Soybean, soyoil, corn and wheat traded higher. Soymeal was unchanged. US stocks, US Dollar and Gold were lower. Crude was higher.

SOYBEANS

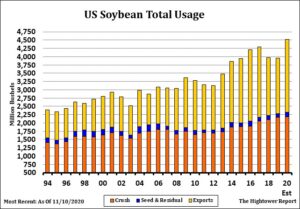

Soybeans trade higher but closed off session highs. Some feel there was some late liquidation due to possible overnight rains in central Brazil and before tomorrow’s USDA export sales report. Managed funds were early buyers of 12,000 soybean, 5,000 soyoil and 3,000 soymeal, We estimate Managed money net long 263,000 Soybeans; 87,000 lots of soymeal, and long 116,000 soyoil. There was still no new US soybean sales to China despite rumors of them buying US soybeans. Asian soybean and soyoil contracts are at new highs. Talk of higher feed and food demand. Matif canola seed and Canada canola seed values are at new highs. Lower sunoil/palmoil. Malaysian palmoil prices hit new highs. Next objective is 4,000 and Feb,2011 highs. LH Feb Brazil soybean export prices +50 cents March. This could help US Feb export demand. Argentina domestic soybean prices near 6 year highs. Dry weather is supportive. December soyoil futures are above the 2016 highs. Some look for 45 cent objective. US weekly soybean sales are est near 600-1,000 versus 978 last week. Total commit Is near 49.9 vs 22.1 ly. USDA goal is 59.8 vs 45.6 ly.

CORN

Corn futures traded higher on talk of new US corn sales to unknown which some feel could be China. Weekly US ethanol date was near expectations but talk of a 2021 US vaccine has some raising next year’s US corn demand for ethanol as business and travel try to get back to normal. Managed funds have been buyers of 7,000 corn. We estimate Managed Money net long 261,000 Corn. USDA announced 140 mt US corn to unknown. China currency is at 30 month highs. There is talk of them stockpiling crude and Ag goods. Nearby China corn futures near 10.18 and new highs. Russia and Ukraine domestic corn prices are at new highs. Livestock producers are asking for export tax/quotas. Weekly US ethanol production was down 6 pct ly, stocks were down 1 pct. Margins improved. Weekly US corn sales are estimated at 600-1,000 mt versus 978 last week. Total commit is near 34.1 vs 12.4 last year. USDA goal is 67.3 vs 45.1 last year. USDA est World corn exports near 184.7 vs 171.0 last year. Ukraine 22.5 vs 30.5 est in Oct

WHEAT

Wheat futures traded higher. Lower Dollar and higher corn prices offered support. Wheat futures continue to be supported by forecast of dry weather in parts of Russia and US south plains. WZ is trading between 50 day moving average support near 5.88 and 20 day moving average resistance near 6.05. Some feel managed funds are short wheat futures against long corn and long soybean. Virus is still raising concern about lower US/global demand for food as countries go to restaurant lockdowns. Slower economies and wages could also reduce demand. Talk of a 2021 vaccine could help return demand. Managed funds were buyers 3,000 wheat. We estimate Managed money net long 23,000 contracts of SRW Wheat. On recent lower wheat futures price action open interest dropped 27,000 contracts. KWZ remains in a 5.40 to 5.80 range with 20 day moving average near 5.53. Weekly US wheat sales are estimated near 250-500 mt versus 300 last week. Total commit is near 17.0 mt vs 15.1 ly. USDA goal is 26.5 vs 26.2 last year.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.