TODAY—EXPORT SALES—FATS AND OILS—GRAIN CRUSHINGS

Wire story reports Quarterly grain stock reports from the U.S. government have the tendency to jolt the Chicago futures market due to their unpredictable nature; that held true on Wednesday, but the main reason for the surprise was something that virtually nobody saw coming; Sept. 1 supplies of U.S. corn, soybeans and wheat all came in below trade expectations when the U.S. Department of Agriculture released the data, but the corn number stood out the most since it included a large, unprecedented adjustment to prior stocks.

One thing that was different this year was that NASS moved the review period for the prior year’s corn crop to September from January, in sync with soybeans; some market participants were vaguely aware of this beforehand, but the potential implications were evidently unclear; according to a NASS official, the agency was able to analyze the entire marketing year this month instead of in January since the production review was complete; it seems that NASS reviewed all the components that go into the stocks and decided that June 1 stocks were too high.

Overnight trade has SRW Wheat unchanged, HRW down 2; HRS Wheat unchanged, Corn is up 3 cents; Soybeans up 6; Soymeal up $2.00, and Soyoil up 10 points.

For the month, SRW Wheat prices were up roughly 26 cents; HRW up 34; HRS up 1; Corn was up 22 cents; Soybeans up 70; Soymeal up $30.00, and; Soyoil up 30 points. Crushing margins were unchanged at $0.95; Oil share down 2% at 32%.

Chinese Ag futures are closed for a week long holiday (Oct 1st thru 8th).

Malaysian palm oil prices were up 76 ringgit at 2,790 (basis December) supported by bargain buying and stronger soyoil prices.

The player sheet had funds net buyers of 25,000 contracts of SRW Wheat; net bought 55,000 Corn; bought 30,000 Soybeans; bought 11,000 Soymeal, and; net bought 4,000 Soyoil.

We estimate Managed Money net long 30,000 contracts of SRW Wheat; long 145,000 Corn; net long 217,000 Soybeans; net long 68,000 lots of Soymeal, and; long 99,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures up roughly 7,600 contracts; HRW Wheat up 3,000; Corn up 13,100; Soybeans up 10,000 contracts; Soymeal up 2,500 lots, and; Soyoil up 755.

Deliveries were 22 Soymeal and ZERO Soyoil.

There were no changes in registrations—Registrations total 109 contracts for SRW Wheat; ZERO Oats; Corn 361; Soybeans 1; Soyoil 1,907 lots; Soymeal 300; Rice ZER0; HRW Wheat 135, and; HRS 1,195.

Tender Activity—Jordan seeks 120,000t optional-origin wheat—Thailand bought 70,000t optional-origin feed wheat—

U.S. ethanol production for the week ended September 25th averaged 881,000 barrels per day (down 2.76% versus a week ago, down 8.04% versus a year ago); stocks totaled 19.691 mil barrels (down 1.53% versus a week ago, down 15.19% versus last year); corn use for the week was 87.4 mil bu (89.9 mil last week) and versus the 98.4 mil bu needed to meet USDA projections.

US ethanol inventories dropped this week; meanwhile, production also dropped for the week; it’s the lowest US ethanol production has been since mid-June.

U.S. biodiesel production rose to 162 million gallons in July from 151 million gallons a month earlier, the U.S. Energy Information Administration said; soybean oil remained the largest biodiesel feedstock, with 775 million lbs used in July, or about 63 percent of the total; in June, soyoil used in biodiesel production was 747 million lbs.

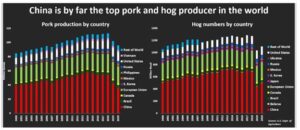

Wire story reports China’s huge pig herd is rebounding rapidly after being decimated by disease but pork output will take much longer to restore given the low quality of the new herd, say experts and analysts.

German pig prices remain unchanged this week at 1.27 euros a kilograms despite a series of import bans after African swine fever (ASF) was found in the country, the association of German animal farmers VEZG said; prices had been around 1.47 a kg slaughter weight before the ASF case was confirmed on Sept. 10 and had fallen to 1.27 euros a kg on Sept. 11.

Russia has harvested 122.5 million tons of grain before drying and cleaning from 89% of the area with an average yield of 2.87 tons per hectare, data from the agriculture ministry’s analytical centre published. Farmers have also sown winter grains for next year’s crop on 62.5% of the planned area, or on 12.0 million hectares, broadly in line with Sept. 29, 2019

Ukraine’s grain exports fell 11.2% in the first three months of the 2020/21 July-June season to 11.78 million tons, the economy ministry said; the volume included 4.258 million tons of grain exported in September

Euronext wheat climbed by nearly 3% on Wednesday, tracking a surge in Chicago fanned by lower than expected U.S. grain stocks and concern over drought-affected wheat sowing in Ukraine and Russia; benchmark December milling wheat settled 5.50 euros or 2.9% higher at 197.75 euros ($231.59) a ton; in late trading it reached 198.25 euros, near to a life-of-contract high of 199 euros struck over two years ago; the intraday peak also marked a 4-1/2 month high for a spot price.

Ideal weather and supportive vegetation densities from satellite imagery in New South Wales (NSW) raise 2020/21 Australia wheat production by 4% to 27.4 [24.0–30.9] million tons. Sufficient precipitation, adequate soil moisture and normal to slightly warm temperatures have benefited wheat production in NSW; after review of the ideal weather and updated satellite imagery, we raise wheat yield in NSW to 2.75 tons per hectare; should the favorable conditions continue through October, wheat yield in NSW may reach the record set in 2016 (3.02 tons per hectare) – Refinitiv Commodities Research.

Rainfall prospects in the south bode well for Australia rapeseed yield potential – Refinitiv Commodities Research: Recent and expected weather and updated vegetation densities from satellite imagery raise 2020/21 Australia rapeseed production by 2% to 3.36 [2.68–4.33] million tons; sufficient precipitation, adequate soil moisture and normal to slightly warm temperatures have benefited rapeseed production in New South Wales (NSW); the ideal weather and supportive satellite imagery place rapeseed yield in NSW to 1.55 tons per hectare.

Morocco’s wheat imports in MY2020/2021 are estimated at 6.2 million MT (metric tons), about 35% higher than imports in the MY2019/20; this significant increase was mostly due to the weak domestic production and the suspension of wheat import duties; France and Ukraine continue to control the largest share for the Moroccan common wheat market, while Canada dominates the durum wheat market; U.S. wheat remains priced out of the Moroccan market, even with the full removal of Moroccan duties

The Algerian Ministry of Agriculture has not released any figures regarding the MY2020/21 grain production; the Algerian Office of Cereals (OAIC) is reviewing import specifications to allow Black Sea wheat imports; the Government of Algeria is no longer subsidizing durum wheat for pasta manufacturing nor bread (common) wheat for other types of flour

India’s monsoon rains in 2020 were above average for the second year in a row, the first time that has happened in more than six decades, weather department officials said; the 9% above-average rainfall replenished reservoirs and built up ground water, helping assuage water shortages in pockets of the country of 1.3 billion people.

Indonesia will raise export tax for crude palm oil (CPO) to $3 per ton for shipments in October, a trade ministry regulation showed; the CPO export tax will increase from zero in September as the government reference price for CPO exports was set at $768.98 for October, above the $750 threshold for taxes to apply; that compared to the $738.07 per ton reference price in September.

The United States has banned imports of palm oil from Malaysian company FGV Holdings following an investigation into allegations it uses forced labor, the U.S. Customs and Border Protection (CBP) agency said; FGV, the world’s largest crude palm oil producer, and some other suppliers of the oil used in everything from food to cosmetics to biodiesel have long faced allegations from rights groups over labor and human rights abuses.

Exports of Malaysian palm oil products for September rose 11.2 percent to 1,604,729 tons from 1,442,905 tons shipped during August, cargo surveyor Societe Generale de Surveillance said.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.