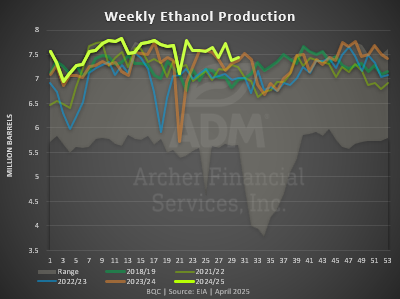

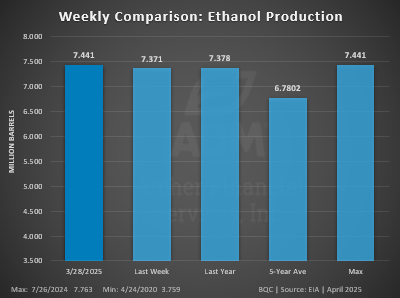

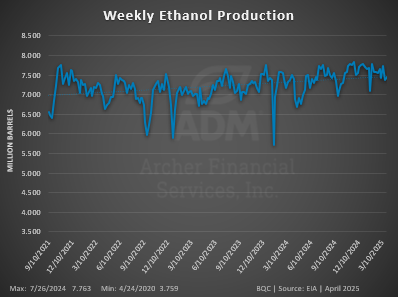

EIA Weekly Ethanol Production

(For week ending 3/28/2025)

|

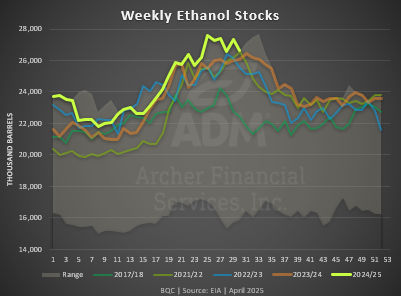

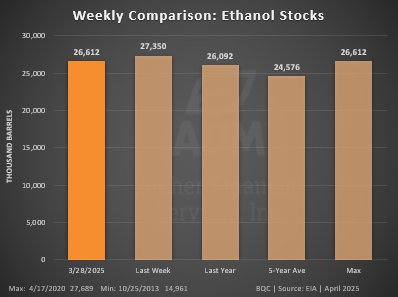

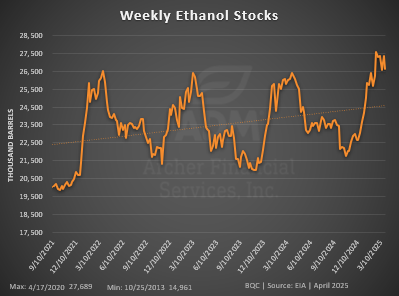

EIA Weekly Ethanol Stocks

Ethanol Stocks were down to 26.612 million barrels and fell below expectations. Spot margins have increased 3-fold since January lows.

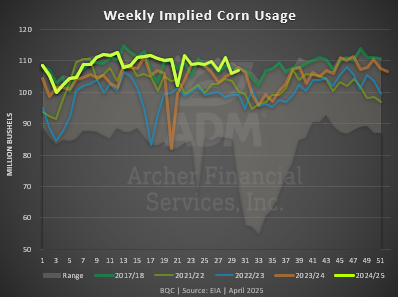

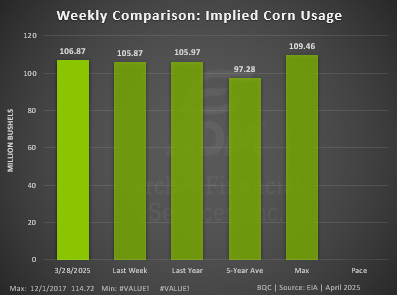

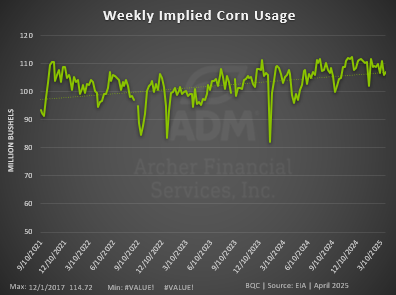

EIA Weekly Implied Corn Usage

Implied Corn Usage was up 1 million bushels week-over-week. Next Thursday the USDA will release the WASDE report and many believe they will need to raise usage 20-30 million bushels.

CALENDAR SPREAD

Spread | Last | Chg | Full | % of FC |

CK25/CN25 | -7 1/2 | -1 | -21 | 36% |

CN25/CU25 | 24 1/2 | -1 3/4 |

|

|

SK25/SN25 | -15 1/2 | – 1/2 | -27 | 57% |

SN25/SQ25 | 1 3/4 | +1/4 |

|

|

SN25/SX25 | 7 3/4 | -2 1/4 |

|

|

MWK25/MWN25 | -15 1/2 | +1/2 | -20 1/4 | 77% |

WK25/WN25 | -13 1/2 | – 1/4 | -15 3/4 | 86% |

KWK25/KWN25 | -11 1/4 | +1/4 | -16 | 70% |

COST OF CARRY

Daily Trading Limits: Corn $0.30 (expanded $0.45); Soybeans $0.85 (expanded $1.30); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

Futures Settlements & Technicals

Symbol | Close | Chg | High | Low | Support | Resist | 20-Day | 50-Day |

CK25 | 457 3/4 | -4 | 460 3/4 | 454 | 455 | 480 | 461 1/4 | 481 3/4 |

CN25 | 465 1/4 | -3 | 467 3/4 | 461 1/2 | 461 | 485 | 468 1/2 | 487 |

SK25 | 1029 1/2 | -4 3/4 | 1033 | 1024 1/2 | 1014 1/2 | 1040 | 1014 1/2 | 1038 |

SN25 | 1045 | -4 1/4 | 1048 3/4 | 1040 1/4 | 1028 1/2 | 1053 | 1028 1/4 | 1052 1/4 |

SQ25 | 1043 1/4 | -4 1/2 | 1047 1/2 | 1039 1/2 | 1025 | 1050 | 1025 1/4 | 1048 1/2 |

MWK25 | 592 1/2 | -1 1/2 | 597 3/4 | 587 3/4 | 580 | 599 | 597 1/2 | 612 3/4 |

MWN25 | 608 | -2 | 613 | 603 1/4 | 590 | 612 1/2 | 612 1/2 | 626 |

WK25 | 539 1/4 | -1 1/4 | 543 | 532 1/2 | 535 | 550 | 550 1/2 | 568 |

WN25 | 552 3/4 | -1 | 556 1/2 | 546 3/4 | 540 | 566 1/2 | 566 | 581 1/2 |

KWK25 | 568 1/2 | +3 1/4 | 572 3/4 | 560 3/4 | 550 | 575 | 568 1/2 | 588 |

KWN25 | 579 3/4 | +3 | 583 1/4 | 572 1/4 | 560 | 590 | 589 3/4 | 599 3/4 |

SMK25 | 287.2 | -5.10 | 292.7 | 287.1 | 290.00 | 300.00 | 298.60 | 304.00 |

BOK25 | 48.50 | +1.06 | 48.54 | 47.14 | 43.90 | 45.95 | 43.22 | 44.77 |

>>Interested in more commentary by Joe Mauck? Go HERE

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.