Price Overview

The petroleum complex continued to trade on the downside following its failure against the 76.90 area early Tuesday. The weakness reflected issues with OPEC+ unified approach to oil policy following demands by the UAE to get a higher baseline in 2022. The impasse has put a spotlight on disagreement between Saudi Arabia and the UAE over production policy and market shares from these two major producers. Although it has been reported that Russia, another major producer, is attempting to bring Riyadh and Abu Dhabi back to the table to negotiate, some sources have indicated little progress and that no new meeting date has been set.

The talks concluded on Friday with the UAE accepting a proposal from Saudi Arabia that would raise output in stages by about 2 mb/d from August to the end of 2021 but rejected an extension of cuts beyond April 2022 when the current agreement expires without an adjustment in UAE baseline production. The Saudi’s fear that giving in to the UAE demand would undermine the commitment of other members since at the time the agreement was inked many countries had increased output because of a price war between Saudi Arabia and Russia.

Whether current cuts are maintained will likely be a source of uncertainty as other producers attempt to expand output given higher prices. In addition, questions over the ability of OPEC+ to maintain their production discipline will be a variable even if a consensus is reached given the history associated with these agreements as national interest come into play. The level of compliance will be watched closely to see if there is slippage ahead of the expected reentry of Iran into the market later this year.

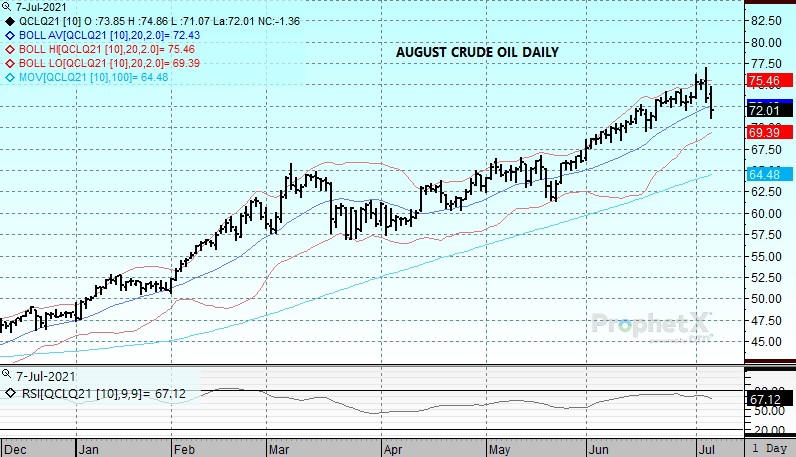

The breakdown in Aug WTI crude from a high of 76.98 early Tuesday to current levels of 72.10 has likely priced in the uncertainty over OPEC production plans and might begin to attract buying interest ahead of the DOE report tomorrow and likely drawdown of crude inventories. This week’s high will offer strong resistance while support toward 70.00 is likely as economic activity expands along with global oil consumption.

The DOE report is expected to show crude inventories off 4 mb, distillate up .2 and gasoline down 2.2. Refinery utilization is expected up .4 percent to 93.3 percent.

Natural Gas

The natural gas market has seen volatile trade since our last report, with prices covering a 30 cent range over the last two sessions. Strength coming out of the weekend was hard to explain as the August was pushed to a new high for the move at 3.822 during Monday’s shortened session. Volume was extremenly light and it appeared likely that algorithmic trading was behind the move. Weather reports saw slightly positive revisions over the weekend, but not enough to justify the spike considering the Columbia Gas pipeline issues appeared to be corrected on Saturday and it was evident by Sunday that Tropical Storm Elsa would have little effect on production in the Gulf. Prices weakend late yesterday and throughout today’s session as consensus built that the storm track through Florida and portions of the East Coast would likely have an adverse effect on demand. The recovery in production added to the selling pressure as nominations exceeded 93 bcf yesterday. The August contract settled 4.1 cents lower today at 3.596 after trading as low as 3.52, which eased some of the overbought pressure from an RSI that had held above 80 percent all of last week. With today’s selloff the market has achieved a 38 percent retracement of the late June rally. The 3.49 level marks the next likely area of support as it would represent a 50 percent retracement of the move. Tomorrow’s storage report is expected to show a build of 34 bcf verses the 5 year average of 63. With the current demand set up, any additonal warming will likely reestablished the upward bent with the 4.00 level the next target.

Charts Courtesy of DTN Prophet X, EIA, Reuters

The authors of this piece do currently maintain positions in the commodities mentioned within this report.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.