CORN

Prices surged to new highs late closing $.05 – $.09 better with spreads also narrowing. July-24 closed right at its 100 day MA while briefly trading above its March high of $4.60. Dec-24 closed above its 100 day MA resistance however held just below its March high at $4.81. While flooding rains continue to ravage far Southern Brazil, much of the central and northern growing regions remain dry, stressing the late developing 2nd corn crop. Export sales at 30 mil. bu. were in line with expectations. YTD commitments at 1.840 bil. bu. are up 23% from YA, vs. the USDA forecast of up 26%. Today’s census export data from Mch-24 showed 232 mil. bu. shipped during the month, only about 6 mil. above weekly inspections. To reach the current USDA forecast, sales in the last 5 months of the MY need to reach 922 mil. vs. only 784 mil. YA. Near today’s close the BAGE lowered their Argentine production forecast another 3 mmt to 46.5 mmt, well below the USDA April-24 forecast of 55 mmt. Harvest progress advanced only 2% to 22%.

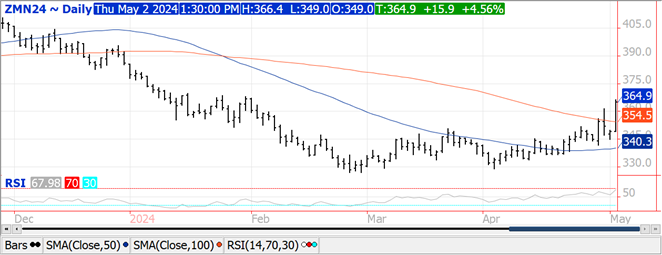

SOYBEANS

Soybean prices surged $.22 – $.35, meal was up $12 – $16, while oil was steady to lower. Torrential rains and flooding in RGDS in far southern Brazil to me was the driving force behind today’s price surge. Estimates from 4–8 mmt of soybeans remain in the waterlogged fields. As expected, this morning’s updated US drought monitor showed US cropland in drought continuing to decline. Above normal rains will continue to delay planting progress in the central and WCB. Good progress this week in the ECB. Next resistance for July-24 beans is the 100 day MA at $12.23 ½. Fresh 3-month high for July-24 meal, next resistance at $370. Spot board crush margins slipped a few more cents to $.64 bu., a fresh 10 month low. BO PV plunged to 37.3%, the lowest since Nov-23. Export sales at 15 mil. bu. were at the high end of expectations. YTD commitments at 1.540 bil. are down 17% from YA, vs. the USDA forecast of down 15%. Meal sales were weak at 131k tons, while oil sales were decent at just over 7k tons. Census exports in March at 112 mil. bu. were only 2 mil. above what the inspections data suggested. To reach the USDA export forecast of 1.70 bil. bu. sales over the last 5 months of the MY need to reach 285 mil. bu., vs. 270 mil. YA. With the added uncertainty of the SA production, my guess USDA makes no change this month. The BAGE reports harvest progress advanced 10% LW to 36% complete. While crop ratings slipped 1%, it doesn’t appear they changed their production est. from 51 mmt, vs USDA at 50 mmt.

WHEAT

Prices closed higher across all 3 classes in 2 sided trade. KC led the way closing $.11 higher while MGEX and Chicago were $.04 – $.07 higher. MGEX July-24 reached a 3 month high. Rains are expected to provide some relief to dry areas of W. KS and the TX/OK panhandles, but by no means a drought buster. Spotty rains have brought only modest relief to wheat areas near the Black Sea region. Export sales at 14 mil. (-1 mil. -23/24, 15 mil. for 24/25) were in line with expectations. YTD commitments are now down 1% from YA, vs. the USDA forecast of down 6.5%. New crop sales were 6 mil. – HRW, 4 mil. – HRS, while SRW and white wheat were just over 2 mil. each. Census exports in March at 77.5 mil. were roughly 4 mil. over weekly inspections vs. 68 mil. in Feb-24 and up 54% from Mch-23. In order to reach the current USDA export forecast of 710 mil. bu. sales will need to reach 142 mil. in April/May vs. 109 mil. YA. US winter wheat area in drought fell 2% last week to 28%. Ukraine expects their wheat exports to slip to 14 mmt in 24/25, vs. 18 mmt in the current MY.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.