WOW. Soybeans soymeal and wheat traded sharply higher. Corn traded up the daily limit. Synthetic market on the close was near 5.25 CH. Corn will be in 40 cent expanded limits tomorrow. Soyoil traded unchanged.

SOYBEANS

Soybeans and soymeal traded sharply higher after USDA Jan report. Soybeans were trading higher before the report on concern that continued dry weather in South America could increase US demand and tighten US balance sheet. USDA announced 120 mt US soybeans sold to unknown. USDA estimated US 2020/21 soybean carryout at 140 mil bu vs 175 last month. In order to keep that carryout at 140 USDA had to increase imports 20 mil bu and drop residual 12. USDA did raise export 30 and crush 5. USDA estimated Brazil+Argentina soybean crop near 181 mmt versus 183 last month. Most feel that number will come down. Dec 1 US soybean stocks were near 2,933 mil bu vs 3,252 last year. USDA left 2021 China soybean imports at 100 mil bu. Some are raising China imports to 102-104 mmt and 2022 to 108-110. USDA dropped US 2020 soybean crop to 4,135 mil bu versus 4,170. Most look for Soybean futures to continue to trend higher.

Weekly nearby soybean futures chart

CORN

Corn futures traded up the daily price limit after the USDA report. CH was trading synthetically near 5.25 on the close. Daily limits expand to 40 cents tomorrow. Fact USDA dropped the US 2020 corn crop more than expected triggered the new buying. The fact USDA dropped demand? To get a 1,552 carryout is also interesting. Demand is not slowing yet. USDA dropped US 2020 corn crop to 14,182 mil bu versus 14,507. USDA dropped the 2020 corn yield to 172.0 versus 175.8. USDA estimated US 2020/21 corn carryout at 1,552 mil bu vs 1,702 last month. USDA had to dropped total demand 250 mil bu, exports 100 mil bu. Add the 250 back and the carryout is only 1,250. USDA estimated Brazil+Argentina corn crop near 156 mmt versus 159 last month. Most feel that number will come down. Dec 1 US corn stocks were near 11,322 versus 11,951 expected and 11,327 last year. USDA left 2021 China corn crop at 260 mmt versus some private estimates near 230 and raised imports to 17.5 mil bu versus some private estimates of 25.0. Most look for corn futures to continue to trend higher.

Weekly nearby corn futures chart

WHEAT

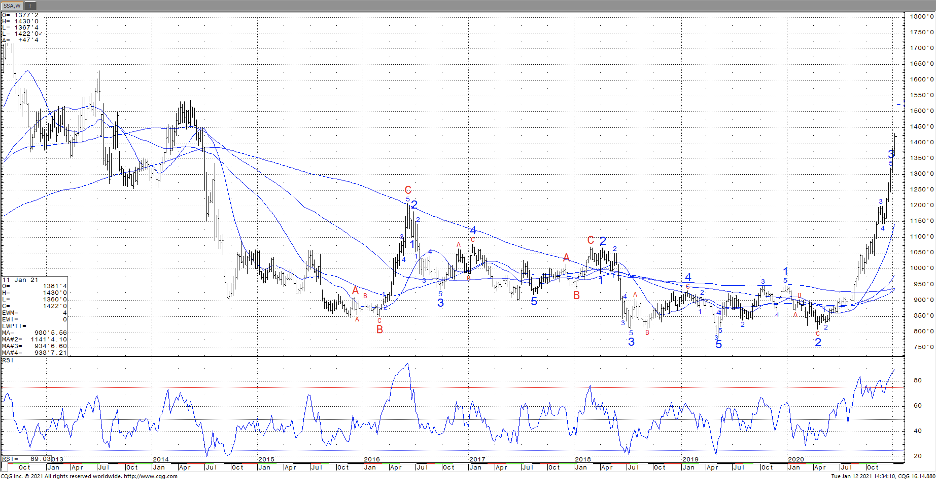

Wheat futures traded higher. Markers were higher before the USDA report on talk Russia may double their wheat export tax to try to preserve domestic supply. Fact Egypt passed on their wheat tender was also supportive. Paris wheat futures made new highs and highest level since 2013. There are no clear Russia wheat export prices past mid February. Limit up in corn also supported wheat futures. USDA dropped Argentina wheat crop to 17.5 but raised Russia to 85.3. USDA estimated US 2020/21 wheat carryout at 836 mil bu versus 859 expected and 862 last month. USDA estimated World 2020/21 wheat end stocks is 313.1 mmt versus 315.3 expected and 316.5 last month. USDA estimated US 2021 winter wheat acres at 32.0 million versus 31.5 expected and 30.4 last year. WH closed near 6.65. Range was 6.34-6.70. KWH closed near 6.62. Range was 5.94-6.70.

Weekly nearby Chicago wheat futures chart

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.