CLOSING COMMENTS

Geopolitics:

The War between Russia and Ukraine may have sight of a finish line. The issue with that is, this has been a marathon and the runners may sprint the last 100 yards. 50,000 Russian troops gathered to force Ukraine out of Kursk and some fighting has already began between them and the Ukrainian posts. Ukraine’s President Zelensky issues some remarks today stating that under a Trump administration “the war will end faster”. The US has sent over $64 billion to Ukraine since February of 2022. $8 billion of that was received in late September while Zelensky was visiting the White House and a Pennsylvania weapons manufacturing facility. When he signed bombs with PA governor Shapiro. Wheat is the most exposed commodity to this region. Russia recently increased their wheat export tax 4.7%.

Ag Fundamentals:

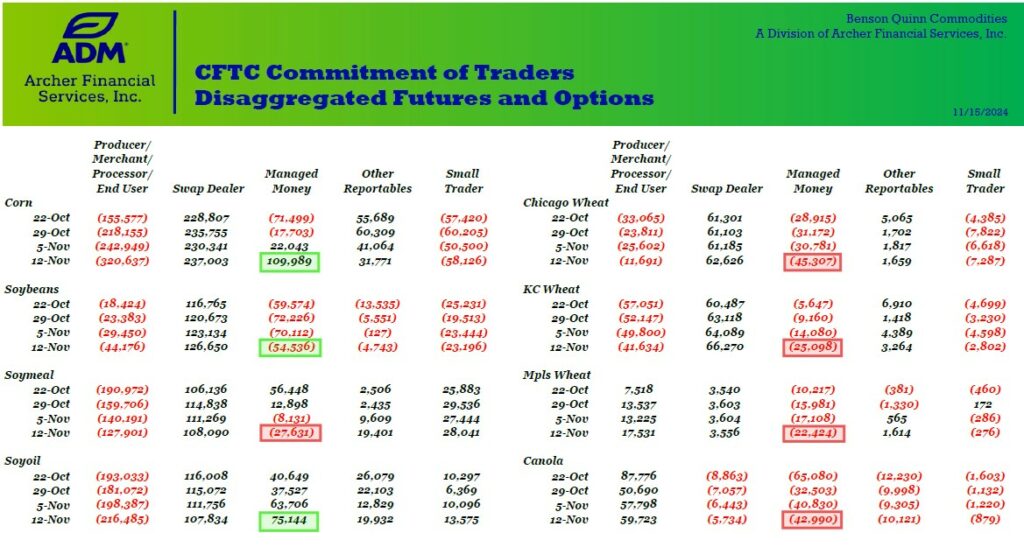

All green in the Soy complex today, but soymeal did make contract lows at $285.3 before closing $4 per MT higher. Soybean exports are 53 million bushels behind last year’s pace. Bean oil finds support at the 200 day moving average ($44.40). Argentina corn planting is at 40% and the drier pockets are not too concerned, using the clear weather to get out in the field. Wheat harvest in Argentina is 17% complete. The US wheat belt is expected to get another show of rain in the next 7 days. Winter wheat crop conditions should improve on Monday’s report. The disaggregated commitment of traders report can be seen below.

Map of Kursk relative to Ukraine and where the fight is taking place. Hoping we do not see more escalation this weekend.

The COT Disaggregated Report below shows managed money increasing their shorts across the board in wheat markets. Corn positions jumps in length and they cover some shorts in soybeans.

Calendar Spreads

Spread | Last | Chg | Full | % of FC |

CZ24/CH25 | -11 1/4 | +1/2 | -31 | 36% |

SF25/SH25 | -10 1/4 | +1 1/2 | -26 1/4 | 39% |

SH25/SK25 | -13 1/4 | +3/4 | -27 | 49% |

SF24/SN25 | -35 3/4 | +2 1/4 | -80 | 45% |

MWZ24/MWH25 | -19 | +1/4 | -30 1/4 | 63% |

WZ24/WH25 | -17 1/2 | +1/2 | -23 3/4 | 74% |

KWZ24/KWH25 | -12 1/4 | +1 1/2 | -23 3/4 | 52% |

Cost of Carry

Daily Trading Limits: Corn $0.30 (expanded $0.45); Soybeans $0.85 (expanded $1.30); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

>>Interested in more commentary by Joe Mauck? Go HERE

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.