Price Overview

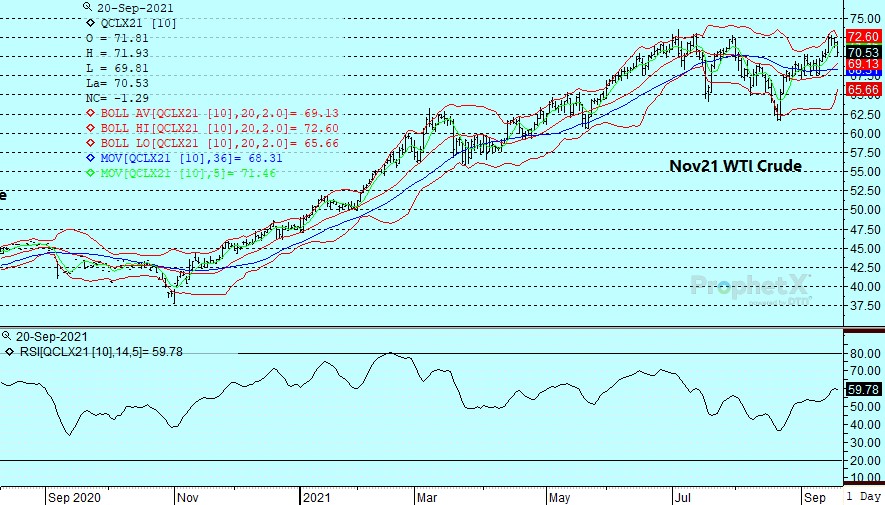

The petroleum complex continued to trade on the defensive as weakness in equities, credit issues with a Chinese property company and ongoing strength to the dollar helped undermine sentiment and encouraged long liquidation. In the background was the return of US Gulf production following Ida and Nicholas. In addition, the prospect that OPEC+ was unlikely to make any change in policy in October and the FOMC meeting that begins tomorrow and the DOE report set for release on Wednesday are also in focus.

Looking ahead the market will continue to be sensitive to tropical storm threats. The appearance OPEC is looking to facilitate a stable market around current levels as the demand picture becomes clearer and inventories remain at the low end of historical levels will likely inhibit a sharp decline in values. The prospects for a sharp demand recovery in the fourth quarter will also provide support on setbacks. Nevertheless a potential slowing of economic growth in China will likely provide some caution on the upside and inhibit any sharp spike in prices on the appearance US production rates will slowly recover.

The DOE report is expected to show crude inventories -2.4 mb, distillate -1.1 mb and gasoline -.2. Refinery utilization is expected to be up 3.2 percent to 85.3 percent in Wednesday’s report.

Natural Gas

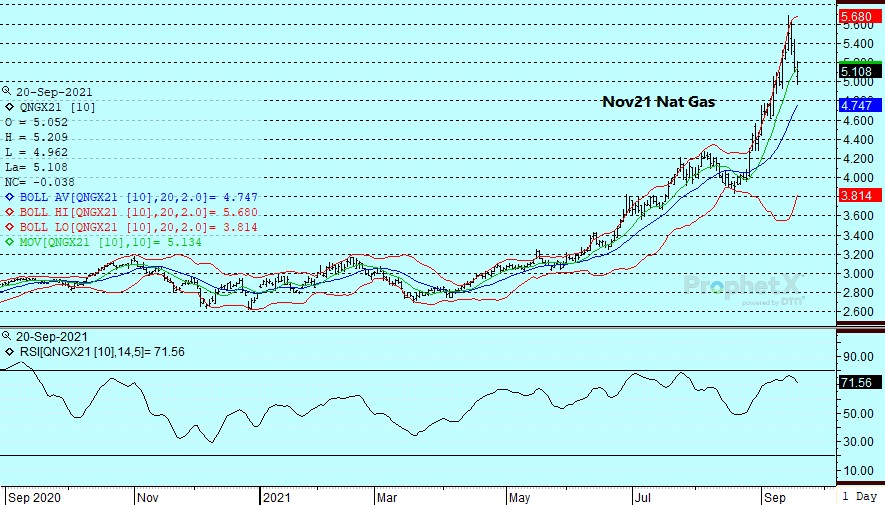

Nat Gas traded traded on both sides of unchanged before settling lower and on the defensive late. Prospects of cooler temperatures cutting into demand later this week and a pick up in production in the Gulf of Mexico as rigs come back on line encouraged the late selling interest. Reports that record high nat gas prices in Europe is forcing substitution with coal also has encouraged a more cautious approach. The sharp increase in gas prices of 280 percent this year in Europe is also raising inflationary fears and its possible impact on monetary policy and economic growth.

For the near term, the market will likely focus upon the EIA report on Thursday following last week’s larger than expected injection. For this week, forecasts point to a build of 73 bcf on average but some estimates are as high as 82 bcf. With GOM production coming back online, the recovery in output in the absence of fresh storm threats should provide the basis for further trade near the 5.00 area and a retest of today’s lows near 4.96 basis Nov in advance of the EIA report and potentially toward the 4.75 level if outside markets remain weak.

Charts Courtesy of DTN Prophet X, EIA, Reuters

The authors of this piece do currently maintain positions in the commodities mentioned within this report.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.