TODAY—COMMITMENT OF TRADERS—

Overnight trade has SRW Wheat down roughly 4 cents; HRW down 5; HRS Wheat down 3, Corn is up 1 cent; Soybeans up 8 to 5 cents; Soymeal up $0.50, and Soyoil up 60 to 25 points.

For the week, SRW Wheat prices are up roughly 10 cents; HRW up 16; HRS up 6; Corn is up 16 cents; Soybeans up 20 cents; Soymeal up $2.00, and; Soyoil up 250 points. Crushing margins are up 11 cents at $0.65 (July); Oil share up 1% at 39%.

Chinese Ag futures (September) settled up 72 yuan in soybeans, up 30 in Corn, up 61 in Soymeal, up 140 in Soyoil, and up 224 in Palm Oil.

Malaysian palm oil prices were up 104 ringgit at 3,694 (basis July) at midsession on improving exports.

U.S. Weather Forecast: Significant rain and snow tonight into Friday in much of the Hard Red Winter Wheat Region will still notably increase soil moisture with the exception of the Texas Panhandle and western part of the Oklahoma Panhandle.

The GFS model continues to shift around a possible storm system in the Northern Plains in the last week of April. Last evening’s run was drier and less aggressive with this system April 26 – 28 compared to the midday GFS model.

South America Weather Forecast: In Brazil, erratic shower and thunderstorm activity is expected through April 24 leading to some areas receiving meaningful rainfall with an increase in soil moisture and some pockets missing out from getting much. Last evening’s GFS model kept “some” rain in Brazil through the end of April; though, it showed less rain in northern areas and greater rainfall near Paraguay April 28 – 30 compared to the midday GFS model run. In Argentina, conditions will still be mostly good; though, rain Monday into Thursday of next week will cause some temporary fieldwork disruption.

The player sheet had funds net buyers of 3,000 contracts of SRW Wheat; net sold 1,000 contracts of Corn; net bought 4,000 Soybeans; bought 2,000 lots of Soymeal, and; bought 3,000 Soyoil.

We estimate Managed Money net long 20,000 contracts of SRW Wheat; net long 456,000 Corn; net long 157,000 Soybeans; long 60,000t Soymeal, and; net long 78,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures down roughly 235 contracts; HRW Wheat up 140; Corn up 4,800; Soybeans up 95 contracts; Soymeal up 2,000 lots, and; Soyoil up 4,000.

There were changes in registrations (SRW Wheat down 30)—Registrations total 10 contracts for SRW Wheat; ZERO Oats; Corn ZERO; Soybeans 15; Soyoil 968 lots; Soymeal 175; Rice 1,013; HRW Wheat 1,291, and; HRS 235.

Tender Activity—Philippines passed on 380,000t optional-origin feed wheat—S. Korea passed on 55,000t optional-origin corn—Egypt bought 30,000t optional-origin soyoil—

U.S. MARCH SOYBEAN CRUSH 177.984 MILLION BUSHELS – NOPA

—NOPA members were estimated to have crushed 179.179 million bushels of soybeans in March versus 155.158 million bushels and below the March 2020 crush of 181.374 million bushels.

U.S. MARCH SOYOIL STOCKS 1.771 BILLION LBS – NOPA

Soyoil supplies at the end of March were estimated at 1.822 billion pounds versus 1.757 billion pounds the prior month and 1.899 billion pounds at the end of March 2020.

For the week ended April 8th–

U.S All Wheat sales are unchanged versus a year ago, shipments unchanged with the USDA forecasting 2% increase

By class, HRW wheat sales down 11%, shipments down 7%, with USDA down 8%

SRW down 25%, shipments down 28% (USDA down 18%)

HRS up 2%, shipments up 4% (USDA up 6%)

Corn up 93%, shipments up 82% (USDA up 50%)

Sorghum up 126%, shipments up 209% (USDA up 45%)

Soybeans up 62%, shipments up 71% (USDA up 36%)

Soymeal unchanged, shipments up 8% (USDA up 1%)

Soyoil down 31%, shipments down 14% (USDA down 12%)

The U.S. Environmental Protection Agency has asked industry groups for their input on the future of the nation’s biofuel policy after it ends its current phase in 2022. The consultations will provide a new opportunity for the oil, corn and biofuel lobbies to reshape the regulation, called the Renewable Fuel Standard, which has bitterly divided the two industries for more than a decade.

Under the RFS, oil refiners must blend increasing billions of gallons of biofuels into the nation’s fuel mix each year or buy trade able credits from those that do. The oil industry dislikes the policy because it is costly and props up a huge and competing market for biofuels like corn-based ethanol, while the corn and biofuel sectors want to see the program expanded to help farmers hard hit by years of low commodity prices and trade disputes.

- U.S. GENERATED 406 MLN BIODIESEL (D4) BLENDING CREDITS IN MARCH, VS 306 MLN IN FEBRUARY -EPA

- U.S. GENERATED 1.19 BLN ETHANOL (D6) BLENDING CREDITS IN MARCH, VS 903 MLN IN FEBRUARY -EPA

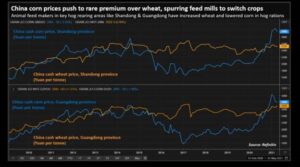

China’s wheat feeding to pigs and poultry has dented demand for alternate feeds and clouded the market outlook for soybean meal and other key ingredients used by the country’s massive feed sector. Chinese feed producers have sharply raised wheat purchases in the past several months to replace corn, which has rallied by more than a third in the past year to a rare premium over wheat following a drop in corn output and state stockpiles last season. Greater feed use of wheat, which has more protein than corn, has also cut demand for soymeal, the main protein source in livestock rations, putting further pressure on local crushing margins and raising questions about China’s appetite for soybeans just as U.S. farmers gear up to commit more than 87 million acres to the crop.

China’s first-quarter pork production rose 31.9% from a year earlier to 13.69 million tonnes, data showed on Friday, the highest quarterly volume in two years. The surge comes after huge investments in rebuilding China’s hog herd since the deadly African swine fever disease ravaged farms in 2018 and 2019. China’s pig herd increased to 415.95 million head at the end of March, a 29.5% rise on the year, and up from 406.5 million at the end of December, the National Bureau of Statistics said.

Brazil’s Litoral Soluções, an unlisted port agent representing U.S. grain trader Bunge, won the reversal of an injunction blocking its right to ship grains from a key southern Brazilian port’s public terminal. The ruling was handed down on Wednesday by Judge João Carlos Franco, who overturned his own decision from last week suspending the contract. A final court decision is still pending on whether Litoral’s contract, which was supposed to take effect on April 12, will enter force.

Argentine farmers are expected to harvest 46 million tonnes of corn in the 2020/21 season, the Buenos Aires Grains Exchange said, citing better than expected yields as the reason for increasing its previous 45 million tonne estimate. Dry weather on the Pampas farm belt, which started in mid-2020 and lasted through February, had caused worry about crop performance. But March and April rains have eased those concerns.

Ukraine’s UMG Investments plans to build a grain export terminal at the Black Sea port of Pivdenyi near Odessa with the annual capacity of 9 million tonnes, it said. The terminal could cost about $150 million and is expected to be completed in 2-3 years.

Germany’s 2021 wheat crop of all types is expected to increase by 2.2% on the year to 22.63 million tonnes, the country’s association of farm cooperatives said in its second harvest estimate. The DRV association forecast Germany’s 2021 winter rapeseed crop will rise 1.6% from last summer’s crop to 3.57 million tonnes. This was up from its first harvest forecast in March, when the association had forecast a wheat crop of 22.34 million tonnes and a winter rapeseed crop of 3.48 million tonnes.

Euronext milling wheat prices hit new contract highs on Thursday in volatile trade, supported by ongoing concerns of adverse weather in the U.S. Plains and France. Most traded September unofficially closed 1.1% higher at 207.00 euros a tonne after hitting a contract high of 207.75 euros in earlier trade.

India is likely to receive an average amount of rainfall during the monsoon in 2021, the state-run weather office said, raising expectations of higher farm and economic growth in Asia’s third-biggest economy, which is reeling from a surge in coronavirus cases. The monsoon rains are expected to total 98% of the long-term average.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.