TODAY—WEEKLY ETHANOL STATS —

Overnight trade has SRW Wheat down roughly 1 cent, HRW down 1; HRS Wheat up 3, Corn is up 1 cent; Soybeans up 5; Soymeal up $1.50, and Soyoil up 5 points.

Chinese Ag futures (May) settled down 12 yuan in soybeans, down 20 in Corn, up 4 in Soymeal, down 70 in Soyoil, and down 24 in Palm Oil.

Malaysian palm oil prices were down 10 ringgit at 3,356 (basis February) on random trade.

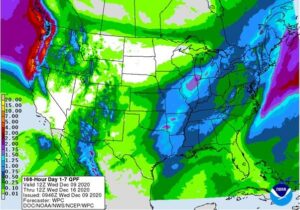

South America Weather Forecast: In Brazil, conditions will still be favorable in much of the nation for crop development. In Argentina, models are mixed over the next 5 days with Euro wetter with 90% coverage versus the GFS with 45% coverage, both with light to moderate amount of rainfall. Temps run below average.

The player sheet had funds net sellers of 6,000 contracts of SRW Wheat; sold 21,000 Corn; net sold 10,000 Soybeans; net sold 5,000 lots of Soymeal, and; sold 5,000 lots of Soyoil.

We estimate Managed Money net short 8,000 contracts of SRW Wheat; long 266,000 Corn; net long 187,000 Soybeans; net long 61,000 lots of Soymeal, and; long 110,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures down roughly 2,000 contracts; HRW Wheat down 1,000; Corn down 660; Soybeans down 25,300 contracts; Soymeal up 2,900 lots, and; Soyoil down 2,900.

Deliveries were ZERO Soymeal; ZERO Soyoil; ZERO Corn; ZERO HRW Wheat; 36 Oats; 15 SRW Wheat, and; ZERO HRS Wheat.

There were changes in registrations (SRW Wheat down 27; Oats up 6)—Registrations total 148 contracts for SRW Wheat; 84 Oats; Corn 1; Soybeans 175; Soyoil 1,425 lots; Soymeal 193; Rice 313; HRW Wheat 113, and; HRS 1,083.

Tender Activity—Japan bought 131,300t U.S./Canadian wheat—S. Korea bought 78,000t U.S. wheat—Taiwan bought 65,000t U.S. corn–Egypt seeks 30,000t optional-origin soyoil, 10,000t sunoil—

U.S. wheat shipments totaled 1.8 million tons (mmt) in November, up 13% from a month ago. In spite of recent decreases, US wheat cash prices are still at high levels, up approximately 20% from half a year ago. Recent sales have remained ahead of the 5-year average. Outstanding sales as of 26 November were 6.1 million tons, compared to 4.1 million tons for last year’s same period. As such, U.S. exports may strengthen over the next few months. Noticeably, U.S. wheat exports to China increased substantially this year. The U.S. has shipped 1.4 million tons of wheat to China since July, compared 0.2 million tons for last year during this time. And there are 0.7 million tons of outstanding sales to China for shipments. Accumulated exports during June-November totaled 13.2 million tons, 4% above last year. To reach USDA’s current estimate of 2020/21 U.S. wheat exports (26.54 mmt), the U.S. needs to export approximately 12.4 million tons of wheat in the second half of the market year, which is slightly above the 5-year average exports during December-May (12.3 mmt).

As expected, Russia wheat exports remained strong in November. According to Refinitiv’s trade flows, Russia exported 4.2 million tons of wheat in November, 34% above the 4-year average November exports. Accumulated exports since July totaled 21.1 million tons, 15% above last year’s same period.

A coalition of U.S. biofuel groups announced on Tuesday it had filed a brief with the D.C. Circuit Court of Appeals challenging the Trump administration’s decision in 2019 to grant 31 oil refineries exemptions from U.S. biofuel blending obligations. The brief borrows arguments from a successful case that several members of the group had filed in the Tenth Circuit Court of Appeals. That case spurred controversy this year when the court sided with the biofuel industry and cast doubt on the legitimacy of the waiver program. The biofuel industry claims the waivers hurt demand for corn-based ethanol; the oil industry disputes that and says the exemptions are needed to keep small refineries afloat.

U.S. President-elect Joe Biden plans to nominate former Iowa Governor Tom Vilsack for agriculture secretary, Axios reported on Tuesday, citing people familiar with the matter.

Brazilian food processor BRF SA is geared toward growth in Brazil and in halal markets like Turkey and Saudi Arabia, where food is produced according to Muslim dietary requirements, company executives said on Tuesday. BRF said it aims to invest about 55 billion reais ($10.8 billion) in the next 10 years to grow the business, focusing on the expansion of its local presence in markets where consumers buy products with higher aggregate value and the company owns strong brands like Sadia and Banvit.

Ukraine has harvested 63.5 million tonnes of grain from 15.1 million hectares, representing 99% of the sown area, as of Dec. 7, the economy ministry said on Tuesday. It said farmers had completed the wheat and barley harvest and collected 27.9 million tonnes of corn from 5.2 million hectares, or 96% of the sown area. The ministry also reported that Ukrainian farmers had sown 8.06 million hectares of winter grain for the 2021 harvest, equating to 98% of the expected area. It included 6.1 million hectares of wheat and 954,700 hectares of barley.

Kyiv-based consultancy ProAgro on Wednesday cut its Ukraine 2020/21 grain export forecast to 47.1 million tonnes from the previous forecast of 48.2 million tonnes due to a smaller harvest. The consultancy revised down its 2020 grain harvest outlook to 63.4 million tonnes from 64.6 million tonnes a month earlier. Ukraine exported 55.63 million tonnes of grain in 2019/20, the consultancy said.

Euronext wheat futures edged higher on Tuesday, with chart support helping prices to recover from the previous day’s two-month low, while physical premiums in Europe held firm on healthy export demand. March milling wheat was up 0.50 euros, or 0.3%, at 201.75 euros ($244.34) a tonne. The contract had slid on Monday to 199.00 euros, its weakest since Oct. 9, before closing above the 200 euro threshold.

China’s ban on beef imports from several Australian abattoirs is costing the industry hundreds of millions of dollars and leaving eight meatworks waiting to resume trade. China’s ban on beef imports from several Australian abattoirs has cost the industry hundreds of millions of dollars while eight meatworks wait to resume trade. Last year, exports of red meat to China were valued at about $3 billion, making it Australia’s most lucrative agriculture export market but the Australian Meat Industry Council says sales have fallen by almost 30 per cent year-on-year.

Indonesia is still in line to export 36 million tonnes of palm oil next despite a recent tariff hike on exports, an official told a virtual press conference on Tuesday. Indonesia announced higher export levies last week, to fund its biodiesel program, which requires diesel in Indonesia be blended with 30% bio content made of palm.

Malaysia palm oil production trends lower on unfavorable weather and seasonality – Refinitiv Commodities Research

—2020/21 MALAYSIA PALM OIL PRODUCTION: 19.3 [17.8–24.1] MILLION TONS, down 1.6% from last update

—Unfavorable weather conditions and downward output trends lower 2020/21 Malaysia palm oil production to 19.3 [17.8–24.8] million tons, down 1.6% from last update. Outputs are also curbed by movement restrictions related to second wave COVID-19 infections and labor shortages.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.