Soybeans, soymeal, soyoil and wheat traded lower. Corn traded higher. There was talk of increase US farmer selling especially 2021 corn and soybeans. US stocks were mixed. US Dollar was higher. Gold was higher. Crude was lower.

SOYBEANS

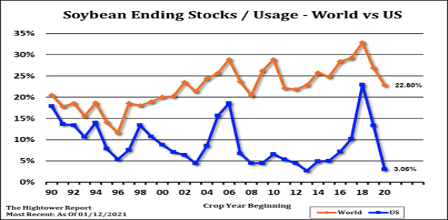

Soybean traded lower. Recent rally was from a low near 13.50 SH to the overnight high near 14.36 in just 7 days. CONAB lowered their estimate for Brazil’s soybean production to 133.7 mmt (vs USDA 133.0 mmt), reflecting a small upward revision in acreage and a small downward revision in yield. Managed funds are net sellers of 4,000 Soybeans; 3,000 lots of Soymeal and 1,000 soyoil. We estimate Managed Money net long 222,000 Soybeans; net long 106,000 lots of soymeal, and; long 106,000 Soyoil. China Dalian soymeal made new contract highs and near 576. USDA did announce 464.0 mt US soybean sold to unknown, 396 2020/21 and 68 mt 2021/22. Weekly US soybean exports sales are est near 300-700 mt. Some feel USDA did not drop South America soybean production as much as is needed. Fact USDA raised US demand only 35 mil bu and imports 20 mil bu is also a mystery . Some could see final US soybean exports near 2,325 mil bu which would suggest a carryout closer to 50 versus USDA 140. Same group could see US 2021 soybean crop near 4,525 but carryout only increasing to 99. Some feel nearby soybean futures could test 15.25 if there are further weather problems in South America or problems this summer in US.

CORN

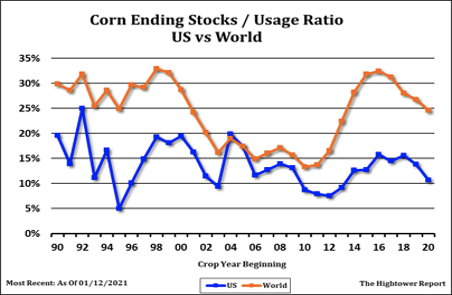

Corn futures traded higher led by nearby March but off session high. March corn rallied from 4.89 to a high near 5.41 in just 24 hours. There was talk of increase US farmer selling of corn especially new crop 2021. EIA weekly ethanol production increased from last week. US ethanol stocks increased from last week and the highest level since early May. Margins remain negative. CONAB lowered their estimate for Brazil’s corn production slightly to 102.6 mmt vs USDA’s 109.0 mmt. Managed funds were buyers of 5,000 corn. We estimate Managed Money net long 383,000 Corn; Dalian corn futures also made new highs near 11.38. Weekly US corn are estimated near 700-1,200 mt. Some feel USDA did not drop South America corn production as much as is needed. Fact USDA dropped US corn demand is also a mystery. Some could see final US corn exports near 2,800 mil bu which would suggest a carryout closer to 1,050 versus USDA 1,552. Same group could see US 2021 corn crop near 15,235 but carryout only increasing to 1,285. Some feel nearby corn futures could find resistance between 5.50-6.00 unless there are further weather problems in South America or problems this summer in US.

WHEAT

Wheat futures traded lower. Managed funds are net sellers of 2,000 SRW Wheat. We estimate Managed Money net long 34,000 contracts of SRW Wheat. Paris Matif wheat futures were higher and highest level since 2013. Weekly US wheat export sales are estimated near 250-500 mt. USDA estimated US Dec 1 wheat stocks near 1,674. This included food use near 248 mil bu versus 247 last year, exports near 231 versus 233 last year and a feed/residual of -9 versus 10 last year. USDA did increase US 2021 winter wheat acres to 32.0 versus 30.4 last year. HRW 22.3 versus 21.3 last year and SRW 6.2 mil versus 5.5 last year. Most look for US 2021 wheat crop near 1,875 mil bu versus 1,826 last year and demand near 2,156 versus 2,138 this year. Same group could see US 2021/22 wheat carryout drop to 700 mil bu versus 836 this year. USDA continued to estimate World crop near 772 mmt versus 764 last year, trade near 193 mmt versus 190 last year and end stocks of 313 mmt versus 300 last year. Talk Russia will increase its wheat export tax

could support prices.

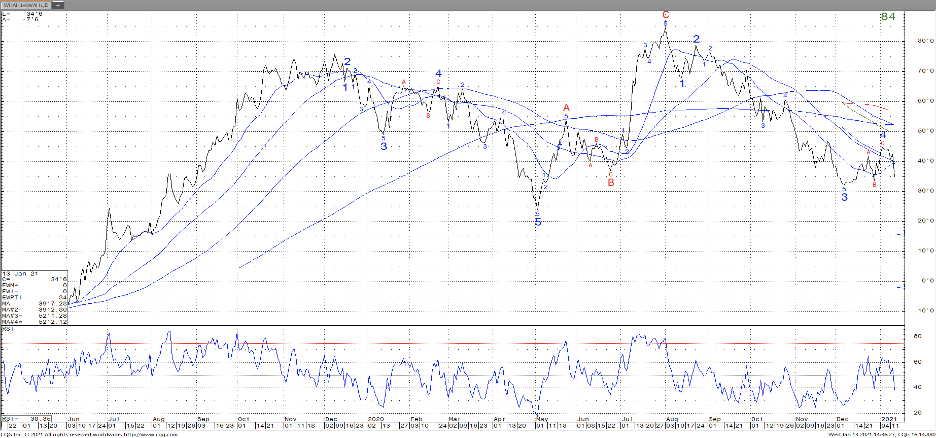

Chicago March wheat futures minus KC wheat futures spread

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.