TODAY—WEEKLY ETHANOL STATS—

Overnight trade has SRW Wheat up roughly 3 cents, HRW up 4; HRS Wheat up 2, Corn is up 3 cents; Soybeans up 9; Soymeal up $5.00, and Soyoil up 25 points.

Chinese Ag futures (January) settled down 66 yuan in soybeans, down 8 in Corn, up 19 in Soymeal, up 136 in Soyoil, and up 120 in Palm Oil.

Malaysian palm oil prices were up 35 ringgit at 2,893 (basis January) with better export demand being seen.

U.S. Weather Forecast: The 6 to 10 day forecast for the Midwest has moderate rainfall favoring the eastern Midwest with near 100% coverage; lesser amounts look to fall north and west. Temps look to be turning below average by the weekend and into next week. The Southern Plains over the 6 to 10 day period has rainfall favoring the eastern two-thirds of OK and TX. Temps are seen turning to below average by the weekend and into next week.

South America Weather Forecast: The Brazilian growing regions over the next 6 to 10 day period has moderate rainfall to near 90% of the growing areas. The Argentine growing regions has rainfall favoring the southern areas over the next 6 to 10 days with things mostly quiet elsewhere.

The player sheet had funds net buyers of 4,000 SRW Wheat; bought 12,000 Corn; bought 10,000 Soybeans; were net even in Soymeal, and; net bought 6,000 Soyoil.

We estimate Managed Money net long 66,000 contracts of SRW Wheat; long 228,000 Corn; net long 247,000 Soybeans; net long 91,000 lots of Soymeal, and; long 81,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures up roughly 8,200 contracts; HRW Wheat up 1,500; Corn up 13,900; Soybeans down 1,100 contracts; Soymeal down 1,600 lots, and; Soyoil down 665.

There were no changes in registrations—Registrations total 109 contracts for SRW Wheat; ZERO Oats; Corn 361; Soybeans 1; Soyoil 1,907 lots; Soymeal 250; Rice ZER0; HRW Wheat 135, and; HRS 1,195.

Tender Activity—Sudan seeks 1.0 mt of wheat through U.S. assistance—Tunisia seeks 50,000t optional-origin wheat—Taiwan seeks 88,000t U.S. wheat—

Wire story reports Chicago-traded wheat futures have rallied to near six-year highs on strong global demand and unfavorable planting conditions in some major exporters, despite the expectation for record-large stockpiles by mid-2021; most-active CBOT wheat hit $6.38-1/4 per bushel on Tuesday, the contract’s highest since Dec. 24, 2014; that is consistent with rising international prices, particularly in top supplier Russia, where wheat prices hit record levels last week amid the weak currency and high export costs; dry soils are threatening next year’s wheat harvests in Russia and the United States, which together account for a little more than a third of global exports.

U.S. corn production steady as rapid harvest pace continues – Refinitiv Commodities Research

Above-average harvest pace maintains U.S. soybean production estimates – Refinitiv Commodities Research

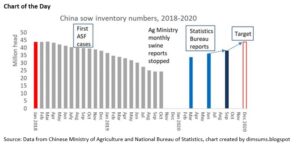

Pork supplies during the upcoming Lunar New Year holiday in China will be 30% higher than a year ago, an agriculture official said after significant efforts to rebuild a depleted hog herd; the recovery of pig production, in addition to large pork imports and changes in consumer demand, would boost pork supplies by about 30% year-on-year, reducing prices compared with last year

—Pig producers have built 12,500 new large-scale pig farms in the first three quarters of the year and restarted more than 13,000 empty farms; the recovery of the hog herd had been “better than expected” after African swine fever wiped out at least 40% of China’s pigs in 2019

—China’s agriculture ministry had set a goal last year of restoring the herd to 80% of normal levels by the end of 2020.

—Through September, pig stocks were 370 million, or 84% of the level in 2017, before the disease hit while breeding sows reached 38.22 million, or 86% of 2017 levels

—Pork prices have fallen for seven consecutive weeks as more pigs are slaughtered, dropping to 50.56 yuan ($7.59) per kg ($1 = 6.6629 Chinese yuan)

BRAZIL CORN EXPORTS SEEN REACHING 5.5 MILLION TNS IN OCTOBER VERSUS 5.2 MILLION TNS FORECAST IN PREVIOUS WEEK – ANEC

BRAZIL SOY EXPORTS SEEN REACHING 2.32 MILLION TNS IN OCTOBER VERSUS 2.34 MILLION TNS FORECAST IN PREVIOUS WEEK

BRAZIL NOT EXPECTED TO IMPORT LARGE QUANTITIES OF SOY IN THE SHORT TERM AFTER SUSPENSION OF SOY AND CORN TARIFFS -GOVERNMENT STATISTICS AGENCY CONAB

BRAZIL CORN IMPORTS NOT FORECASTED TO CHANGE SIGNIFICANTLY THROUGH JANUARY 2021

CONAB SAYS THAT THE U.S. IS THE ONLY COUNTRY WITH CAPACITY TO EXPORT SOY TO BRAZIL AT COMPETITIVE PRICES OUTSIDE OF MERCOSUR TRADE BLOC

CONAB SAYS IT DOES NOT FORESEE A SIGNIFICANT IMPACT IN 2020/21 SOY PRODUCTIVITY FROM DELAYS IN PLANTING

Argentine soymeal exports were subject to a 24-hour strike by the main oilseed workers union, but local operations at Chinese export company COFCO were spared thanks to a special COVID-19 bonus it paid to employees, the union said; the labor group staged the walk-out to press for higher compensation ahead of a meeting with export company executives and Labor Ministry officials scheduled for Thursday; the government, desperate for export dollars to help the country recover from recession, is keen to keep the key soymeal and soyoil industry on its feet.

Ukraine has harvested 47.4 million tons of grain from 12.3 million hectares, or 80% of the sown area, as of Oct. 19, Ukraine’s economy ministry said; it said farmers had completed wheat and barley harvest and collected 11.1 million tons of corn from 2.4 million hectares, or 44% of the sown area.

Ukraine’s grain stocks totaled 15.4 million tons as of Oct. 1, 7.3 million tons less than by the same date in 2019, the APK-Inform consultancy said.

Euronext wheat was little changed in afternoon trading on Tuesday, consolidating after fresh highs as traders assessed rain forecasts for parched wheat belts worldwide and awaited Algeria’s latest import tender; December milling wheat was up 0.25 euros, or 0.1%, at 212.00 euros ($250.50) a ton; it earlier touched 214 euros for a life-of-contract record and highest spot price since August 2018.

Selected highlights from a report issued by an attache with the U.S. Department of Agriculture’s Foreign Agricultural Service in Canberra.

—Drought-breaking rains and an excellent growing season in eastern Australia is expected to result in a sharp rebound in grain production, with Australian wheat production in MY 2020/21 forecast to be up over 80% compared to MY 2019/20

—Barley, sorghum, and rice production are also forecast to be higher; while wheat production in eastern Australian states such as New South Wales are expected to be at near record levels, continued dryness in Western Australia (typically the largest wheat and barley producing state) is impacting production there

—Wheat exports are forecast to nearly double in MY 2020/21, with more Australian wheat expected to flow to key Southeast Asian markets

—FAS/Canberra forecasts Australia’s MY 2020/21 wheat production at 28 million metric tons (MMT), 500,000 metric tons below the official USDA forecast, as a result of continued dryness in Western Australia; if realized, this crop would still be over 80 percent larger than the drought-impacted 2019/20 crop

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.