Price Overview

The petroleum complex continued to strengthen following lows of 70.76 basis August reached in early European trade yesterday prior to the DOE report. A further drawdown in inventories of crude and gasoline attracted buying on fears of a tightening statistical picture as we move through the last half of the year.

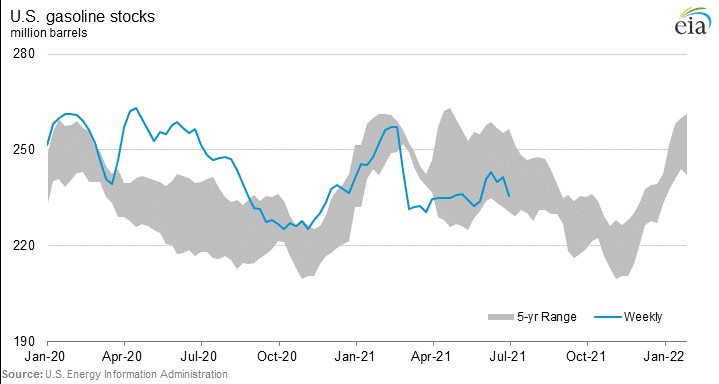

The DOE report, released yesterday due to the July 4th holiday, showed commercial crude inventories declining by 6.9 mb to 621.3 in the week ended July 2nd compared to expectations for a decline of 4.2. A draw in gasoline stocks of 6.1 mb was also well above expectations at 2.2. The decrease reflected strong gasoline demand which reached a 1-week record of 10 mb. Distillate inventories built by 1.6 mb. Total inventories including products fell 9.9 mb while total disappearance reached pre-pandemic levels at 21.5 mb on the back of strong gasoline demand. Refinery utilization was indicated at 92.2 percent, while domestic crude oil production increased to 11.3 mb/d from 11.1 last week.

Next week the market will likely be anticipating further inventory declines for the US. Although increasing infection rates from the Delta variant will be watched closely, the reopening of many economies, and particularly the US, will be watched closely. More important will be the status of OPEC+ compliance levels. Demands by the UAE to get a higher baseline will remain a source of uncertainty along with the progress of negotiations with Iran.

For now, it looks like support near 70.00 basis August crude should hold, while resistance in the 75.00-75.50 range could be formidable. Further declines in DOE stocks next week could lead to a retest of the 76.98 high established on Tuesday.

Natural Gas

Prices surged higher yesterday with the August contract gaining over 9 cents on the settlement. The weekly storage report was the catalyst, as it indicated a small 16 bcf injection verses expectations near 34 and a five year average of 63. Total gas in storage is currently 2,574 bcf, which is nearly 7 percent below the five year average. The upward momentum carried over into today’s session as the August pushed through yesterday’s highs early in the session before settling slightly lower on the day. Weather reports into the weekend were mostly unchanged, with demand lowered slightly on expected increases in wind and solar generation leading to lower gas burns. LNG flows have been consisted near 11 bcf/d the entire month, and likely continue near maximum capacity as the summer wears on as long as processing facilities can avoid any major storm issues like were seen last year. Exports to Mexico appear to be heading back toward 7 bcf/d after a brief dip, while production has recently returned to the 92 bcf/d range after last weeks pipeline issues. With these supportive underlying factors for the most part priced in, the last and most important piece of the puzzle is weather. Long term forecasts point to continued above average temperatures in July and August, and if those expectations can materialize prices could test the 4.00 level in the coming weeks. Initial support now rests just under 3.60, while the 3.49 level would likely hold up to a stronger selloff.

Charts Courtesy of DTN Prophet X, EIA, Reuters

The authors of this piece do currently maintain positions in the commodities mentioned within this report.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.