CLOSING COMMENTS

Macroeconomics:

Jerome Powell and the Federal Reserve decided to keep federal interest rates unchanged. Powell in his comments following the report said, “we don’t need to be in a hurry to adjust policy stance”, “he committee’s 2% inflation goal will be retained and will not be focus of the review”, and “I’ve had no contact with the President”. Following his comments the Fed probability website slightly decreased the likelihood of 2 more rate cuts this year, with 1 cut starting to look more plausible.

Ag Fundamentals:

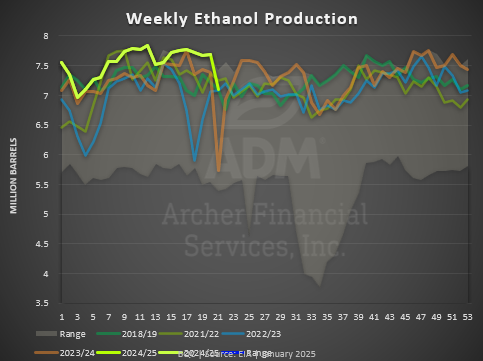

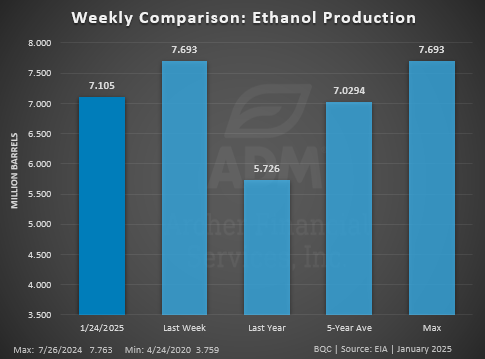

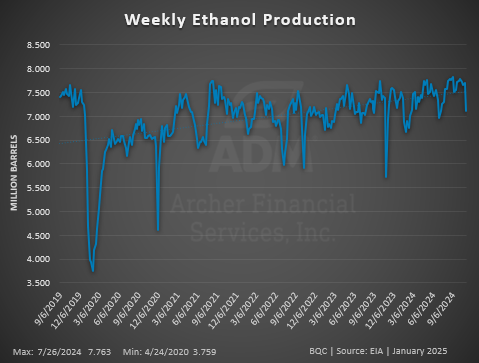

Ethanol production slowed by nearly 600K barrels week-over-week to hit production levels just above the 5-year average for this time of year. Ethanol margins tightening and stocks increasing rapidly over the last few weeks have caused production to slow. We also had a national holiday last Monday and plants tend to run slower due to colder weather. Export sales estimates will be released tomorrow morning and estimates are seen in the section below

Export Sales Estimates (for week ending 1/24/25)

Sales 24/25 | Est Range | Sales 25/26 | Est Range | |

Wheat | _______ | 150K-500K | _______ | 0-50K |

Corn | _______ | 850K-1,800K | _______ | 0 |

Beans | _______ | 450K-1,700K | _______ | 0 |

Meal | _______ | 100K-400K | _______ | 0 |

Soyoil | _______ | 4K-20K | _______ | 0 |

EIA Weekly Ethanol Production

For Week Ending 1/24/2025

Ethanol Production dropped 588K barrels week-over-week to 1.015 million barrels of ethanol per day last week. High stock inventories and low margin incentive is the main reason for the drop in production.

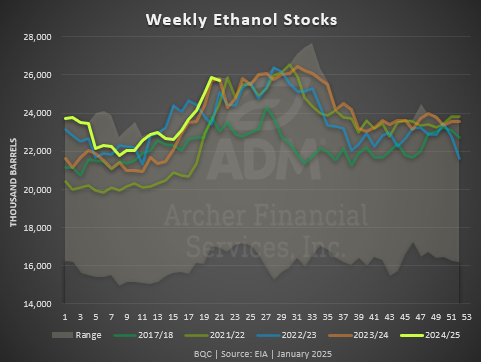

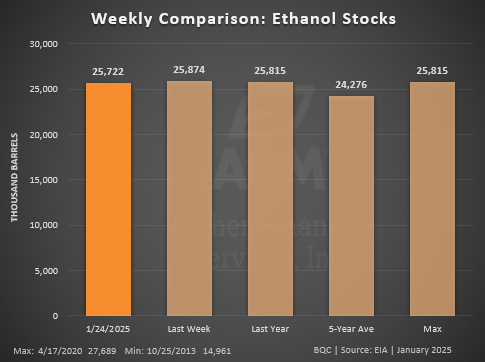

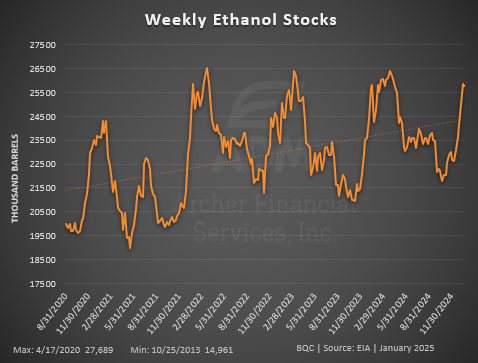

EIA Weekly Ethanol Stocks

Ethanol Stocks dropped slightly as production decreases have given the stock surge some headwind. Only 93K barrels off the record high for this time of year.

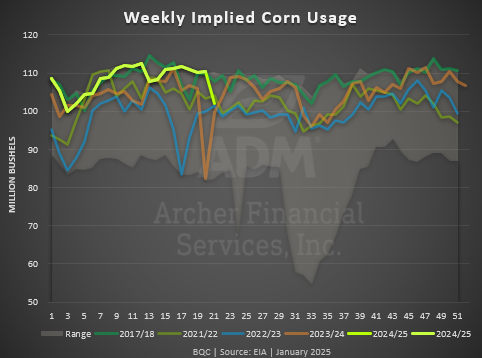

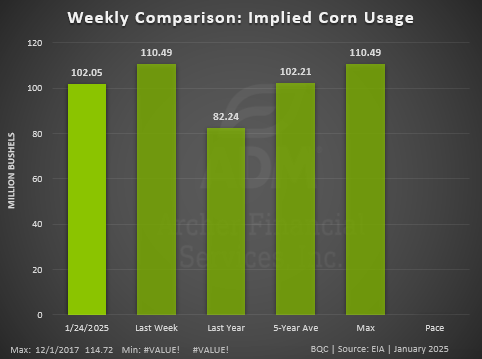

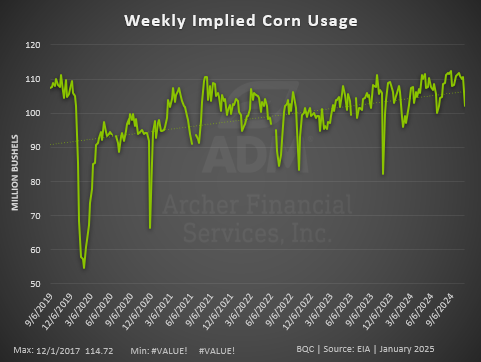

Implied Corn Usage

|

*Corn usage estimate subtracts sorghum used for ethanol based on USDA monthly grain crush report. Bushel to gallon conversion is based on implied yield: EIA monthly ethanol production divided by net (corn and sorghum) bushels crushed from USDA month report.

CALENDAR SPREADS

|

COST OF CARRY

Daily Trading Limits: Corn $0.30 (expanded $0.45); Soybeans $0.85 (expanded $1.30); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

Futures Settlements & Technicals

Symbol | Close | Chg | High | Low | Support | Resist | 20-Day | 50-Day |

CH25 | 497 | +11 3/4 | 497 1/2 | 485 | 489 | 500 | 473 1/4 | 453 1/2 |

CK25 | 507 1/2 | +11 1/2 | 508 | 495 1/2 | 499 | 511 | 482 1/4 | 461 |

SH25 | 1060 1/2 | +15 1/2 | 1061 3/4 | 1044 1/2 | 1051 | 1072 | 1030 3/4 | 1007 3/4 |

SK25 | 1075 1/4 | +15 3/4 | 1076 3/4 | 1059 1/2 | 1062 | 1085 | 1043 | 1019 1/4 |

SN25 | 1088 3/4 | +16 1/2 | 1090 1/2 | 1072 | 1078 | 1094 | 1054 1/4 | 1030 3/4 |

MWH25 | 613 3/4 | +16 | 614 1/4 | 596 1/2 | 605 | 620 | 592 1/4 | 595 |

MWK25 | 622 1/4 | +14 1/4 | 623 1/2 | 607 3/4 | 613 | 628 | 601 1/2 | 603 1/2 |

WH25 | 562 1/2 | +17 1/4 | 564 3/4 | 544 1/2 | 553 | 574 | 543 1/2 | 548 3/4 |

WK25 | 576 | +17 1/4 | 577 3/4 | 558 1/2 | 566 | 584 | 556 1/4 | 559 1/2 |

KWH25 | 580 1/4 | +19 1/4 | 582 | 560 3/4 | 572 | 586 | 558 | 556 |

KWK25 | 590 1/4 | +19 1/4 | 591 3/4 | 570 1/2 | 582 | 596 | 567 1/2 | 564 1/4 |

SMH25 | 309.8 | +8.20 | 310.8 | 301.6 | 305.00 | 313.00 | 306.10 | 300.90 |

BOH25 | 44.97 | -0.16 | 45.41 | 44.7 | 44.75 | 46.50 | 43.83 | 42.81 |

>>Interested in more commentary by Joe Mauck? Go HERE

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.