MORNING COMMENTS

Geopolitics:

The Biden administration is expected to announce the US will send a $275 million weapons package to Ukraine. The weapons will come out of the US stockpiles. This comes after Russia sent 120 missiles and 90 drones into Ukraine and brought 11,000 North Korean troops to help out. Trump reportedly called Russia’s President Putin and told him to deescalate. Instead both Ukraine and Russia are now trying to get the most leverage over each other leading up to the Trump negotiation. Trump takes office 2 months from today.

Macroeconomics:

NVIDIA Corp is reporting their third quarter earnings today after the close. NVDA makes up 7.22% of the S&P 500 ETF weight. followed by Apple at 6.93%. Nvidia’s Revenue has gone from $18.12 billion in October of 2023 to $30.04 billion in July of this year. They have continuously beat earnings and it is important to watch because they are at the front of the AI revolution.

Ag Fundamentals:

China bought 7.421 million bushels of soybeans this morning. The last time China bought beans in a flash sale was half as much 12 days ago, on November 8th. The sale before that was 21 days ago on October 30th. China is still taking the minimum necessary approach to their bean purchases from the US. Ethanol numbers will be out later this morning. Sentiment still leans heavy on the USDA raising their usage number in next month’s WASDE.

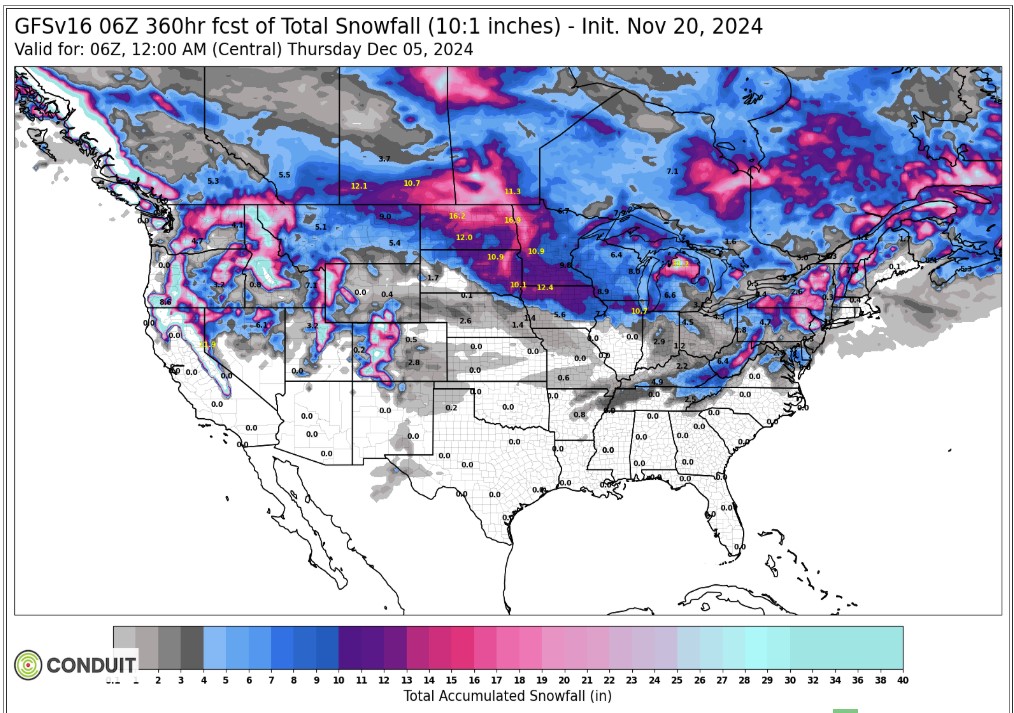

14-Day Snowfall Forecast from now through December 4th.

Export & World News

202K MT of soybeans to China from the US. Additionally the US sold 226K MT of soybeans to unknown destinations.

Malaysian palm oil futures were down overnight 109 ringgit, at 4815.

Daily Trading Limits: Corn $0.30 (expanded $0.45); Soybeans $0.85 (expanded $1.30); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

>>Interested in more commentary by Joe Mauck? Go HERE

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.