MORNING AG OUTLOOK

Grains are higher. US stocks are higher on talk of lower US rates. US Dollar is lower. Crude is unch. US retail sales and industrial production today, Fed notes and housing starts Wednesday. BOE Thursday. BOJ Friday.

SOYBEANS

SX is near 10.06. Some feel SX could be in a choppy 9.55-10.31 range. US domestic soybean basis is lower ahead of harvest. SX-SF spread remains wide. Weekly crop exports were 401 mt, This was below expectations, USDA announced 132 mt US soybeans to unknown. USDA rated the crop 64 pct G/E, down 1 pct from last week. IA 77, IL 72, NE 65. OH 40. Harvest is 6 pct. LA 46. MS 44. AR 29. Key to soybean futures could be South America weather over next 45 days. Forecast is dry and warm across C and N Brazil. Palmoil is lower. India increased import duty.

CORN

CZ is near 4.11. Some feel CZ could be in a choppy 3.85-4.20 range. Corn is supported by dry US and South America weather. Some are beginning to doubt USDA 183.6 corn yield. Weekly crop exports were 521 mt. This was below expectations. Higher US barge freight has pushed US export prices above other origins. USDA rated the crop 65 pct G/E, up 1 pct from last week. IA 77. IL 76. NE 68 OH 39. Harvest is near 9 pct. TX 80. TN 46. KY 33. MO 25. 45 pct of crop is mature. Key to corn futures could be South America weather over next 45 days. Forecast is dry and warm across C and N Brazil.

WHEAT

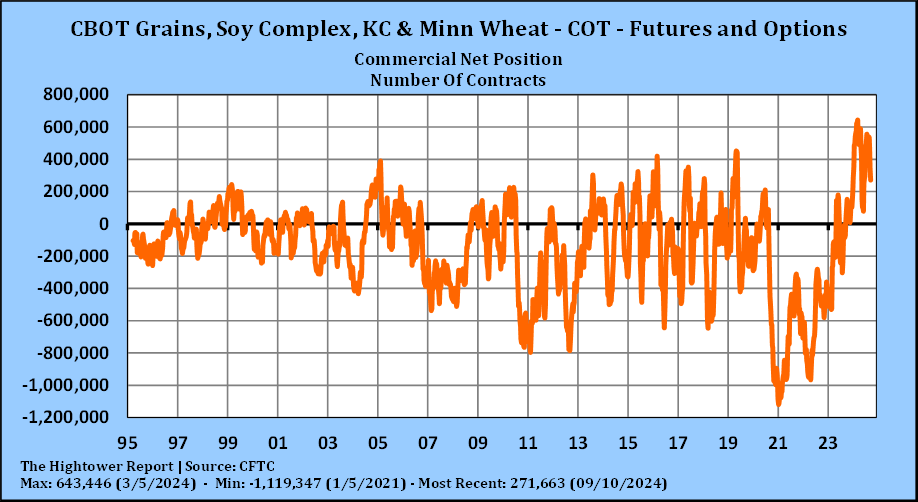

WZ is near 5.83. KWZ is near 5.86. MWZ is near 6.25. Wheat futures traded lower on increase tech selling. Some feel Managed funds were ready to reestablish wheat shorts. Overnight trade is higher. Key is demand for US wheat and 2024 south hemisphere/Russia and 2025 crop weather. US winter wheat plantings are near 14 pct. KS 9.

Interested in more futures markets? Explore our Market Dashboards here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.