CLOSING COMMENTS

Ag Fundamentals:

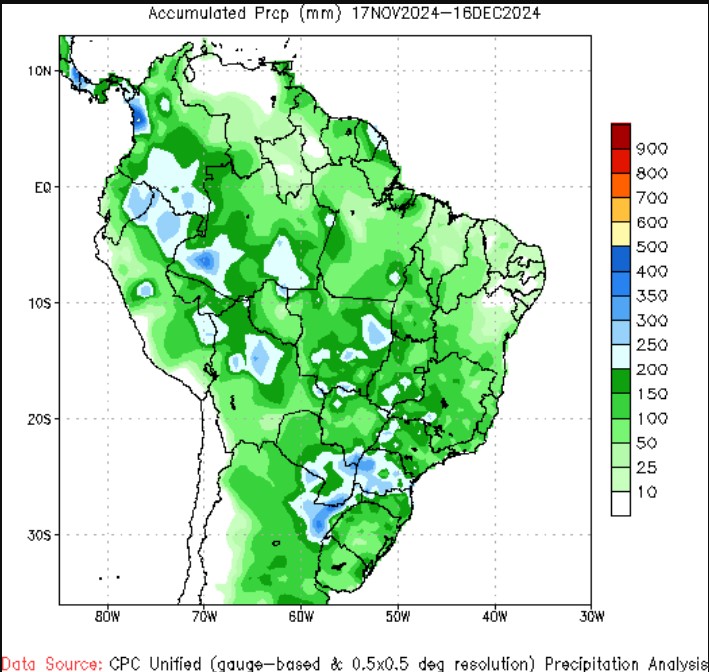

This morning’s flash export sales was not enough to keep corn or beans out of the red. Main driver today is favorable South American weather and lack new news from China regarding the recovery of their economy. Moisture levels in South America are in good shape despite the hit-or-miss rain coverage we have seen recently. Soybean production will likely increase above 170 million MT. Crude oil was down 50¢ with nearby prices just above $70 per barrel with weaker than expected demand from China. Wheat also falling with France increasing their harvested area to 4.51 million hectares. Not many are willing to bet against the US; the dollar reached over 107.00 today briefly. Many expect the Fed to cut interest rates by -25 basis points tomorrow.

Weather:

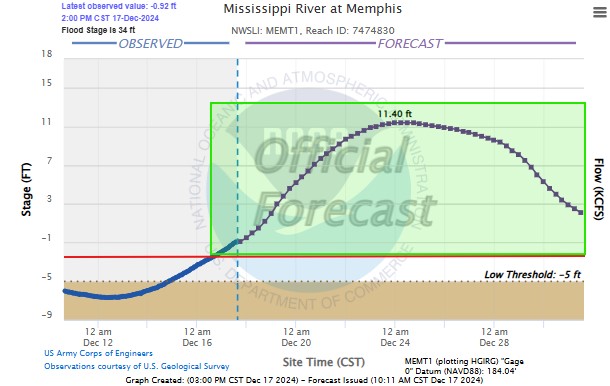

Recent rains in the US (Mid south and Ohio River Valley) has given life to the southern Mississippi river level. The rest of December should allow for full drafts on barges loaded St. Louis-south and tow sizes should be back to normal through the holidays.

The Mississippi River Gauge at Memphis will be above full draft levels for the rest of December. Drafts start to lower at -2.5 ft and below. Recent rains have given life to the river for now.

The Last 30 Days of Rain in South America range from 4-6 inches in the green to 10-14 inches in the blue. Plenty of rain to begin their crucial growing season. Expectations are they will raise close to a record yield, resulting in a record production.

Calendar Spreads

Spread | Last | Chg | Full | % of FC |

CH25/CK25 | -6 1/2 | +1/4 | -21 | 31% |

SF25/SH25 | -2 | +2 | -25 3/4 | 8% |

SH25/SK25 | -8 1/2 | +1 1/2 | -26 1/2 | 32% |

SF24/SN25 | -20 3/4 | +4 1/2 | -78 3/4 | 26% |

MWH25/MWK25 | -7 1/2 | – 1/4 | -20 1/2 | 37% |

WH25/WK25 | -9 1/2 | +1 1/2 | -16 | 59% |

KWH25/KWK25 | -7 3/4 | – 1/4 | -16 | 48% |

Cost of Carry

The Soybean board is not getting farmers to sell, basis levels have improved but ultimately this market is attempting to force beans loose by making the spreads do the work. 975’0 support is also helping lift the SF/SH spread.

Daily Trading Limits: Corn $0.30 (expanded $0.45); Soybeans $0.85 (expanded $1.30); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

>>Interested in more commentary by Joe Mauck? Go HERE

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.