CLOSING COMMENTS

Ag Fundamentals:

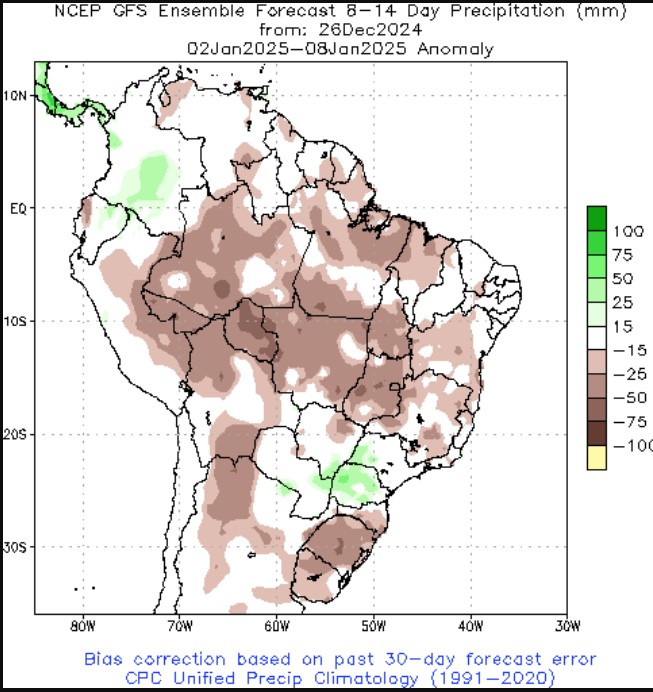

Export Sales will be released tomorrow due to the US holiday, estimates below. March corn closes above the 200 day moving average with May futures closing above 4.60. Corn has experienced the more bullish headlines than other row crops with strong exports, solid ethanol production, and the potential for production cuts in both the US and Argentina. US corn yield estimates could pull back from the 183.1 bu/acre November/December WASDE estimates. Dryer than normal weather in Argentina could drop their corn production below 50 MMT depending on the next 30 days of rain. Soybean meal up $13/ton today on the news of less than perfect weather in Argentina. Argentina is the worlds largest meal exporter and any news of a production loss would merit a meal rally. The 40% of old crop beans that the US farmer still needs to sell could keep a cap on the basis value hikes the processors could introduce after this 2-week, $25/ton meal rally.

March Corn closes above the 200 day moving average after 3 separate rejections. If we continue to hear solid corn demand, and possibly the lowering of US corn production in the January WASDE, the 200 day could offer support. Corn now on a golden cross watch in the coming month.

March Soybean Meal leads the green charge today with a +$13/ton jump following news of a dryer than normal 2 week forecast in Argentina. “A meal rally is a real rally”.

The 30-Day Precipitation Anomaly Forecast is showing dryer than normal weather in the north central regions of Brazil and parts of southern Brazil and northern Argentina.

Calendar Spreads

Spread | Last | Chg | Full | % of FC |

CH25/CK25 | -6 3/4 | – 1/4 | -21 | 32% |

SF25/SH25 | -9 1/4 | -3 1/4 | -26 | 36% |

SH25/SK25 | -10 1/4 | -1 1/2 | -26 3/4 | 38% |

SF24/SN25 | -30 1/2 | -4 1/2 | -79 1/2 | 38% |

MWH25/MWK25 | -8 1/4 | 0 | -20 1/2 | 40% |

WH25/WK25 | -11 | – 1/2 | -16 | 69% |

KWH25/KWK25 | -8 | 0 | -16 | 50% |

Cost of Carry

The SF/SH bean spread has moved from -9¢ carry to +0.25¢ inverse and back to a -9¢ carry in the last 30 days. This large move higher is more likely due to a shift in large positions and less on the reaction to a huge South American forecast and then an adjustment to news of dryness in Argentina. Currently the US farmer on average still has 40% old crop beans left to sell.

Daily Trading Limits: Corn $0.30 (expanded $0.45); Soybeans $0.85 (expanded $1.30); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

>>Interested in more commentary by Joe Mauck? Go HERE

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.