TODAY—DELIVERABLE STOCKS—LAST TRADING DAY JULY FUTURES—

Overnight trade has SRW up roughly 4 cents, HRW up 5; HRS Wheat up 3, Corn is up 1 cent; Soybeans up 3, Soymeal up $1.00, and Soyoil up 20 points.

Chinese Ag futures (Sep) settled down 52 yuan, down 2 in Corn, down 18 in Soymeal, up 16 in Soyoil, and up 102 in Palm Oil.

Malaysian palm oil prices were up 11 ringgit at 2,440 (basis September) at midsession supported by a weaker ringgit.

U.S. Weather Forecast

Last evening’s GFS model run was notably wetter in the Dakotas and southwestern Minnesota July 21 – 23; the flow aloft will support weather disturbances and complexes of thunderstorms with heavy rain to impact this area.

Another notable rainfall change in last evening’s GFS model run was the increase in the southwestern Corn Belt, in areas such as Missouri, central and southern Illinois, southern Indiana, western Kentucky, southern Iowa, and eastern Kansas, July 23 – 25.

The 6 to 10 day and the 11 to 16 day Midwest weather models are back to conflicting; the GFS is wetter for the Midwest with the European sees less rains and favoring the northern Midwest over the 10 day period; the outlook to the 16 day models has the GFS producing average to a bit below average rains and average temps while, the European sides with ridging.

The player sheet had funds net sellers of 7,000 contracts of SRW Wheat; net sold 32,000 Corn; sold 12,000 Soybeans; net sold 8,000 lots of soymeal, and; sold 2,000 Soyoil.

We estimate Managed Money net short 10,000 contracts of SRW Wheat; short 183,000 Corn; net long 78,000 Soybeans; net short 31,000 lots of Soymeal, and; long 10,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures down roughly 5,900 contracts; HRW Wheat down 1,900; Corn up 4,000; Soybeans down 8,100 contracts; Soymeal down 490 lots, and; Soyoil down 1,700.

Deliveries were 24 Soymeal; 22 Soyoil; ZERO Rice; ZERO Corn; 25 HRW Wheat; ZERO Oats; ZERO Soybeans; 57 SRW Wheat, and; N/A HRS Wheat.

There were changes in registrations (SRW Wheat up 49; HRW Wheat down 5; HRS up 8)—Registrations total 95 contracts for SRW Wheat; ZERO Oats; Corn ZERO; Soybeans ZERO; Soyoil 3,141 lots; Soymeal 511; Rice 10; HRW Wheat 52, and; HRS 1,387.

Tender Activity—Egypt seeks optional-origin wheat—Japan seeks 125,000t optional-origin wheat—S. Korea seeks 140,000t optional-origin corn–

U.S. Winter Wheat harvested was 68% (trade estimate was 70%) versus 56% last week, 54% a year ago, 66% average.

U.S. Spring Wheat headed was 80% versus 63% last week, 72% a year ago, 85% average.

Spring Wheat was rated 68% good to excellent (trade estimate was 70%) versus 70% last week, and 76% a year ago; 24% fair (24% a week ago, 20% a year ago), and; 8% poor to very poor (6% last week, 4% a year ago).

Corn doughing was 3% versus NA% a week ago, 2% last year, and 3% average.

Corn was rated 69% good to excellent (trade estimate was 70%) versus 71% last week, and 58% a year ago; 23% fair (23% last week, 30% last year), 8% poor to very poor (6% last week, 12% last year).

U.S. Oats harvested was 12% versus NA% a week ago, 9% last year, and 12% average.

U.S. Soybeans setting pods was 11% versus 2% a week ago, 3% last year, and 10% average.

U.S. Soybeans were rated 68% good to excellent (trade estimate was 70%) versus 71% a week ago, and 54% a year ago; 25% fair (24% last week, 34% a year ago), and; 7% poor to very poor (5% last week, 12% a year ago).

Unusually warm temperatures prevailed across U.S. corn and soybean growing areas last week, though late-week rains supported field conditions for the Crop Watch farmers, who expect above-average yields at this point; most of the U.S. Corn Belt can expect a break from the heat this week along with periodic showers and storms; that is much improved from earlier forecasts that called for the persistence of the hot and dry weather, and it is good news for the Crop Watch corn fields, many of which are pollinating this week.

Yesterday’s U.S. weekly export inspections had

—Wheat exports running up 1% versus a year ago (11% behind last week) with the USDA currently forecasting a 2% decrease on the year

—Corn 19% behind a year ago (19% last week) with the USDA down 14% for the season

—Soybeans are down 2% on the year (down 1% last week) with the USDA having a 6% decrease forecasted on the year

White House Economic Adviser Larry Kudlow said that President Donald Trump is not in a good mood about China because of the coronavirus pandemic, new Hong Kong security laws and the treatment of the Uighurs, but the country is still part of the first phase of its massive trade deal with China.

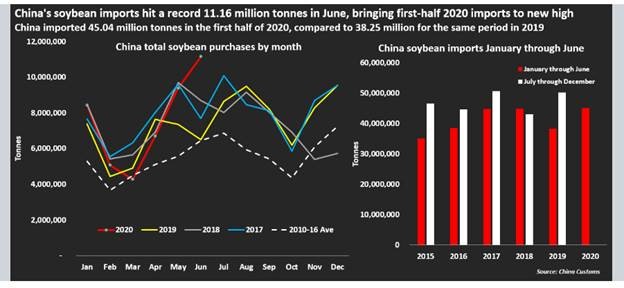

China’s monthly imports of soybeans leapt to a record high in June, jumping 71% from a year earlier, customs data showed, as a flurry of cargoes arrived from top supplier Brazil; China, the world’s top importer of the oilseed, shipped in 11.16 million tons in June from 6.51 million a year ago and up 19% from 9.38 million tons in May, data from the General Administration of Customs showed; exports from Brazil have picked up since March after weather improved in the South American country.

China imported 4.75 million tons of meat including offal in the first six months of the year, customs data showed, up 73.5% on the same period a year ago; Chinese buyers boosted overseas meat purchases after a collapse in domestic pork production caused by an epidemic of African swine fever; China imported 896,000 tons of meat including offal in June, the data from the General Administration of Customs showed, up 9.8% from 813,000 tons in May.

China’s state grain stockpiler Sinograin is investigating the quality of corn in one of its warehouses in northeastern China, it said in a statement on Sunday, after a video shared on social media alleged that the site was full of moldy, low-grade corn.

Exports of Russian grain are expected to total 41.7 million tons in the current agricultural season, according to the Russian Federal State Statistics Service; supplies of wheat to the global market may reach 33.2 million tons; that’s in line with pre-pandemic projections from industry experts, who said in February deliveries could be in the range of 32-to-42 million tons.

Euronext wheat fell on Monday, in retreat from a seven-week high struck last week as a stronger euro and profit-taking weakened prices and traders awaited a clearer picture of the forthcoming European harvest; spot September milling wheat settled down 2.25 euros, or 1.2%, at 184.75 euros ($210.12) a ton; the contract had risen on Friday to 189.75 euros, its highest since May 21, before meeting resistance at the 190 euro level and closing slightly lower.

The European Union exported 241,577 tons of soft wheat from July 1-12, the first two weeks of the 2020/21 season, down 62% from the same time in the previous season, European Commission data showed

European Union soybean imports over July 1-12 – the first two weeks of the 2020/21 season – totaled 531,785 tons, down 19% from the previous season, official EU data showed

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.