TODAY—EXPORT INSPECTIONS—CROP PROGRESS/CONDITIONS

The USDA on Friday released details of a second round of COVID-19 aid for farmers, which will pay up to $14 billion to growers of major crops such as corn, soybeans and wheat, as well as livestock, dairy and tobacco.

Overnight trade has SRW Wheat down roughly 5 cents, HRW down 3; HRS Wheat down 2, Corn is down 2 cents; Soybeans down 5; Soymeal down $0.50, and Soyoil down 30 points.

For the week, SRW Wheat prices were up roughly 33 cents; HRW up 33; HRS up 19; Corn was up 10 cents; Soybeans up 47; Soymeal up $18.00, and; Soyoil up 145 points. Crushing margins were down 2 cents at $0.86; Oil share was unchanged at 34%.

Chinese Ag futures (January) settled down 14 yuan in soybeans, up 21 in Corn, up 8 in Soymeal, up 114 in Soyoil, and up 118 in Palm Oil.

Malaysian palm oil prices were up 15 ringgit at 3,095 (basis December) at midsession, an 8 month high following Dalian vegoils and higher September exports so far.

U.S. Weather Forecast: The 6 to 10 day forecast for the Midwest sees a front working through over the weekend and bring rains to the region. Models are mixed with their ideas of rain placement. Temps over the next 5 day look to run below average but become more average over the 6 to 10 day period. The Southern Plains over the 6 to 10 day period sees little to now rains for most of the region. Temps will be below average this week warming to average in the 6 to 10 day period. The Delta has light rains over the 6 to 10 day period in most areas.

South America Weather Forecast: Showers and thunderstorms in parts of Brazil and Argentina in the next two weeks will help improve topsoil moisture – at least temporarily – for some early season spring planting.

The player sheet had funds net buyers of 15,000 contracts of SRW Wheat; bought 10,000 Corn; bought 15,000 Soybeans; bought 7,000 Soymeal, and; net bought 2,000 Soyoil.

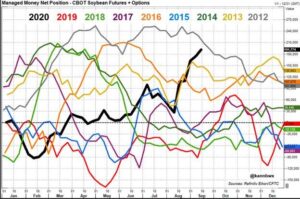

We estimate Managed Money net long 45,000 contracts of SRW Wheat; long 101,000 Corn; net long 241,000 Soybeans; net long 65,000 lots of Soymeal, and; long 102,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures up roughly 13,300 contracts; HRW Wheat down 115; Corn up 17,000; Soybeans up 10,500 contracts; Soymeal up 5,800 lots, and; Soyoil up 2,600.

There were changes in registrations—(HRS Wheat down 93)—Registrations total 109 contracts for SRW Wheat; ZERO Oats; Corn 222; Soybeans 1; Soyoil 1,907 lots; Soymeal 300; Rice ZER0; HRW Wheat 135, and; HRS 1,195.

Tender Activity—Taiwan seeks 91,300t U.S. wheat—Pakistan seeks 300,000t optional-origin wheat—

Global supplies of soybeans are about to get even tighter, with the development of a La Nina climate pattern potentially leading to lower production; that would provide a boost for the commodity, which has already seen significant growth in demand from China and prices rising to their highest levels in over two years.

Strong demand from China will likely put a floor under corn and soybean consumption in 2020-21, Capital Economics says; but with record expected yields in the U.S., we expect corn and soybean prices to come off the boil; a recovery in China’s hog numbers–now that African swine fever has been brought under control–should support demand for soybean-based animal feed; however, we also expect soybean supply to increase in response to this upturn in demand.

Speculators have likely placed record bullish bets for the time of year on Chicago-traded soybeans amid the historic rally in futures, and those bets may be within striking distance of the all-time high set more than eight years ago; in the week ended Sept. 15, money managers boosted their net long position in CBOT soybean futures and options to 191,774 contracts from 173,907 a week earlier, according to data published Friday by the U.S. Commodity Futures Trading Commission.

Alberta crop report – Reuters News: Over the past week, the southern half of the province remained dry, receiving less than one mm of rain; despite less favorable harvest conditions over the past week, producers across the province were able to combine an additional 12 per cent of their major crops; overall, about 30 per cent of major crops have now been harvested, on par with both the 5-year and 10-year averages (see Table 1), while 24 per cent are in swath.

China is directing authorities in East China’s Zhejiang province to start planning to build stockpiling bases for energy and agricultural products, part of a push to develop regional free-trade zones (FTZs), a government document said on Monday; Zhejiang FTZ should plan to build bonded storage and transfer centers for imported grains that can provide special quarantine approval and customs clearance on shipments, starting with soybean imports, the document said; facilities for the processing of high protein food such as imported beef will also need to be expanded.

U.S. lawmakers will consider two bills next week on goods made with forced labor from China’s Xinjiang region, House Speaker Nancy Pelosi said on Friday, with one that would restrict imports and another that would require disclosures from publicly-traded U.S. companies on their supply chains.

African swine fever and Covid-19 have led to volatility in China’s animal protein market, causing shifts in distribution channels and consumer behavior, Rabobank says; Chinese pork retail prices are expected to stay relatively high in the coming years, with consumption comparatively low, leading to opportunities for substitute meats such as poultry and beef

Russia’s September exports of wheat, barley and maize (corn) are estimated at 5.65 million tons, up from 5.10 million tons in August, the SovEcon agriculture consultancy said.

High demand from importers and concern over the winter harvest drove Ukraine’s 2020 export prices for 12.5% protein milling wheat around $9 per ton higher over the last week, APK-Inform agriculture consultancy said; Ukrainian 12.5% protein wheat prices stood at $228-$231 per ton on a free-on-board (FOB) Black Sea basis at the end of last week, the consultancy said in a report; for lower quality 11.5% protein wheat, the price was between $226 and $229 per ton FOB Black Sea.

Another six cases of African swine fever (ASF) have been confirmed in wild boars in the eastern German state of Brandenburg, Germany’s federal agriculture ministry said on Friday; the new cases follow six others confirmed in wild boars, not farm animals, in the past week and bring total confirmed cases to 13, the ministry said.

South Africa remains on course to register the largest wheat crop in a decade thanks to timely, well-distributed rains across the country, says the chief economist at South Africa’s Agricultural Business Chamber; output in Africa’s No. 2 wheat producer will likely rise 28% to 2 million metric tons, boosted by good weather and farmland expansions; that will likely reduce imports, which climbed 32% last season to 1.8 million tons following a production slump.

Indonesia exported 3.13 million tons of palm oil in July, including refined products, the Indonesian Palm Oil Association (GAPKI) said; it rose from 2.92 million tons a year earlier and compared to 2.77 million tons in June; Indonesia produced 4.23 million tons of crude palm and palm kernel oils in July and the country’s stockpile stood at 3.62 million tons at the end of July.

Growth in demand for palm oil this year will be driven by domestic consumption as exports drop amid the COVID-19 pandemic, according to the Indonesian Oil Palm Association (GAPKI); Indonesia is expected to raise domestic consumption by 1.2 percent year-on-year (yoy) to 15.8 million tons in 2020, GAPKI data unveiled on Sept. 1; the growth will be entirely driven by the government’s 30 percent palm oil-mixed biodiesel (B30) program, which is expected to offset lower domestic demand for palm-oil based groceries.

Exports of Malaysian palm oil products for Sept. 1-20 rose 9.4 percent to 1,035,041 tons from 946,338 tons shipped Aug. 1-20, cargo surveyor Intertek Testing Services said.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.