CORN

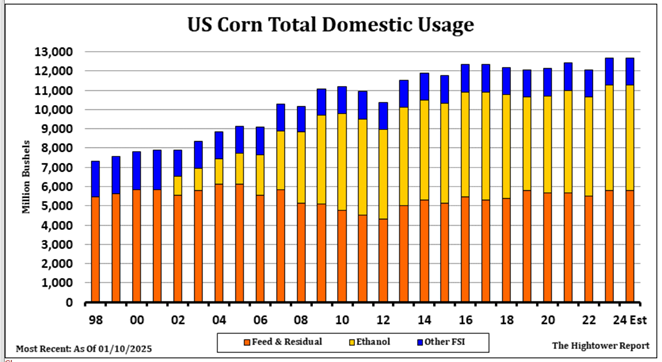

Corn futures are higher and near 4.96. Rally remains tech related and supported by drier South Brazil and Argentina forecast. Delay in Brazil corn planting is also supportive. Bears trying to hold on looking for better SA weather. Weekly US ethanol production was down 7 pct vs last week. Stocks were up 6 pct vs last year. USDA est corn use for ethanol at 5,500 mil bu vs 5,478 last year and 5,176 in 2022/23. Weekly US export sales are est at 700-1,700 mt vs 1,660 last week. Total commit is near 42.0 mmt vs 32.0 last year. US feed and residual is more residual than actual animal numbers and feed use. Number goes up on big crop and drops on lower crops. USDA dropped feed/residual 50 mil bu in Jan due to lower crop.

SOYBEANS

Soybean futures are higher and near 10.61. SH is back above 10.50 with resistance near 10.75. Rally led by soymeal. Rally remains tech related and supported by drier South Brazil and Argentina forecast. Delay in Brazil soybean harvest is also supportive. Bears trying to hold on looking for better SA weather. Weekly US export sales are est at 600-1,800 mt vs 1,490 last week. Total commit is near 42.0 mmt vs 38.0 last year. Total US soybean use is est at 4,349 mil bu vs 4,105 ly. US export are est at 1,825 vs 1,695 ly. Crush is est at record 2,410 mil bu vs 2,287 last year. Some est 2025/26 US crush at 2,650 and exports at 1,600.

WHEAT

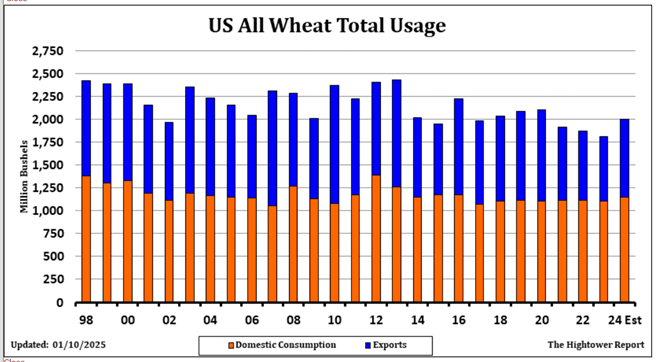

WH is near 5.61 and near session high. KWH is near 5.79. KWH is near 6.13. There is more short covering on talk of lower US crop due to dryness and cold temps. Some est 2025 crop at 1,935 mil bu vs 2024 1,971. Weekly US export sales are est at 200-600 mt vs 164 last week. USDA est US domestic use is near 1,150 mil bu of which food use is 966

>>See more market commentary here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.