SOYBEANS

Soybeans ended lower. Market continued to shave over weather premium in front of next weeks rains. Trade will be watching amounts and coverage across the dry areas of N Argentina, S Brazil and Paraguay. Long range forecast suggest normal weather across C and N Brazil but a possible return to drier weather across S Brazil, North Argentina and Paraguay. This week, USDA dropped World soybean stocks due to lower S America crops. Some private crop estimates are even lower than USDA. Some estimate World soybean trade near 166.5 mmt vs 161.4 ly. 2022/23 trade is est near 167.0. Of the total, US is 55.8 vs 61.6 ly. Brazil is 92.6 vs 80.8 ly. World soymeal trade is near 62.3 mmt vs 62.7ly. 2022/23 trade is est near 66.1. Of the total, Argentina is 26.3 vs 29.5 ly. Brazil is 18.4 vs 18.3 last year. US is 12.9 vs 12.5 ly. US Dec 1 on farm soybean stocks were 48 pct or above normal.

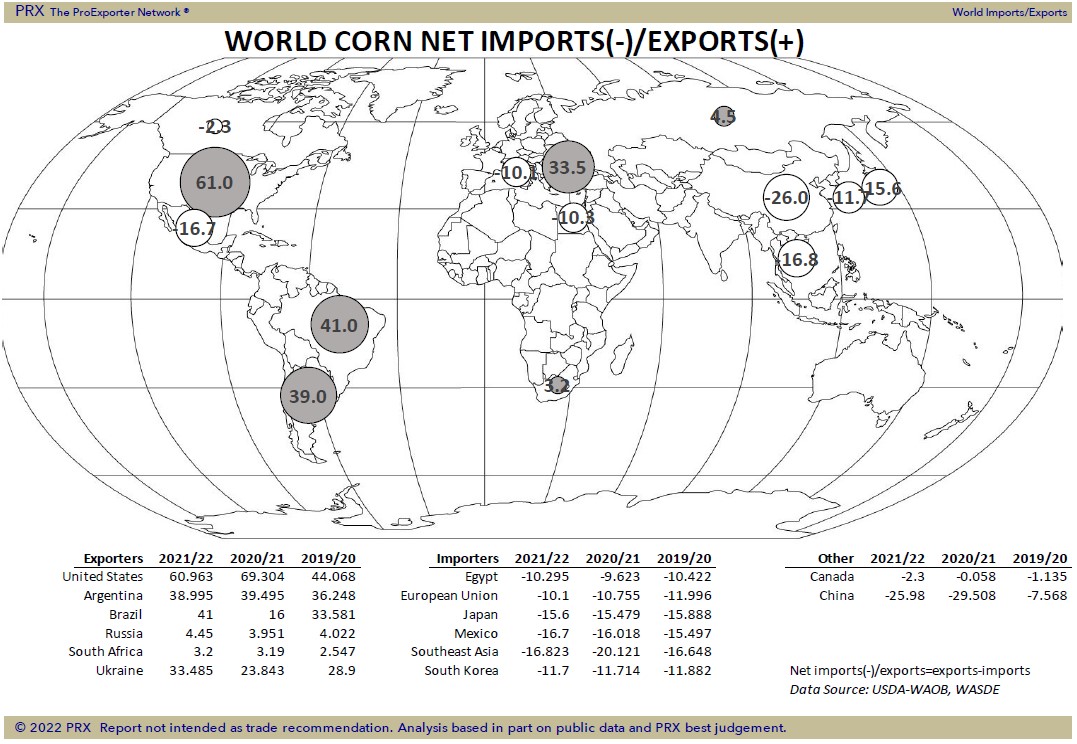

CORN

Nearby corn futures ended higher. For the week, CH range was 5.85 to 6.08 and ended near 5.88. Talk of new demand for US corn exports may have supported nearby futures. Managed funds liquidated longs on talk of needed rains falling across some of the driest areas of South America early next week. Long range maps suggest normal weather for N and C Brazil but a return to drier weather in N Argentina, S Brazil and Paraguay. A host of private crop estimates were lower than USDA estimate of the Brazil corn crop near 115 mmt and Argentina 54.0. This week USDA raised US corn 2021 corn crop, raised ethanol use but lowered exports. Some feel higher energy prices could increase demand for ethanol and lower SA crops could increase US corn export demand. 62 pct of US Dec 1 corn stocks were still on the farm. ICG lowered World corn crop 5 mmt from their previous estimate. Some remain concerned about Omicron spread slowing US supply chain and increase job shortages. Omicron is also slowing work at China Dalian, Tianjin and Ningbo ports and US LA and Long Beach ports. China trade surplus was $676 billion vs $542 last year and highest since 1950. US surplus was $396 billion up 25 percent from last year. China fell $5-6 billion short of US Ag trade deal.

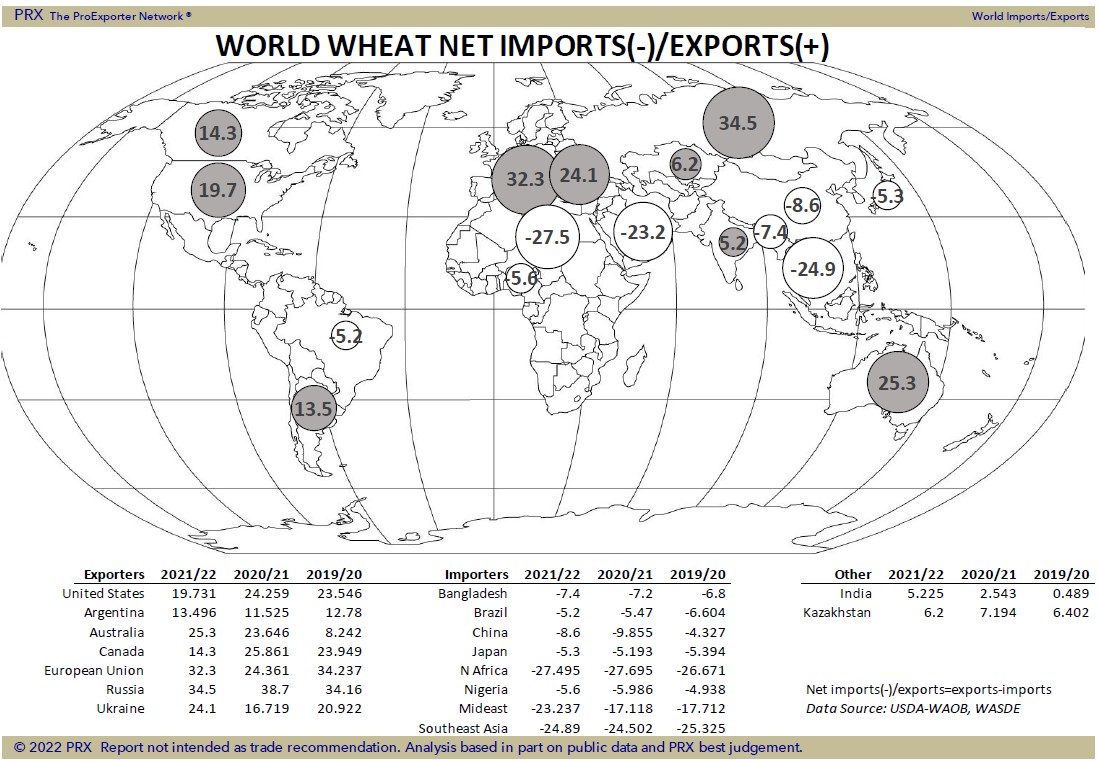

WHEAT

Wheat futures continue its downward spiral. WH ended down 5 cents and near 7.41. WH is down 36 cents so far this month. KWH ended down 13 cents and near 7.46. KWH is down 65 cents for the month. MWH ended down 17 Cents and near 8.78. MWH is down 117 cents for the month. KWH futures are oversold. HRW export basis continues to trend higher. EU wheat prices are near 3 month lows and looking for export business. Russia domestic Wheat prices are above export which could slow new sales. Australia Wheat futures were lower on increase supply. Higher south hemisphere crops and lower US export demand continues to weigh on wheat futures. USDA est US 2022 winter wheat acres higher than expected especially SRW. Weather watchers still concerned about continued dryness across is south plains HRW crop areas. Can’t lose a crop in January but it increases need for March-April rains.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.