MORNING LIVESTOCK FUTURES OUTLOOK

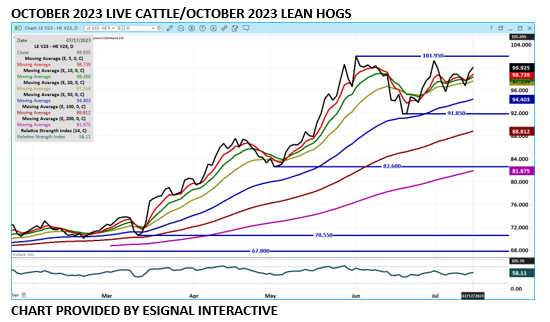

LIVE CATTLE

Live Cattle trade volume slowed down on Monday. Large funds now are most active in October. It doesn’t help beef prices to have beef exports down to just 9,900 MT. Japan the largest buyer took a mere 3,200 MT with Taiwan the next largest buyer at 1,600 MT. Exporters aren’t going to buy US beef because they can source larger Choice quantities from Brazil and Australia. The US is importing 2.86% less beef this year likely because there is more Select beef to buy in the US.

LEAN HOGS

Lean Hog futures trade volume have also slowed. CME Lean Hog prices going up slower than the CME Pork Index is positive for the packer. If needed, packers will pay more for hogs. The cheap US Dollar falling should be positive for pork especially with the strength the Mexican Peso has.

Learn more about Chris Lehner here

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.