TODAY— EXPORT SALES—

Overnight trade has SRW Wheat down roughly 9 cents, HRW down 7; HRS Wheat down 9, Corn is up 1 cent; Soybeans down 1; Soymeal down $0.50, and Soyoil up 10 points.

Chinese Ag futures (May) settled down 2 yuan in soybeans, down 31 in Corn, unchanged in Soymeal, up 70 in Soyoil, and up 58 in Palm Oil.

Malaysian palm oil prices were closed for holiday.

In Brazil, conditions are still expected to be good for most key production areas with a few exceptions. The northeast will continue to need more rain. Rio Grande do Sul will still be too wet in the next seven to ten days with some expected flooding (and in southern Paraguay as well). There may also be some flooding in Santa Catarina and Parana; however, the greatest rainfall is likely in Rio Grande do Sul.

In Argentina, conditions will still be mostly good for crops with a favorable mix of rain and sunshine in most areas. Some of southern La Pampa and southwestern Buenos Aires will still likely be too dry. Northeastern parts of the nation, such as Corrientes, Misiones, and some immediate nearby areas will be notably wet in the first week of the outlook with flooding expected.

The player sheet had funds net sellers of 6,000 SRW Wheat; bought 2,000 Corn; net bought 6,000 Soybeans; bought 1,000 lots of Soymeal, and; net bought 4,000 Soyoil.

We estimate Managed Money net long 8,000 contracts of SRW Wheat; long 390,000 Corn; net long 158,000 Soybeans; net long 72,000 lots of Soymeal, and; long 106,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures down roughly 525 contracts; HRW Wheat down 1,700; Corn up 4,300; Soybeans down 7,600 contracts; Soymeal down 2,600 lots, and; Soyoil up 210.

There were changes in registrations (Soyoil down 3)—Registrations total 49 contracts for SRW Wheat; ZERO Oats; Corn ZERO; Soybeans 169; Soyoil 1,286 lots; Soymeal 175; Rice 732; HRW Wheat 91, and; HRS 1,023.

Tender Activity— Jordan bought 60,000t optional-origin wheat—Algeria bought 630,000t to 660,000t optional-origin wheat—Japan bought 60,715t Australian wheat—

Outlooks for 2021/22 U.S. winter wheat planted area and production are unchanged at 30.9 million acres and 33.3 [30.2–36.3] million tons, respectively. In Winter Wheat and Canola Seedings (12 January), USDA set its initial estimate of 2021/22 plantings at 32 million acres, the first yearly rise since 2013. This prediction is directionally consistent with our expectations (first released on 30 September 2020) which suggested an upward shift in winter wheat plantings from last season’s 30.4 million acres. Specifically, hard red winter (HRW) wheat area was set at 22.3 million acres, up 4% from last season, while soft red winter (SRW) wheat area was estimated at 6.2 million acres, up 12% from last season. Our current estimates are placed at 21.7 (HRW) and 5.7 (SRW) million acres, respectively.

U.S. Ethanol production for the week ended Jan 22 totaled 933,000 bls per day (down 1.3% vs a week ago, down 9.3% vs a year ago); Stocks were 23.6 mil bls (down 0.1% vs a week ago, down 2.7% vs a year ago); Corn use 94.3 mil bu vs 95.5 mil last week and 94.6 mil needed to meet USDA projections.

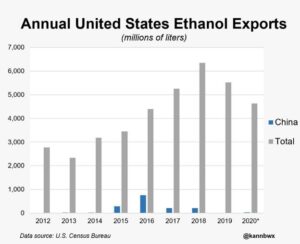

U.S. ethanol output has remained generally weak in January amid shabby profitability, though a shot of optimism arrived this week on a report that China, which somewhat shunned the American biofuel four years ago, has already secured a record annual haul for 2021. China has never been a leading player on the U.S. ethanol export front and the corn-based biofuel historically accounts for a small portion of American farm product trade. But possibilities could be strong given China’s generally thin supplies of agricultural commodities and its record purchases of items like corn and soybeans.

U.S. soy processors, fresh off their busiest year on record, have booked soybean purchases well beyond their normal few weeks of supply due to soaring export demand, rising prices and fears of soy shortages later this season. The aggressive buying foreshadows an expected battle for beans between exporters and processors this spring and summer that will likely increase prices further and could result in rare imports to the United States, the world’s No. 2 soybean producer and exporter.

U.S. farmers are expected to increase acreage of both soybeans and corn this year in response to high prices, Cynthia Nickerson, deputy chief economist at the U.S. Department of Agriculture (USDA), said at the Paris Grain Day conference. In an initial projection in November, the USDA had forecast an increase in the soybean area and slightly lower corn acreage in 2021. It will update its forecasts next month.

The U.S. Agriculture Department said on Wednesday it was temporarily suspending some debt collections from farmers facing financial distress due to the COVID-19 pandemic. The move is expected to affect 12,000 farmers who owe money under the government’s Farm Storage Facility Loan and the Direct Farm Loan programs administered by USDA’s Farm Service Agency.

Canadian farmers could increase canola plantings by 6% this year, encouraged by attractive margins, LeftField Commodity Research said. High prices, reflecting strong export demand and tightening supplies, should support a bigger canola area, though competition from other crops could limit expansion for the oilseed

Persistent dryness and cold spell early January slightly reduce China wheat production – Refinitiv Commodities Research

Argentina is looking for ways to ensure ample domestic wheat supplies without resorting to shutting down exports, a top official said on Wednesday, as farmers fretted about possible state intervention in the markets. The government, worried about food price inflation, recently tried to limit corn exports, but the idea was beaten back by growers. Now the focus is on wheat, with rumors swirling around the Pampas grains belt that export limits might be on the way. “In the case of wheat, we are seeing what we can do to ensure that we have enough in the country without closing the export market,” said Agriculture Minister.

Argentina corn production slightly up on improving weather conditions and positive outlooks – Refinitiv Commodities Research

Russia’s tougher wheat-export restrictions could spell good news for its North American rivals.

There are already signs importers are starting to balk at higher Russian prices before an export tax is introduced in mid-February, and then raised for four months starting in March. With low stockpiles in the European Union and near-term cargoes in Australia booked, that’ll likely increase demand for U.S. and Canadian grain, according to consultant AgResource. “I’m sure everyone will turn to the EU first, but the EU just doesn’t have the wheat available to export,” AgResource said.”There’s only one place that people can really turn to for wheat – North America.”

The Ministry of Economic Development, Trade and Agriculture of Ukraine and grain market participants agreed to set the maximum volume of corn exports at 24 million tons for 2020/2021 MY. Relevant changes will be made in the appendix to the Memorandum of Understanding between grain market participants. The parties also agreed, if necessary, to revise the approved maximum amount of maize allowed for export, following the publication of official statistics on crop production in 2020. “Currently, according to the regions, the projected production of corn is 30.3 million tons – this is one of the best corn harvests in all years. The Ministry of Economy believes that there are no problems with the export of corn to foreign markets or a possible shortage of this crop in the domestic market.

Recent and expected weather continues to favor India wheat production – Refinitiv Commodities Research

Higher reported sown area raises 2021/22 India wheat production by 1.5% to a record high at109 [99–117] million tons. India wheat planting is mostly complete. According to the Ministry of Agriculture, India has sown 34.5 million hectares as of 21 January, up 3% from last year during the time.

Indonesia set a higher reference price for crude palm oil (CPO) for February at $1,026.78 per tonne, a Trade Ministry regulation published on Thursday showed, up from $951.86 per tonne in January. Based on the reference price, CPO export tax will be set at $93 per tonne in February, while the export levy will be at $255 per tonne.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.