MORNING LIVESTOCK FUTURES OUTLOOK

CATTLE COMPLEX

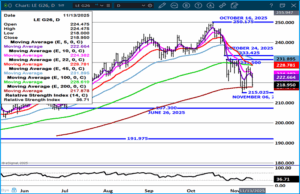

Live cattle trade volume was active and volume was close to the same for december, february and april. With the drop in open interest, longs continue to liquidate. They aren’t risky the profits.

Large packers are heavily investing in automation which will help to eliminate the smaller packers that can’t afford the costs of automation.

LEAN HOG COMPLEX

Lean hog open interest has been dropping on long liquidation. Open interest on lean hogs is a light trading commodity. Longs could blow into the market and change direction in a snap. Pork is cheap.

When export reports start up again, exports could be stronger. Mexico should have been buying for the holidays along with other Central and South American countries.

>>Read full report here

Interested in more futures markets? Explore our Market Dashboards here

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.