TODAY—DELIVERABLE STOCKS—NOPA CRUSH REPORT

Overnight trade has SRW Wheat up roughly 2 cents, HRW up 1; HRS Wheat up 3, Corn is down 2 cents; Soybeans down 5; Soymeal down $1.50, and Soyoil up 5 points.

Chinese Ag futures (May) settled down 75 yuan in soybeans, down 14 in Corn, down 6 in Soymeal, up 56 in Soyoil, and up 66 in Palm Oil.

Malaysian palm oil prices were down 10 ringgit at 3,446 (basis February) falling from 8 year highs despite good Dec 1-15 export estimates.

South America Weather Forecast:

In Brazil, conditions will still be favorable for crop development in most of the nation. There will be some areas that could use greater rain in the first week though. Mato Grosso and northern Mato Grosso do sul into Bahia will be notably drier-biased in week 1 of the outlook with any meaningful moisture being localized. Greater rain is then likely in much of this area in week 2, with the exception of northeastern Bahia, and this will help keep concerns low of notable impacts from dryness. The bottom line is good for crops.

In Argentina, a needed rain event will occur in southern production areas Friday into Saturday. Meaningful moisture is expected which will be beneficial for crops and will at least temporarily reduce the concerns of dryness in the area. Temps run below average.

The player sheet had funds net sellers of 17,000 contracts of SRW Wheat; net even in Corn; net bought 8,000 Soybeans; net bought 1,000 lots of Soymeal, and; bought 4,000 lots of Soyoil.

We estimate Managed Money net long 20,000 contracts of SRW Wheat; long 284,000 Corn; net long 203,000 Soybeans; net long 67,000 lots of Soymeal, and; long 99,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures down roughly 5,200 contracts; HRW Wheat down 1,500; Corn up 265; Soybeans down 5,100 contracts; Soymeal up 2,000 lots, and; Soyoil down 1,100.

Deliveries were 57 Soymeal; ZERO Soyoil; 69 Corn; 6 HRW Wheat; ZERO Oats; 20 SRW Wheat, and; N/A HRS Wheat.

There were changes in registrations (SRW Wheat down 2; Corn up 68; Soymeal up 57)—Registrations total 82 contracts for SRW Wheat; ZERO Oats; Corn 69; Soybeans 175; Soyoil 1,421 lots; Soymeal 250; Rice 313; HRW Wheat 113, and; HRS 1,078.

Tender Activity—Egypt seeks optional-origin wheat—Jordan seeks 120,000t optional-origin wheat—

The U.S. soybean crush in November was likely down from an all-time high in October, although the daily processing pace remained near the highest on record, according to analysts polled ahead of a National Oilseed Processors Association (NOPA) report due on Tuesday.

NOPA members were estimated to have crushed 180.025 million bushels of soybeans last month; it would be down 2.8% October’s record-large crush of 185.245 million bushels but up 9.2% from November 2019, when NOPA members crushed 164.909 million bushels.

The monthly NOPA report is scheduled for release at 11 a.m. CST (1700 GMT) on Tuesday. The organization releases crush data on the 15th of each month, or the next business day.

Soyoil supplies among NOPA members at the end of November were seen rising to 1.548 billion pounds, up from 1.487 billion pounds at the end of October and 1.448 billion pounds at the end of November 2019; if realized, the stocks would be the largest in four months.

Currently, All Wheat exports are running 1% ahead of a year ago, Corn up 65%, Soybeans up 72%.

The U.S. Environmental Protection Agency is now aiming for Dec. 31 as the point by which it will propose rules on the amount of biofuels refiners must blend into their fuel mix next year, after missing a deadline last month to release the proposal.

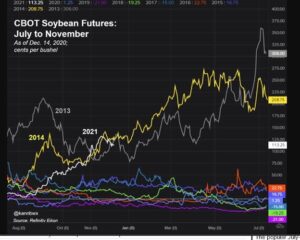

Wire story reports Chicago soybean futures have rallied more than 30% since the start of August and are set to finish the year on the strongest note since 2013, though U.S. farmers in the spring could initiate a price reset similar to 2014 with a boost in plantings. Futures are trading off their $12 per bushel top from late November, though prices are still holding at 4-1/2-year highs with U.S. soybean stockpiles expected to tumble substantially over the next nine months. Tight supplies of soybeans throughout mid-2021 will likely keep old-crop contracts elevated and domestic cash prices firm, but the new-crop prices could come under significant pressure as U.S. farmers are seen increasing acres in the upcoming cycle.

China sold 649,373 tonnes of wheat, or 16.1% of the total offer, at an auction of state reserves last week, the National Grain Trade Centre said; the average selling price was 2,339 yuan ($357.40) per tonne.

China’s pig and sow herds, ravaged by African swine fever over the past two years, recovered to more than 90% of normal levels by the end of November, the official news agency Xinhua said. Production capacity should fully recover by the first half of next year. Just over a year ago, China’s pig herd had shrunk by 40% ministry data showed, after swine fever devastated farms across the nation. Strong policy support and subsidies launched last year have helped drive a rapid recovery, with the building and stocking of new farms outpacing most expectations. But hog and pork prices are still much higher than usual, and analysts say that although capacity has recovered rapidly, output is still far short of demand.

Brazilian farmers had sown soybeans on 95% of the area forecast to be planted with the crop in the 2020-2021 growing season as of Dec. 10, just slightly behind the 96% that was finished on the same date last year, according to agricultural consultancy AgRural. Dry weather in some soybean-producing areas has been a concern for farmers, but good rains in many areas over the past week came at a good time for recently planted areas and also in areas that were planted earlier. AgRural last week cut its forecast for Brazil’s soybean crop for the 2020-2021 season to 131.6 million metric tons, which would still be record output for the country.

Brazil will likely import larger-than-usual volumes of the oilseeds next year to cater to domestic demand, oilseeds crushers’ association Abiove told a news conference; At the same time, internal demand is heated, Brazil will continue supplying its most prized export commodity to global clients, leaving little to crush internally. Brazil’s 2021 soybean imports will be 800,000 tonnes, up from 500,000 tonnes projected in November, This year, Brazil will likely import 1 million tonnes, an all-time record

This year, Brazil’s end stocks are estimated at 219,000 tonnes and next year they will be 419,000 tonnes, according to the association.

Brazil’s farmers will reap a forecast 132.6 million tonnes of soy in 2021, up from an estimated 127 million tonnes in the previous year.

On export markets, Brazil’s sales are forecast to reach 83.5 million tonnes in 2021, 1.2 million tonnes more than this year, Abiove predicted.

Russian domestic prices for wheat fell sharply at the end of last week as supply rose ahead of a wheat export tax which Russian officials are planning to impose in addition to a grain export quota.

Russia plans to impose a set of measures to slow the rise of domestic food prices, including the wheat export tax of 25 euros ($30.4) for Feb 15-June 30, its government said. Domestic prices for third-class wheat fell by 225 roubles to 15,725 roubles ($215.4) per tonne last week; Russian wheat with 12.5% protein loading from Black Sea ports for supply in December was at $252 a tonne on a free-on-board (FOB) basis at the end of last week, unchanged from the week before. Sovecon said wheat export prices rose by $2 to $257 a tonne.

Russia plans to impose an export tax on wheat, the economy minister told a government meeting on Monday, as part of measures to stabilise rising domestic food prices, which have been criticised by President Vladimir Putin. The export tax will be set at 25 euros ($30.4) a tonne between Feb. 15 and June 30. The export tax will be in addition to a grain export quota of 17.5 million tonnes over the same period.

Russia is considering imposing a sunflower oil export tariff of 15%, but no less than 135 euros per tonne in case of price growth.

Soft wheat exports from the European Union and Britain in the 2020/21 season that started in July had reached 11.61 million tonnes by Dec. 13, official EU data showed; that was 17% below the volume cleared by the same week last year.

—EU and UK 2020/21 barley exports had reached 3.48 million tonnes, down 8%

—Maize imports stood at 7.56 million tonnes, down 23%.

Soybean imports into the European Union and Britain in the 2020/21 season that started in July totalled 6.63 million tonnes by Dec. 13, up 3% compared with the same last week last year, official EU data showed

—EU and UK 2020/21 rapeseed imports had reached 3.17 million tonnes, down 11%,

—Soymeal imports stood at 8.30 million tonnes, down 6%.

—Palm oil imports were at 2.74 million tonnes, up 7%.

European wheat futures in Paris fell sharply on Monday, following U.S. markets in Chicago lower despite Russia announcing plans for a tax on wheat exports. March milling wheat closed down 4.25 euros, or 2%, at 206.25 euros ($250.70) a tonne. Euronext had hit its highest since Nov. 27 at 211.25 euros on Friday following reports that Russia planned to tax wheat exports.

India’s palm oil imports fell 8% on year in November to their lowest in five months, as a rally in the price of the tropical oil made soyoil more attractive for refiners. The country imported 618,468 tonnes of palm oil in November, down from 672,363 in the same month last year, the Solvent Extractors’ Association of India (SEA) said in a statement. “Palm oil’s discount over soyoil narrowed last month. It made soyoil imports more profitable for refiners. India’s soyoil imports jumped 52% to 250,784 tonnes, while sunflower oil imports dropped 19% to 214,077 tonnes.

Indonesia’s palm oil exports in October rose 9.5% from the preceding month, data from the Indonesian Palm Oil Association (GAPKI) showed. Palm oil exports stood at 3.03 million tonnes in October. In value terms, exports rose 10.7% in October, from $1.9 billion in September to $2.1 billion in October.

Exports of Malaysian palm oil products for December 1 – 15 rose 9.8 percent to 717,660 tonnes from 653,541 tonnes shipped during November 1 – 15, cargo surveyor Intertek Testing Services said.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.