw to hit the rim.

Macroeconomics:

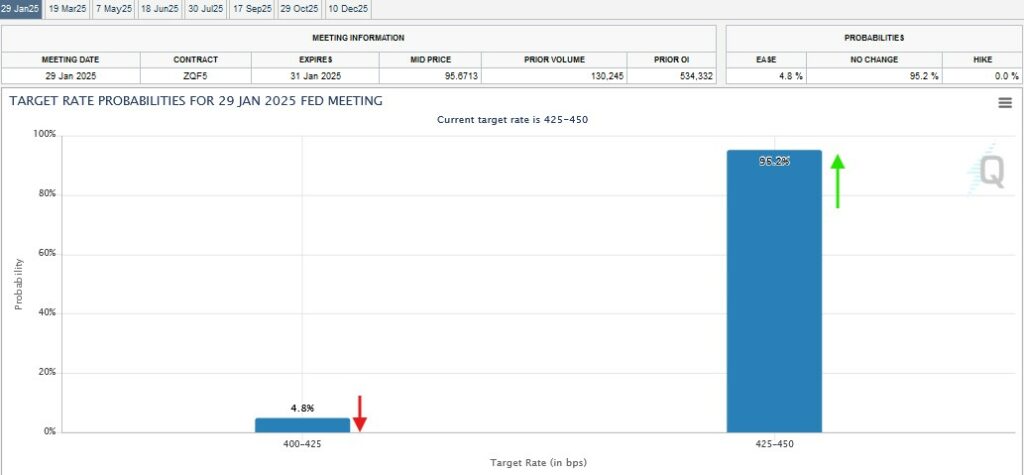

Today’s Job Openings and Labor turnover Survey reported around 370K more job openings than estimated. The Fed will make it’s next decision on federal interest rates on January 29th. Today they are expected to keep rates unchanged at 4.25-4.50%.

Ag Fundamentals:

Ethanol exports in November were up 31% from the previous month, at 188 million gallons (7-month high). Ethanol usage data will be out tomorrow and is expected to read nearly unchanged from the 1.111M barrels per day. Ethanol stocks can be expected to climb between now and July, which is historically typical. Soybean oil lead the complex by surging nearly $1 to close above the 20-day moving average. Helped by Chinese used cooking oil fob values rising from 41.5¢ to 45¢ in the last month, making soybean oil the cheaper alternative for biofuel. With funds now short soybean oil a short squeeze could become reality with a retracement to $45.60. The SH/SK bean spread firmed back up to -10’2 as the dry Argentina narrative holds onto headlines. We’ll see if the USDA changes SA production much on Friday. I am expecting an increase in Brazilian production to above 170 MMT, but Argentina’s production estimate may be punted to February. If South America produces over 220 MMT I would not want to be long the SH/SK bean spread.

Today’s JOLTS Report (Job Openings and Labor Turnover Survey) came in hot with a higher than expected number of job openings in the month of December. This could be a turning point for the indicator. Many argue that the progression of automation will disrupt the number of job openings as Artificial Intelligence is integrated into every labor sector.

The Federal Rate Movement Probability currently shows a 95% probability of no change to rates on January 29th. Current rates are set at 4.25-4.50%, down 100 basis points from decade high rates back in July 2023.

FUTURES SETTLEMENTS & TECHNICALS

Symbol | Close | Chg | High | Low | Support | Resist | 20-Day | 50-Day |

CH25 | 458 | +1/4 | 458 1/2 | 453 | 452 | 461 | 448 3/4 | 439 3/4 |

CK25 | 465 3/4 | +1/2 | 466 | 460 3/4 | 459 | 468 | 455 1/2 | 446 3/4 |

SH25 | 997 1/4 | – 1/2 | 998 1/4 | 985 1/2 | 985 | 1005 | 990 1/4 | 1000 1/2 |

SK25 | 1007 3/4 | -1 | 1009 | 996 1/4 | 996 | 1012 | 1000 1/4 | 1012 1/2 |

SN25 | 1019 | -1 1/2 | 1020 1/4 | 1007 3/4 | 1008 | 1025 | 1011 1/4 | 1024 1/2 |

MWH25 | 594 3/4 | +2 1/2 | 598 | 588 1/4 | 588 | 603 | 595 | 602 1/2 |

MWK25 | 602 3/4 | +2 1/2 | 606 | 597 | 596 | 611 | 602 3/4 | 611 3/4 |

WH25 | 542 1/2 | +2 | 544 1/4 | 535 1/4 | 535 | 552 | 545 1/2 | 560 |

WK25 | 554 1/2 | +2 | 555 3/4 | 547 1/4 | 548 | 563 | 556 | 570 |

KWH25 | 555 3/4 | +2 1/2 | 559 1/2 | 549 1/4 | 548 | 564 | 553 3/4 | 561 1/4 |

KWK25 | 564 1/2 | +1/2 | 567 3/4 | 557 3/4 | 557 | 572 | 561 3/4 | 569 1/2 |

SMH25 | 303.5 | -3.80 | 307.3 | 300.1 | 300.00 | 308.00 | 301.90 | 300.30 |

BOH25 | 41.25 | +0.92 | 41.32 | 40.05 | 40.75 | 42.35 | 41.06 | 43.05 |

Calendar Spreads

Spread | Last | Chg | Full | % of FC |

CH25/CK25 | -7 3/4 | – 1/4 | -21 | 37% |

SH25/SK25 | -10 1/2 | +1/2 | -26 3/4 | 39% |

SK25/SN25 | -11 1/4 | +1/2 | -26 3/4 | 42% |

SH25/SN25 | -21 3/4 | +1 | -53 1/2 | 41% |

MWH25/MWK25 | -8 | 0 | -20 1/2 | 39% |

WH25/WK25 | -12 | 0 | -16 | 75% |

KWH25/KWK25 | -8 3/4 | – 1/4 | -16 | 55% |

Cost of Carry

Daily Trading Limits: Corn $0.30 (expanded $0.45); Soybeans $0.85 (expanded $1.30); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

>>Interested in more commentary by Joe Mauck? Go HERE

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.