USDA 2021 acres less than expected. SK +59 at 14.25 CK up limit at 5.64, WK +15 at 6.17.

USDA estimated US March 1 soybean stocks near 1,564 mil bu vs 1,534 expected and 2,255 last year.

USDA estimated US March 1 corn stocks near 7,700 mil bu vs 7,767 expected and 7,952 last year.

USDA estimated US March 1 wheat stocks near 1,314 mil bu vs 1,272 expected and 1,415 last year.

USDA estimated US 2021 corn acres near 91.1 mil versus 93.2 expected and 90.8 last year.

USDA estimated US 2021 sorghum acres near 6.9 mil versus 6.8 expected and 5.9 last year.

USDA estimated US 2021 soybean acres near 87.6 mil versus 90.0 expected and 83.1 last year.

USDA estimated US 2021 all wheat acres near 46.3 mil versus 45.0 expected and 44.3 last year.

USDA estimated US 2021 spring wheat acres near 11.7 mil versus 11.6 expected and 12.2 last year.

USDA estimated US 2021 all cotton acres near 12.0 mil versus 11.9 expected and 12.1 last year

Now trade money flow, weather and USDA April 9 supply and demand guess.

Soybeans may be supported by higher soyoil prices and increase pricing of soyoil demand.

Some feel 44 cents BOZ is too low for demand.

Q1 US stocks went from 30,223 to 33,259. Crude from 47.50 to 67.79 then 60.78.

US Dollar 89.15 to 93.47. SK from 12.97 to 14.60 then 13.64. CK from 4.90 to 5.72 then 5.33.

WK from 6.40 to 6.88 then 5.93

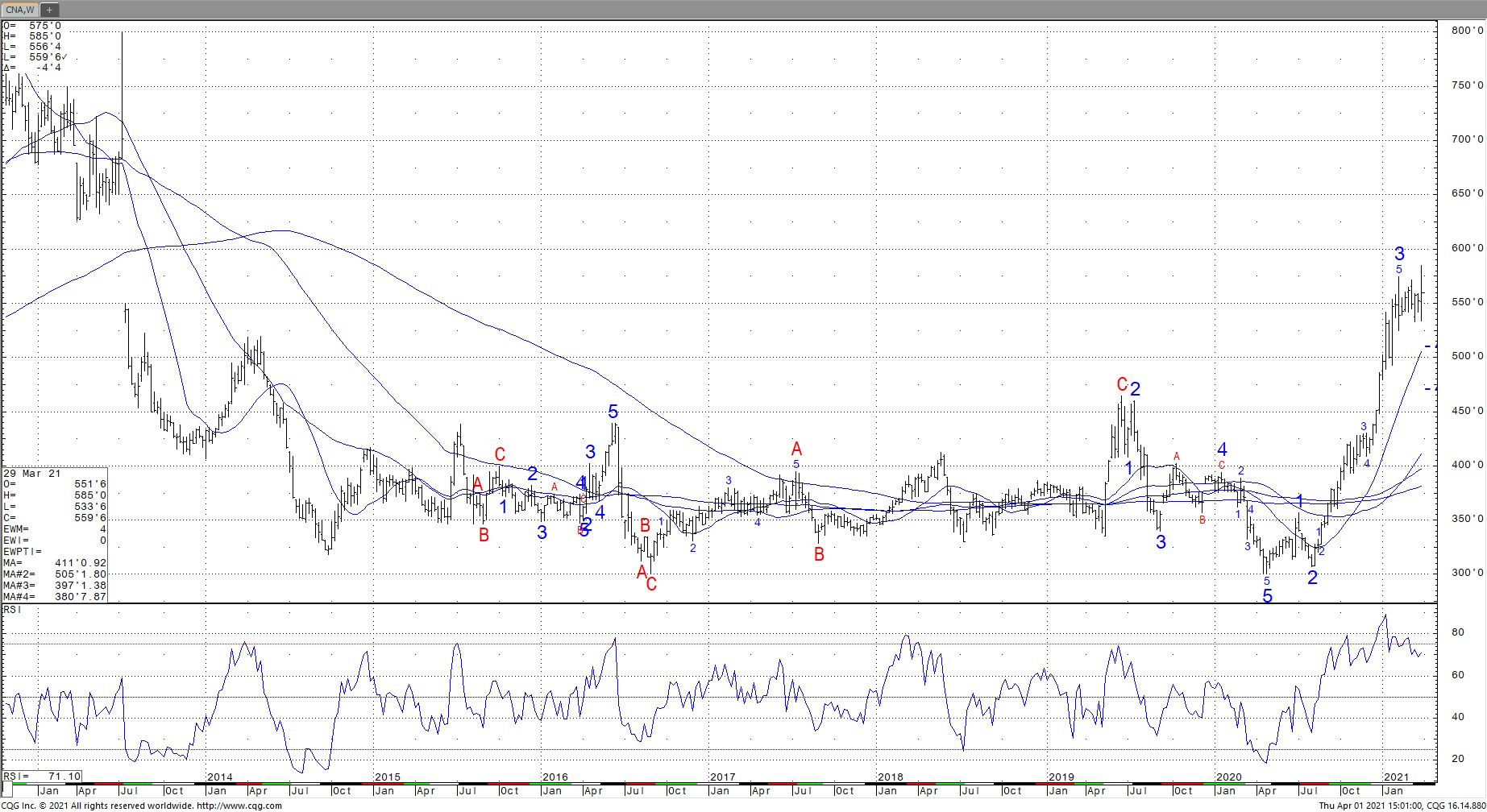

Infographic

Video

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.