TODAY – EIA WEEKLY PETROLEUM STATUS REPORT

Wheat prices overnight are down 28 1/2 in SRW, down 27 1/2 in HRW, down 21 in HRS; Corn is down 9 1/2; Soybeans up 12 1/4; Soymeal up $0.18; Soyoil up 0.94.

For the week so far wheat prices are up 19 1/4 in SRW, up 40 3/4 in HRW, up 19 in HRS; Corn is down 14; Soybeans down 5; Soymeal up $0.87; Soyoil down 1.41. For the month to date wheat prices are up 191 3/4 in SRW, up 177 in HRW, up 95 1/4 in HRS; Corn is up 57 3/4; Soybeans up 34 1/4; Soymeal up $39.50; Soyoil up 2.10.

Year-To-Date nearby futures are up 46% in SRW, up 41% in HRW, up 11% in HRS; Corn is up 26%; Soybeans up 26%; Soymeal up 18%; Soyoil up 33%.

Chinese Ag futures (MAY 22) Soybeans up 21 yuan; Soymeal down 49; Soyoil up 32; Palm oil up 110; Corn down 4 — Malaysian palm oil prices overnight were up 181 ringgit (+2.95%) at 6313.

There were no changes in registrations. Registration total: 2,185 SRW Wheat contracts; 1 Oats; 17 Corn; 247 Soybeans; 98 Soyoil; 50 Soymeal; 154 HRW Wheat.

Preliminary changes in futures Open Interest as of March 15 were: SRW Wheat up 1,243 contracts, HRW Wheat down 95, Corn up 4,998, Soybeans up 914, Soymeal up 2,011, Soyoil down 1,266.

Northern Plains Forecast: Isolated showers Wednesday. Mostly dry Thursday-Saturday. Temperatures above normal through Saturday. 6-to-10-day outlook: Scattered showers Sunday-Monday. Mostly dry Tuesday. Scattered showers Wednesday-Thursday. Temperatures above normal Sunday-Thursday.

Central/Southern Plains Forecast: Mostly dry Wednesday. Scattered showers Thursday-Friday. Mostly dry Saturday. Temperatures near to above normal through Thursday, near to below normal Friday, near to above normal Saturday. 6-to-10-day outlook: Mostly dry Sunday. Scattered showers Monday-Tuesday. Mostly dry Wednesday-Thursday. Temperatures near to above normal Sunday-Monday, near to below normal Tuesday-Wednesday, near to above normal Thursday.

Western Midwest Forecast: Mostly dry Wednesday. Scattered showers south Thursday-Friday. Mostly dry Saturday. Temperatures above normal through Saturday.

Eastern Midwest Forecast: Mostly dry Wednesday. Isolated showers Thursday. Scattered showers Friday-Saturday. Temperatures above normal through Saturday. 6-to-10-day outlook: Mostly dry Sunday-Monday. Scattered showers Tuesday-Wednesday. Mostly dry Thursday. Temperatures above normal Sunday-Thursday.

Brazil Grains & Oilseeds Forecast: Rio Grande do Sul and Parana Forecast: Isolated showers Tuesday. Mostly dry Wednesday-Thursday. Scattered showers Friday, north Saturday. Temperatures near normal through Wednesday, near to above normal Thursday-Friday, near to below normal Saturday. Mato Grosso, MGDS and southern Goias Forecast: Scattered showers through Saturday. Temperatures near normal through Saturday.

Argentina Grains & Oilseeds Forecast: Cordoba, Santa Fe, Northern Buenos Aires Forecast: Mostly dry through Wednesday. Isolated showers Thursday. Mostly dry Friday-Saturday. Temperatures near to above normal through Thursday, below normal Friday-Saturday. La Pampa, Southern Buenos Aires Forecast: Mostly dry through Wednesday. Isolated showers Thursday. Mostly dry Friday-Saturday. Temperatures near to above normal through Thursday, below normal Friday-Saturday.

The player sheet for 3/15 had funds: net buyers of 19,000 contracts of SRW wheat, buyers of 2,500 corn, buyers of 7,500 soybeans, sellers of 1,000 soymeal, and sellers of 1,500 soyoil.

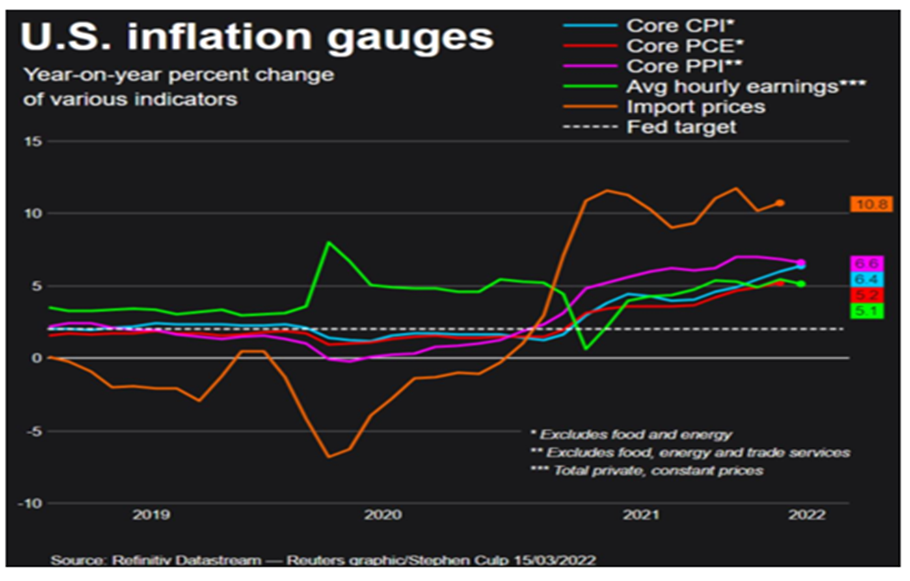

GASOLINE, FOOD LIFT US PRODUCER PRICES IN FEBRUARY

U.S. producer prices increased solidly in February as the cost of goods like gasoline surged, and further gains are in the pipeline following Russia’s war against Ukraine, which has made crude oil and other commodities more expensive. The producer price index for final demand increased 0.8%. A 14.8% jump in wholesale gasoline prices accounted for nearly 40% of the increase in goods prices. Services were unchanged. The PPI climbed 10% in the 12 months through February, in line with economists’ expectations. The so-called core PPI increased 0.8% in January. On an annual basis, it increased 6.6%. In a separate report, the New York Fed said its general business conditions index slumped 14.9 points to -11.8 in March. Also, as home prices soar, housing affordability is sinking to the lowest levels since 2008 and first-time buyers are being squeezed out.

TENDERS

- CORN SALE: South Korea’s Feed Leaders Committee (FLC) purchased about 65,000 tonnes of animal feed corn to be sourced from optional origins in a private deal on Tuesday without an international tender being issued

- CORN SALE: South Korea’s Major Feedmill Group (MFG) has purchased an estimated 201,000 tonnes of animal feed corn in an international tender which closed on Tuesday

- FEED WHEAT SALE: South Korea’s Feed Leaders Committee (FLC) on Tuesday purchased about 55,000 tonnes of animal feed wheat to be sourced from worldwide optional origins in a private deal without issuing an international tender

- WHEAT TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) is seeking to buy a total of 104,483 tonnes of food-quality wheat from the United States, Canada and Australia in regular tenders that will close on Thursday.

- BARLEY TENDER: A buyer in Qatar has issued a tender to buy an estimated 105,000 tonnes of animal feed barley

- FAILED BARLEY TENDER: Jordan’s state grain buyer is believed to have made no purchase in an international tender for 120,000 tonnes of animal feed barley which closed on Tuesday

PENDING TENDERS

- FEED GRAIN TENDER: Iranian state-owned animal feed importer SLAL issued an international tender to purchase up to 60,000 tonnes of animal feed barley, 60,000 tonnes of feed corn and 60,000 tonnes of soymeal

- WHEAT TENDER: Bangladesh’s state grains buyer issued an international tender to purchase 50,000 tonnes of milling wheat

- FEED WHEAT, BARLEY TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) said it would seek 80,000 tonnes of feed wheat and 100,000 tonnes of feed barley to be loaded by June 30 and to arrive in Japan by Aug. 25. It said it would seek the grain via a simultaneous buy and sell (SBS) auction that will be held on March 16.

- WHEAT TENDER: Jordan’s state grain buyer issued an international tender to buy 120,000 tonnes of milling wheat which can be sourced from optional origins

- BARLEY TENDER: Algeria’s state grains agency OAIC has issued an international tender to buy a nominal 50,000 tonnes of animal feed barley to be sourced from optional origins

- WHEAT TENDER: Turkey’s state grain board, TMO, has issued an international tender to purchase and import about 270,000 tonnes of milling wheat

U.S. NOPA Soy Crush Rose From Year Ago to 165.1M Bushels in Feb.

Soybean processing in February rose from 155.2m bu for the same period a year earlier, according to National Oilseed Processors Association data released Tuesday by Thomson Reuters.

- NOTE: Crushing was slightly below average Bloomberg survey estimate of 165.5m bu

- Also down from January processing of 182.2m bu

- Soybean-oil inventories at the end of February were 2.059b lbs vs 1.757b lbs a year ago

- Average analyst estimate was 2b lbs

EU Soft-Wheat Exports Fall 1.4% in Season Through March 13

Soft-wheat shipments during the season that began July 1 totaled 19.1m tons as of March 13, versus 19.4m tons in a similar period a year earlier, the European Commission said Wednesday on its website.

- NOTE: Figures for the prior season include trade for the U.K. until Dec. 31, 2020, when the country departed the EU customs union

- Top soft-wheat destinations are Algeria (2.89m tons), China (198m tons) and Egypt (1.86m tons)

- EU barley exports at 5.6m tons, versus 5.67m tons a year earlier

- EU corn imports at 11.8m tons, versus 11.6m tons a year earlier

Canpotex Plans to Boost Potash Supplies to Brazil: Minister

Canpotex aims to increase fertilizer exports to Brazil, the Brazilian Agriculture minister Tereza Cristina said on her Twitter account after meeting representatives from Canada’s fertilizer companies.

- “The idea is to increase sales to beyond 4m tons a year,” she said

- Last year, Canada exported 3.64m tons of potash to Brazil, according to figures from Canada’s Natural Resources Dept.

- Canpotex didn’t immediately respond to a request for comment

- NOTE: Canpotex is a joint venture that markets potash for Nutrien and Mosaic outside North America

Coceral Raises EU 2022 Soft-Wheat Crop Estimate by 1.5m Tons

This year’s EU wheat crop, excluding durum, is now estimated at 141.3m tons, trade association Coceral says Tuesday by email.

- That’s up from a December estimate of 139.8m tons, but remains lower than the 143.2m tons collected in 2021

- Barley crop estimate kept steady at 59.2m tons

- Compares to 59.4m tons last year

- Corn crop seen at 67.3m tons, versus 66.4m tons in December, based on a bigger harvest in Hungary

- Compares to 67.2m tons last year

- Rapeseed crop seen at 19.3m tons, versus 20m tons in December

- Compares to 18.5m tons last year

- NOTE: The agency’s figures include U.K. production

Brazil Soy Exports Seen Reaching 12.9 mln Tns in March – Anec

- BRAZIL SOY EXPORTS SEEN REACHING 12.900 MILLION TNS IN MARCH VERSUS 13.769 MILLION TNS FORECAST IN PREVIOUS WEEK – ANEC

- BRAZIL SOYMEAL EXPORTS SEEN REACHING 2.011 MILLION TNS IN MARCH VERSUS 1,782 MILLION TNS FORECAST IN PREVIOUS WEEK – ANEC

- BRAZIL CORN EXPORTS SEEN REACHING 55,000 TNS IN MARCH VERSUS 0 TNS FORECAST IN PREVIOUS WEEK – ANEC

- BRAZIL WHEAT EXPORTS SEEN REACHING 501,730 TNS IN MARCH VERSUS 502,608 TNS FORECAST IN PREVIOUS WEEK – ANEC

China purchases record amount of U.S. soybeans for 2022/23 delivery

As expected, concerns of tightening soybean supplies in South America increase Chinese soybean imports from the U.S.. February soybean imports from the U.S. totaled 3.2 million tons, down 44% from a month earlier. However, March imports from the U.S. are projected at 3.3 million tons, an unusual increase from February. Most importantly, China is purchasing a record amount of U.S. soybeans for 2022/23 delivery to secure soybean supplies amid possible shortages of South American soybeans late this year. As of 03 March, U.S. soybean sales to China for 2022/23 delivery reached 5.2 million tons, compared to 2.3 million tons for last year’s same period. Outstanding soybean sales to China for current marketing year also approached 2.0 million tons, compared to 1.1 million tons for prior season.

China soybean imports from Brazil in February and March are projected at 1.2 and 1.9 million tons, respectively. Brazilian soybean arrivals will jump to at least 6.2 million tons in April when Brazilian new crop soybeans approach Chinese ports. We foresee strong imports from Brazil over the next several months. However, soybean imports from Brazil may slump when Brazilian soybean inventory are depleted late this year.

Refinitiv trade flows tracked a total of 4.4 million tons of soybean imports in China in February, down 43% from January and 22% from a year earlier. March imports are projected at 5.2 million tons, close to last year’s level. In April, China soybean imports will increase strongly amid arrivals of Brazilian new crop soybeans. So far 7.3 million tons of soybeans have departed from the loading ports in Brazil and the U.S. and will arrive in China in April. More shipments may be reported later.

Malaysia March 1-15 Palm Oil Exports to EU 133,262 Tons: SGS

Following is a table of Malaysia’s palm oil export figures, according to estimates by independent cargo surveyor SGS Malaysia Sdn.

- EU imported 133,262 tons; -29.3% m/m

- China imported 96,650 tons; +123.2% m/m

- India imported 62,767 tons; +12.1% m/m

India acts to seize gap in wheat export market left by Ukraine war

India is rolling out ambitious measures over the coming weeks to try to establish the country a dominant exporter of high-quality wheat as importers scramble for supplies following Russia’s invasion of Ukraine, two government sources said.

The measures, which should be implemented over the course of around two weeks, include ensuring government-approved laboratories test the quality of wheat for export, making extra rail wagons available for transport and working with port authorities to give priority to wheat exports.

India, the world’s biggest wheat producer after China, has been pursuing deals to export wheat and take advantage of surplus stocks at home and a sharp rise in global prices.

It sees the disruption caused by the conflict involving Russia, the world’s largest wheat exporter and Ukraine, another leading supplier, as an opportunity to sell its wheat on the world market.

Despite surplus wheat stocks, logistical bottlenecks and quality concerns have previously stymied India’s efforts to sell large volumes on the world market.

Exports picked up last year to reach 6.12 million tonnes of wheat from 1.12 million tonnes a year earlier.

The government sources told Reuters the new measures could result in the export of 10 million tonnes of wheat after the new season harvest begins later this month.

Warehouse Bombed, Tractors Stolen as Russia Strikes Ukraine Food

- Russia hits deep in supply chain for agribusiness: companies

- Ukraine says sowing jeopardized in Europe’s breadbasket

Russia’s military is striking deeper into Ukraine’s food supply chain, with shells destroying a frozen-chicken warehouse and soldiers commandeering tractors and other farm equipment to build fortifications and tow armored vehicles.

The action not only threatens the growing season in one of the biggest food exporters, it’s also exacerbating a humanitarian crisis as Ukraine and its neighbors struggle to feed people fleeing cities under siege. Several major agribusinesses say some plantings won’t happen this year if the war continues because it’s not safe for workers to be in the fields.

MHP SE, a major poultry producer, said $8.5 million worth of frozen chickens was destroyed in a warehouse fire caused by shelling near Kyiv. The facility was the nation’s largest frozen-food store. Another 8,500 tons of poultry, worth more than $20 million, is at risk in the southern region, where blown-up roads and railways are limiting access to its facilities.

Russian forces also are destroying agricultural equipment in occupied areas or taking it and then forcing local people to build fortifications, the Ukrainian defense ministry said. About 30 machines in Sumy, east of Kyiv, were destroyed Sunday by bombs. The Kremlin has denied targeting civilians.

The war is forcing Ukraine’s agriculture sector, considered Europe’s breadbasket, to focus increasingly on feeding the nation rather than feeding the world. Ukraine is the second-biggest shipper of grains and biggest exporter of sunflower oil, but the conflict is inflicting heavy damage on growers, their distribution networks and shipping ports.

Some manufacturing lines for Kyiv-based Astarta Holding NV, which produces sugar, grains and milk, and its partners “were interrupted very suddenly,” and some supply chains were broken, Chief Executive Officer Viktor Ivanchyk said in an interview. Astarta typically plants on 220,000 hectares (544,000 acres), yet Ivanchyk said there were “multiple cases” of downed jets, missiles and drones in his fields.

Astarta is trying to prepare for sowing, but consultant APK-Inform expects spring-grain plantings overall could fall 40% from last year, and the sunflower area may plummet to a 13-year low. One of the largest agricultural companies, UkrLandFarming, said it’s producing 40% fewer eggs than usual after closing multiple farms — including Europe’s largest — due to artillery fire and power cuts, leaving millions of hens without feed or care.

Strong Asian rice demand for animal feed sparks food supply worries

- China buying Indian rice for animal feed, in talks for more

- Robust demand for lower quality rice lifts prices in key markets

- Top rice exporters seen using additional volumes for feed

- Rising Indian wheat exports may see higher use of broken rice

A surge in wheat and corn prices is boosting demand for low-grade rice in animal rations across Asia, pushing up prices of the world’s most important staple at a time when global food inflation is already hovering near record highs.

Global crop importers are scrambling for supplies after Russia’s invasion of Ukraine severed grain shipments from the two countries, which together account for around 25% of world wheat and 16% of world corn exports. (Full Story)

Chicago wheat futures Wv1 hit a record high last week while corn Cv1 climbed to its highest in a decade after war-torn Ukraine shut its ports and Western sanctions hit Russian exports.

The price spikes in wheat and corn in turn pushed buyers to seek alternatives, including in China, by far the world’s largest feed market. Importers there are in talks to buy extra volumes of broken rice – inferior rice where the grains have been fractured during the milling process – to fatten hogs and other animals, traders and analysts said.

Rice typically trades at a steep premium to wheat, but wheat’s blistering 50% price surge from a month ago has sharply cut the difference between the two grains, and even made wheat more expensive than some lower grades of rice.

Benchmark food-grade rice from Thai exporters RI-THBKN5-P1 made its biggest weekly gain since October 2020 last week on the back of firmer food and feed demand, climbing 5% to around $421.50 a tonne.

That’s the highest since last June, and sources say prices may keep rising if the disruption to Black Sea flows persists. Export prices from Vietnam RI-VNBKN5-P1 and India RI-INBKN5-P1 have also climbed. RIC/AS

Egypt Moves to Lock In Wheat Purchases as Global Prices Surge

- Farmers will have to sell a quota of their wheat to government

- North African nation is hit by soaring commodities prices

Egypt is offering incentives to farmers to produce wheat and setting an output quota for subsidies as the country rushes to safeguard supplies amid the war in Ukraine.

Farmers must deliver a minimum ratio to the government to participate in the country’s bread-subsidy program, according to a document seen by Bloomberg. They won’t be able to sell the rest of their crop outside the official procurement system without a license, it said.

Officials from Egypt’s Ministry of Supply and Internal Trade declined to comment.

Egypt, the most populous Arab country, imports most of its wheat from Russia and Ukraine, using those supplies as a cornerstone for the subsidy programthat provides bread at reduced prices for about 70 million people. The war in Ukraine has sent wheat prices soaring, putting pressure on the finances of the Egyptian government, which wants to guard against profiteering.

The new rules are part of the country’s efforts to tighten control over the local market to maintain price stability and secure reserves of basic foodstuffs amid the fallout from the war.

Large-scale farmers who deliver at least 90% of this season’s yield to the government will receive incentives in the form of subsidized fertilizers for the summer season, according to the document.

Egypt has raised its target for purchases of local wheat to more than 6 million tons. Earlier this week, President Abdel-Fattah El-Sisi urged the cabinet to offer farmers additional incentives to encourage them to sell the maximum amount of the grain to the government, while closely monitoring the production chain of wheat yield that starts in April.

Sisi on Tuesday also asked the government to study the price of unsubsidized bread with a view to possibly regulating it.

The war has pushed up wheat-flour prices by 19% and vegetable oils by 10%, Prime Minister Mostafa Madbouly said last week. Consumer inflation had already accelerated to an annual 8.8% in February, driven by higher food prices. The crunch comes at a delicate time for the Arab world as Ramadan approaches.

Egypt also banned exports of key staples, including flour, lentils and wheat, pasta and fava beans for three months amid the fallout from the Ukraine war.

Raizen Sees Ethanol Sales Shift From Fuel Pumps to Soda Bottles

Manufacturers like drug makers and beauty companies that use plastic and rubber for their products outranked car drivers to become the top buyers of green fuel from Raizen SA, the largest producer in Brazil, its Chief Executive Officer said.

More than half of its ethanol goes toward industrial-grade biofuel and ends up in hand sanitizers or soda bottles, CEO Ricardo Mussa said in an interview at the Dubai Sugar Conference. That’s a shift from four years ago when the bulk of its ethanol, which is made from sugarcane in Brazil, was used for fuels.

The current high oil price is making petrochemicals like plastic, rubber or pharmaceuticals more expensive. As a result companies are reaching out for the cheaper ethanol. The move toward industrial-grade uses is “a big switch and it’s progressing every year,” Mussa said.

“When we sell to Coca Cola, we sell the sugar for the Coca Cola but also the ethanol that goes into the plastic bottle,” Mussa said, whose company is also the world’s largest sugar maker.

To be sure, Raizen remains an outlier among Brazilian ethanol producers that still see demand largely driven by fuel use. Ethanol became popular as a fuel in Brazil after the 2000s, when the auto-industry started making flex-fuel cars, which can run solely on the biofuel or on a blend of ethanol and gasoline. Today most of the cars in Brazil can run on the crop-based biofuel.

Petroleo Brasileiro SA increased gasoline prices in Brazil last week by 18.8% last week to catch up with international levels, defying President Jair Bolsonaro´s calls to keep them contained. The move increases the competitiveness of ethanol as millers can decide how much of their cane juice should go into biofuel and how much into the sweetener, depending on which pays more. It also gave confidence for those looking to decide whether to invest more in ethanol production.

Strong demand for the green fuel in Brazil is also supported by the country’s renewable energy policy which mandates the use of biodiesel and ethanol as a percentage of total fuel consumption. This could squeeze production of the sweetener in Brazil so much that the country stops beings “the cushion of the sugar market” in times of shortage, Mussa said.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.