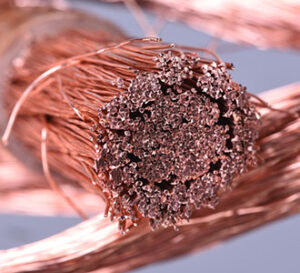

COPPER

With July copper prices exploding again overnight and the most active futures contract holding a massive premium, the press is touting the prospects of a full blown short squeeze. In fact, one could suggest a large portion of a short squeeze has already taken place, except open interest has not come down and it appears speculative trading has combined with commercial and long-term investment fund interest to produce what is becoming a historic rally. Therefore, the trade looks to continue to ride a wave of broad speculative buying interest partially built on expectations of long-term global supply deficits and expanding demand from Chinese electric grid needs and new demand from the push toward green energy. However, speculation is beginning to show some froth with arbitrage between the CME and LME pulling LME stocks into the US.

GOLD & SILVER

Not only did the Fed’s Powell thwart a surge in inflationary fears following yesterday’s hotter than expected US PPI readings, but he also seems to have rekindled US rate cut hopes. However, the second critical monthly US inflation reading in the form of CPI later this morning will be difficult to discount if it posts hotter than expected readings. Certainly, the gold and silver markets will continue to track and react to the ebb and flow of US rate cut prospects, but with strength in a wide array of physical commodities, a breakdown in the US dollar, steady to lower US interest rates and the potential for fresh inflation fuel from US and Chinese trade tariffs, it is possible that gold and silver will begin to behave like inflationary hedges. While gold and silver look to focus on macroeconomic issues, the bull camp should find confidence in the extension of a very long pattern of declining South African gold production. Apparently, South African gold output in February was revised even lower to a decline of 5% with South African March gold output pegged to have declined by 4.5%. It should also be noted that South African gold output declines are not isolated issue as South African PGM output in March declined by 3.6% and key PGM mining companies continue to warn of extreme cost pressures and a lack of investment for new supply! In the end, we hesitate to suggest that gold, silver, platinum, and palladium are returning to classic fundamental trading, but escalating concerns global inflation could get out of control are not out of the question.

Interested in more futures markets? Explore our Market Dashboards here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.